At the close of yesterday's trading session, Arabica coffee prices fell 1.78% to $8,526/ton, while Robusta coffee prices also lost 0.79%, falling to $5,508/ton.

According to the Vietnam Commodity Exchange (MXV), supply and demand factors played a major role in influencing commodity price movements in yesterday's trading session (March 12). In the energy market, the prices of two crude oil products, Brent and WTI, increased in the context of reduced inventories in the US and higher demand for gasoline and diesel.

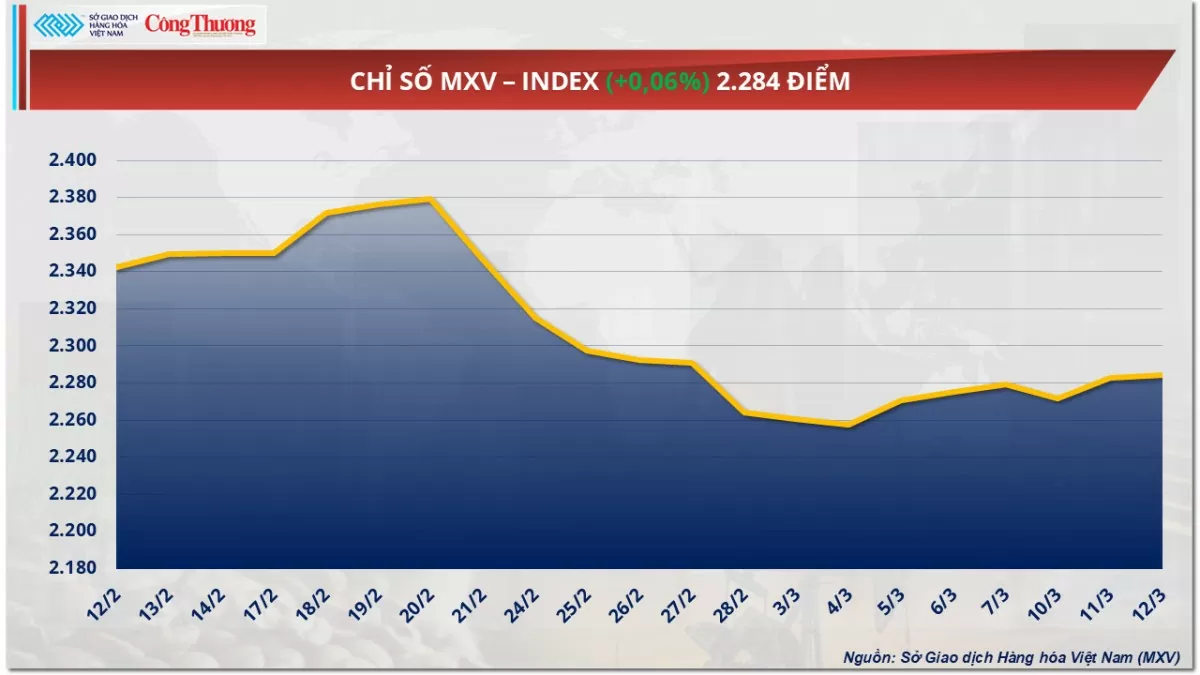

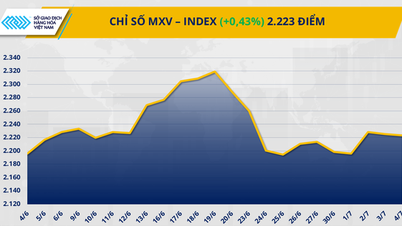

In addition, in the coffee market, prices are under pressure after information about the decline in global coffee exports. The market fluctuated, closing with the MXV-Index slightly increasing by 0.06% to 2,284 points.

|

| MXV-Index |

Crude oil prices extended gains to a second session

At the end of yesterday's trading session, the prices of two crude oil products simultaneously increased after data from the US Government showed that the amount of oil and fuel decreased more than expected.

