Micro, Small and Medium Enterprises (MSMEs) are the lifeblood of many economies , especially in developing countries. In fact, MSMEs account for 69.3% of the total number of enterprises nationwide. With their small size, MSMEs are expected to demonstrate business flexibility by being able to take advantage of local labor and raw materials. As a result, MSMEs can easily enter the market and adapt quickly to economic fluctuations.

However, in reality, MSMEs face many difficulties. The main reasons come from limited capital, limited access to technology and information in grasping opportunities and support policies of the State. In addition, high production and business costs, debt pressure and lack of quality human resources are also major challenges that MSMEs have to face. These difficulties not only affect the development of each enterprise but also impact the socio-economic development of the whole country.

MSME enterprises always face many difficulties, especially financial pressure.

Government and banks join hands to support MSME businesses

In the context of increasingly fierce competition in the global economy, the Government and banks have simultaneously deployed diverse and practical support solutions to reduce the financial burden for MSME enterprises. These measures do not only stop at providing preferential credit packages but also include debt restructuring, reducing loan interest rates, and providing professional financial consulting services to help businesses maintain operations and develop sustainably.

In particular, the State Bank has directed and closely coordinated with commercial banks to ensure that lending interest rates are maintained at a stable and reasonable level. This is an important factor that helps MSME enterprises easily access capital sources, thereby effectively balancing finances, expanding production and business scale and actively contributing to the process of economic recovery and development.

The government and banks have provided a lot of support for MSME businesses in the context of digital transformation.

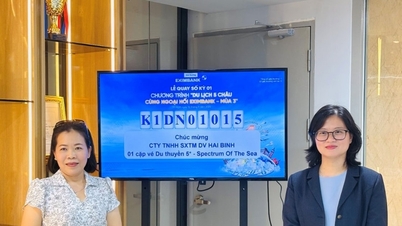

Exclusive solution for MSME businesses from Eximbank

In line with the Government's policy, commercial banks are actively implementing many flexible financial solutions to support small-scale enterprises. In addition to providing timely capital, banks also offer many preferential interest rates through specialized loan packages. Typically, Eximbank has pioneered the introduction of a loan package to supplement business capital for MSMEs, which is considered a flexible financial solution, meeting all the needs of small-scale enterprises.

Eximbank's additional business capital loan products are optimized for the actual needs of MSME businesses.

With a loan amount of up to 90% of revenue, businesses can confidently invest in expanding production, upgrading technology or meeting large orders. Preferential interest rates from only 5.25%/year and a free early repayment policy help businesses optimize financial costs. In addition, the quick approval process, within just 8 hours and modern payment solutions integrated with QR codes help businesses save time and manage finances effectively. In particular, the bank also supports start-up businesses with training and consulting programs, helping businesses firmly step on the path to success.

Thanks to the incentives and favorable conditions, the optimal business capital supplement loan package will be one of the factors demonstrating Eximbank's strong commitment to accompanying small-scale enterprises on the journey of expansion and development.

Source: https://www.congluan.vn/eximbank-sat-canh-msme-vuot-noi-kho-dam-chan-tai-cho-post308837.html

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)