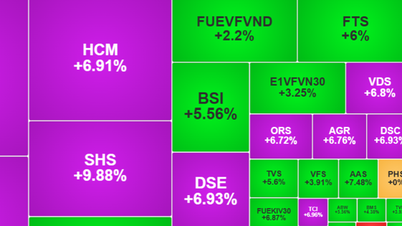

After a nearly 50-point increase on October 6, the stock market returned to a cautious state on the morning of October 7 as the announcement of Vietnam's stock market upgrade by FTSE Russell is just a few hours away.

Cautious investors

In the morning trading session on October 7, the excitement only lasted for the first few minutes of opening. VN-Index soared to over 1,700 points and then fell back when many investors actively sold out because of concerns that the market might reverse.

The market closed the morning session in a slightly volatile state. Red dominated many industry groups, although the VN-Index only decreased slightly by less than 1 point, to around 1,694.9 points.

Total liquidity on the entire floor reached more than VND12,000 billion, showing that cash flow remains high, but investor sentiment is somewhat cautious after last week's technical recovery.

The VN30 group recorded a strong divergence when the index increased by 2.27 points thanks to the support from some large codes such as VRE, MWG,FPT and HPG. VRE shares increased by more than 3%, becoming a bright spot in the real estate group, while MWG and HPG also increased by around 2%. On the contrary, banking codes such as VCB, CTG, BID, and TCB all adjusted slightly, causing the index's growth momentum to narrow.

The market is expected to continue to fluctuate within a narrow range in the afternoon session of October 7, as investors wait for clearer signals from leading stocks.

On forums, many investors said they did not dare to buy but were not in a hurry to sell. "Although most comments predict that Vietnamese stocks will be upgraded by FTSE Russell, I still want to wait for the official announcement results, see how the market reacts before deciding to buy more stocks" - Mr. Nhat Truong (an investor in Ho Chi Minh City) said.

New historical peak in the morning session reached 1,713 points

Securities upgrade scenarios

According to VPS Securities Company, the trading session on October 6 recorded a strong improvement in cash flow when the VN-Index increased by nearly 50 points, mainly thanks to the driving force from large-cap stocks and the VN30 basket. VPS assessed that the general index is facing an opportunity to return to a positive uptrend, with the near target range of 1,720-1,740 points, and can even reach the 1,800 point mark if the cash flow remains stable.

The question being raised by investors is if Vietnam's stocks are officially upgraded by FTSE Russell, will the market enter a new bullish cycle or is it just a temporary psychological reaction?

Mr. Le Tran Khang, market strategy expert of Phu Hung Securities Company (PHS), said that in the medium term, the market's upward trend is still maintained. "The upgrade effect acts as a positive catalyst, not completely dominating the trend. Although foreign investors have recently sold strongly, domestic capital flows have still absorbed well, showing that domestic investors' confidence has been strengthened. If Vietnamese stocks are upgraded, there is a high possibility that foreign capital flows will reverse to net buying, thereby reducing pressure on the market," he commented.

The stock market shook strongly this morning.

In its recently released October strategy report, Dragon Capital Securities (VDSC) also assessed that the third quarter 2025 business results announcement season is the main factor determining valuation trends.

According to VDSC, listed companies' profits this quarter are expected to increase by about 22% year-on-year – higher than the previous forecast of 15%. "The stock upgrade is likely to only play a psychological support role, rather than impacting the real value of the market," the VDSC expert group emphasized.

Mr. Le Tran Khang recommends that during this period, investors should focus on stocks of businesses with solid foundations, leading the industry, especially groups with the ability to attract foreign capital flows after Vietnam's securities market is upgraded.

"The notable groups are still securities, banks and large-cap stocks. In addition, stocks of businesses benefiting from economic stimulus policies, public investment and infrastructure development are also bright spots worth paying attention to," Mr. Khang commented.

Source: https://nld.com.vn/kich-ban-nao-cho-thi-truong-chung-khoan-truoc-va-sau-thoi-diem-cong-bo-nang-hang-196251007112118402.htm

![[Photo] Prime Minister Pham Minh Chinh chairs the 16th meeting of the National Steering Committee on combating illegal fishing.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759848378556_dsc-9253-jpg.webp)

![[Photo] Super harvest moon shines brightly on Mid-Autumn Festival night around the world](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759816565798_1759814567021-jpg.webp)

Comment (0)