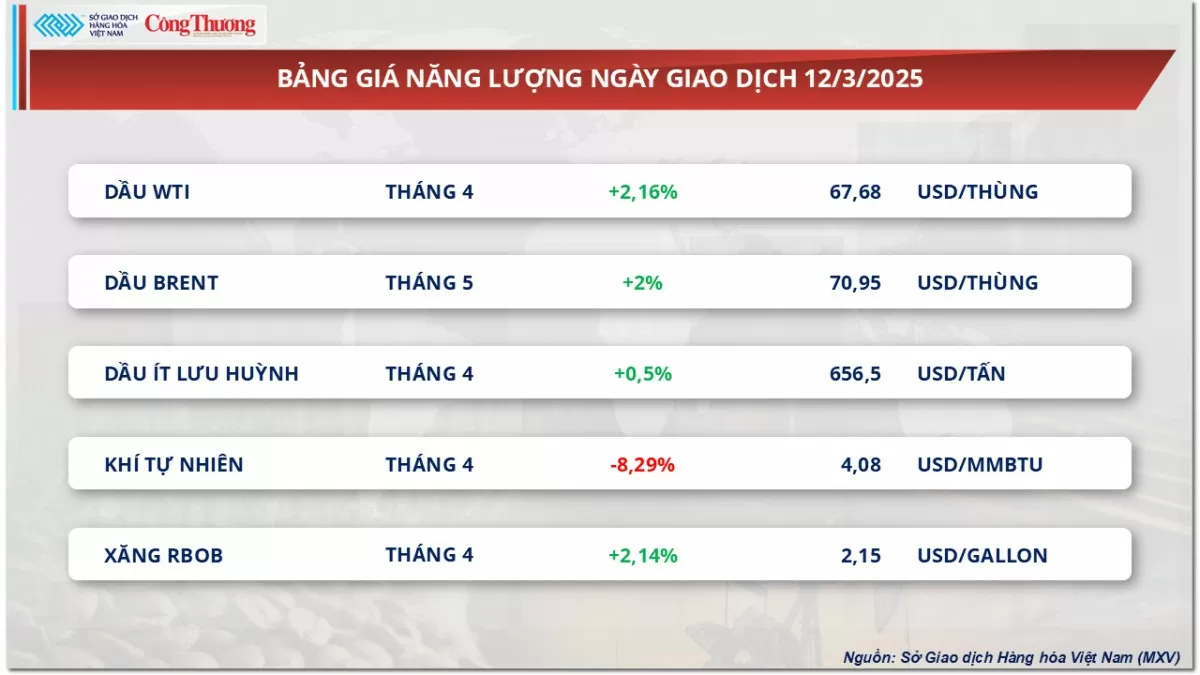

At the end of the session, Brent oil price increased by 1.39 USD (equivalent to 2%), to 70.95 USD/barrel, WTI oil increased by 1.43 USD (equivalent to 2.2%), to 67.68 USD/barrel.

|

| Energy price list |

The main driver behind the rally was a report from the US Energy Information Administration (EIA). According to the EIA, the country's crude oil reserves increased by only 1.4 million barrels in the most recent week, lower than the 2 million barrels that experts predicted. Notably, gasoline inventories fell sharply by 5.7 million barrels, much higher than the expected decrease of 1.9 million barrels, showing that fuel demand is increasing. In addition, the recent weakening of the US dollar's strength also contributed to supporting oil prices.

In addition, geopolitical tensions continue to put pressure on supplies, as Houthi rebels have vowed to continue attacking Israeli ships if the country does not lift its ban on aid to Gaza.

However, the rise in oil prices was capped by concerns that tariffs could raise costs for businesses, fuel inflation and undermine consumer confidence, hurting economic growth.

Meanwhile, the Organization of the Petroleum Exporting Countries (OPEC) kept its forecast for global oil demand growth in 2025 unchanged. OPEC's report also showed that OPEC+ production increased by 363,000 barrels per day in February, mainly from Kazakhstan, which is lagging in complying with its production quota.

