On the morning of October 13, DLG shares of Duc Long Gia Lai Group were sold off heavily, dropping to 2,420 VND/share. By the end of the morning, the remaining selling price of DLG shares at the floor price was up to more than 7.7 million units, while no one placed an order on the buying side.

Compared to the price of over VND 10,000/share in early 2022, DLG shares have dropped sharply.

DLG shares of Duc Long Gia Lai fell sharply after the Gia Lai Provincial People's Court decided to open bankruptcy proceedings against this corporation.

Previously, on July 25, Lilama 45.3 Company submitted a petition to the Gia Lai People's Court requesting to open bankruptcy proceedings against Duc Long Gia Lai Group because it could not collect a debt of 20 billion VND.

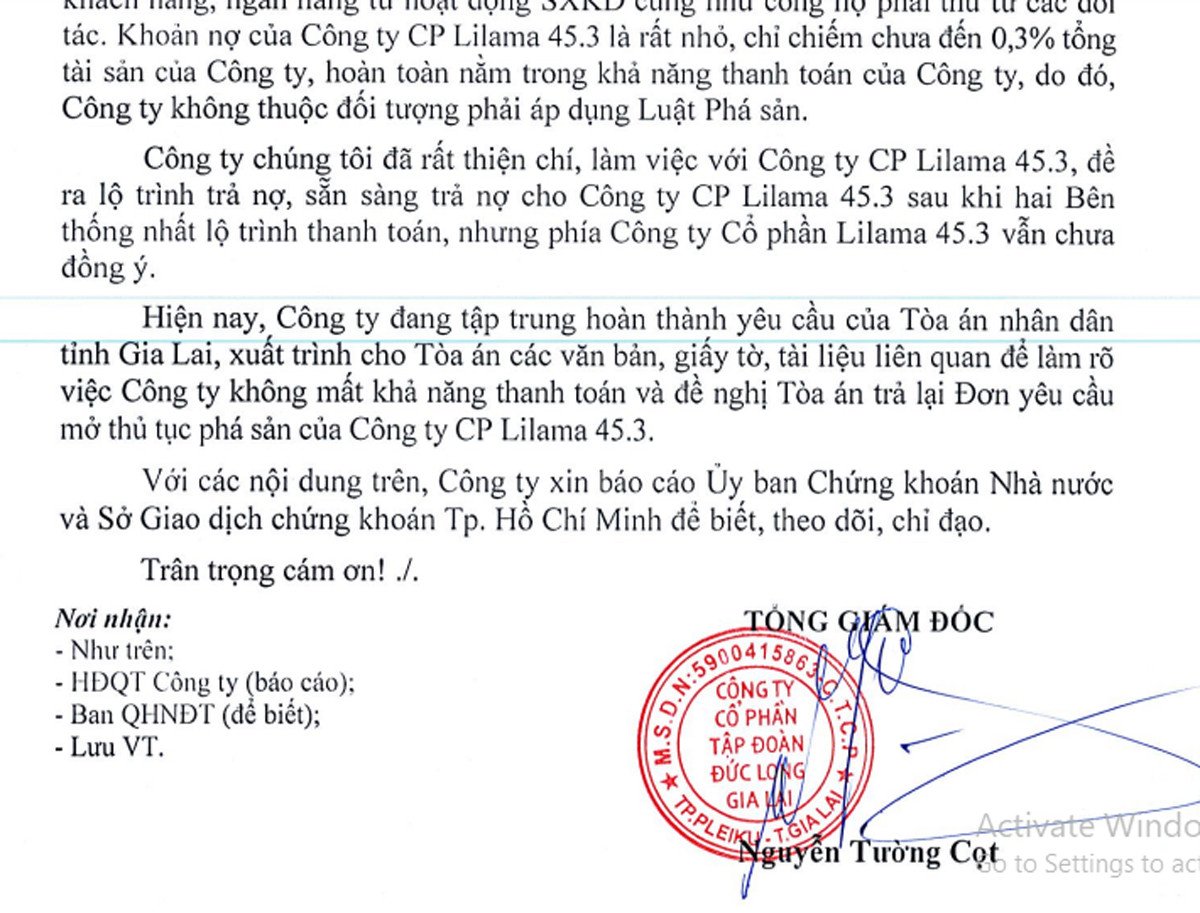

In a document sent to the State Securities Commission (SSC) in early September, General Director Nguyen Tuong Cot said that the enterprise faced temporary financial difficulties due to being severely affected by the COVID-19 pandemic from 2020-2023, the global economic crisis, and increased inflation due to the prolonged Russia-Ukraine conflict.

However, Duc Long Gia Lai is still effectively overcoming the situation, organizing normal production and business activities, creating jobs for workers, fully paying the budget and being responsible to shareholders, investors and customers.

Mr. Nguyen Tuong Cot affirmed that DLG is not insolvent and has total assets of nearly 6,000 billion VND. The financial resources of the enterprise are sufficient to repay debts to partners, customers, banks from production and business activities as well as debts receivable from partners.

According to Mr. Cot, the debt of Lilama 45.3 Joint Stock Company is very small, accounting for less than 0.3% of the company's total assets. This debt is completely within the company's ability to pay, so the company is not subject to the Bankruptcy Law.

The enterprise has also proposed a debt repayment schedule and is ready to pay Lilama 45.3 after the two sides agreed on the payment schedule, but Lilama 45.3 has not agreed.

Encounter many difficulties

Duc Long Gia Lai used to be one of the largest enterprises in Gia Lai with total assets at its peak of nearly 9,000 billion VND. This revenue comes from many fields, from wood, stone, agricultural products, fertilizers, real estate brokerage, bus station services, renewable energy and BOT toll collection.

This business changes and adds and removes business lines continuously.

In mid-2016, DLG acquired foreign enterprises, invested in high technology just to produce screws... in an effort to participate in the global production chain. At that time, a member of Duc Long Gia Lai Group Joint Stock Company (DLG), Mass Noble Investments Limited, officially and successfully acquired Hanbit Company (Korea) with an initial total investment of 10 million USD.

By becoming the new "owner" of DLG-Hanbit Co. Ltd (Hanbit), DLG officially entered the Korean electronic components manufacturing industry, becoming a partner of giants in this field.

This is the second time DLG has chosen the merger and acquisition (M&A) method to fully own a foreign company. In mid-2015, Duc Long Gia Lai also had an unprecedented deal: issuing nearly 20 million shares in exchange for the acquisition of the American company Mass Noble Investments Limited, which means becoming the owner of the ANSEN electronic components factory headquartered in Dongguan city, Guangdong province, China.

To date, the electronic components segment contributes the majority of DLG’s revenue. The company is investing in three component manufacturing plants in Vietnam, Korea and China.

Duc Long Gia Lai also invests heavily in wind power, solar power and hydropower in Gia Lai with a total capacity of nearly 4,000 MW. Most of which are waiting to be added to the planning.

DLG's business performance has not been good recently. Revenue in the second quarter of 2023 reached VND289 billion, down 23% year-on-year. In the third and fourth quarters of 2022, DLG made losses. In the first and second quarters of 2023, profits were low. By the end of the second quarter of 2023, DLG had accumulated losses of more than VND2,000 billion and total liabilities of nearly VND4,570 billion.

In the 2023 semi-annual audited financial report, the auditors doubted Duc Long Gia Lai's ability to continue operating, because they could not determine whether the value of collateral and guaranteed assets was consistent with the group's debt repayment plan.

Previously, in 2020, Duc Long Gia Lai was also suspected of having the ability to continue operating.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the Conference to deploy the National Target Program on Drug Prevention and Control until 2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1759990393779_dsc-0495-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee on overcoming the consequences of natural disasters after storm No. 11](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1759997894015_dsc-0591-jpg.webp)

Comment (0)