Coffee prices continue to fluctuate

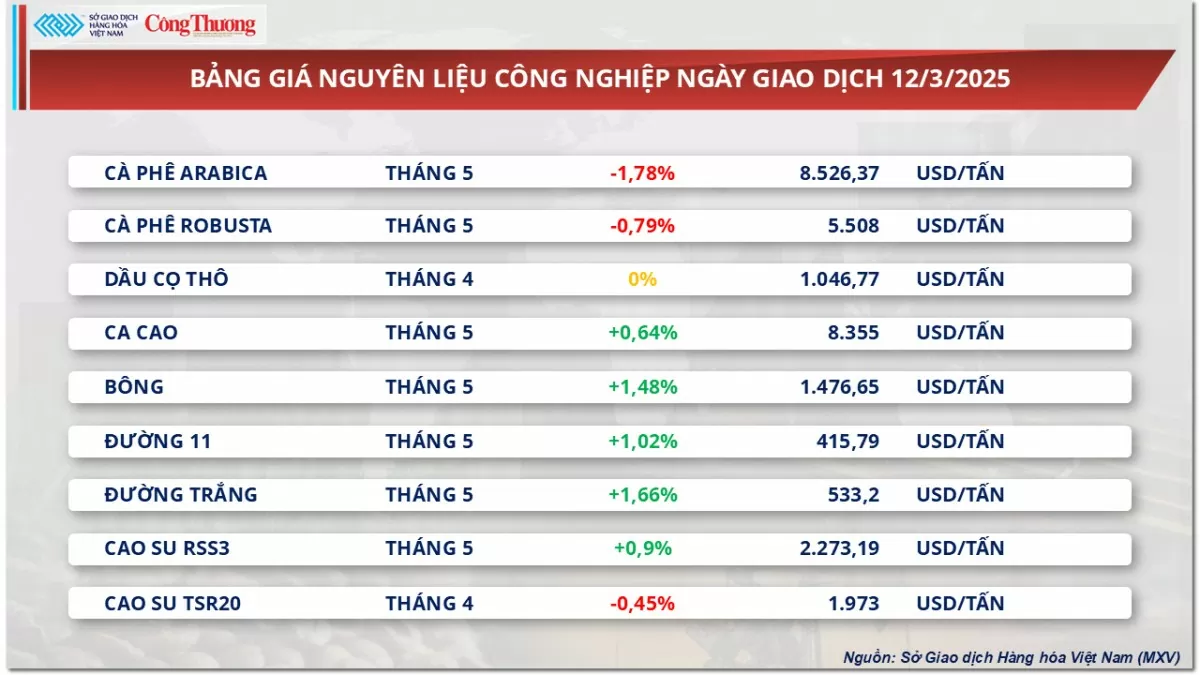

At the end of the trading session on March 12, the price index of industrial raw materials closed in the red when Arabica coffee prices fell 1.78% to 8,526 USD/ton, Robusta coffee prices also lost 0.79%, falling to 5,508 USD/ton. This development took place in the context of a sharp decline in global exports, while ICE inventories showed signs of recovery, raising questions about the actual supply-demand balance of the market.

|

| Industrial raw material price list |

Arabica prices have now moved away from their historic peak of $9,676 per tonne set in mid-February 2025. Experts say that while concerns about drought have been partly reflected in prices, new concerns are shifting to the impact of high prices on global demand.

The latest report from the International Coffee Organization (ICO) shows that global coffee exports in January fell 13.3% to 10.8 million bags, compared to 12.4 million bags in the same period last year. Notably, green coffee exports (unroasted) fell 14.2% to 11.32 million bags, marking the third consecutive month of decline. The Arabica segment alone saw a 2.5% decline to 6.665 million bags, equivalent to a decrease of 171,000 bags. The decline in exports reflects a supply shortage in major producing countries, but it could also indicate weakening demand due to prolonged high prices. This is a difficult problem for investors when considering these two opposing factors.

In addition, inventory data monitored by ICE also showed a positive signal when Arabica coffee volume reached 803,032 bags on March 11. Meanwhile, Robusta inventory also recovered to 4,356 lots, the highest level in the past month.

The news of rising inventories, combined with a new forecast from Marex Solutions, continues to put downward pressure on coffee prices. Marex forecasts a global surplus of 1.2 million bags in the 2025-2026 crop year, up from 200,000 bags in the previous crop year. This assessment makes the market more cautious after the previous sharp price increase.

Prices of some other goods

|

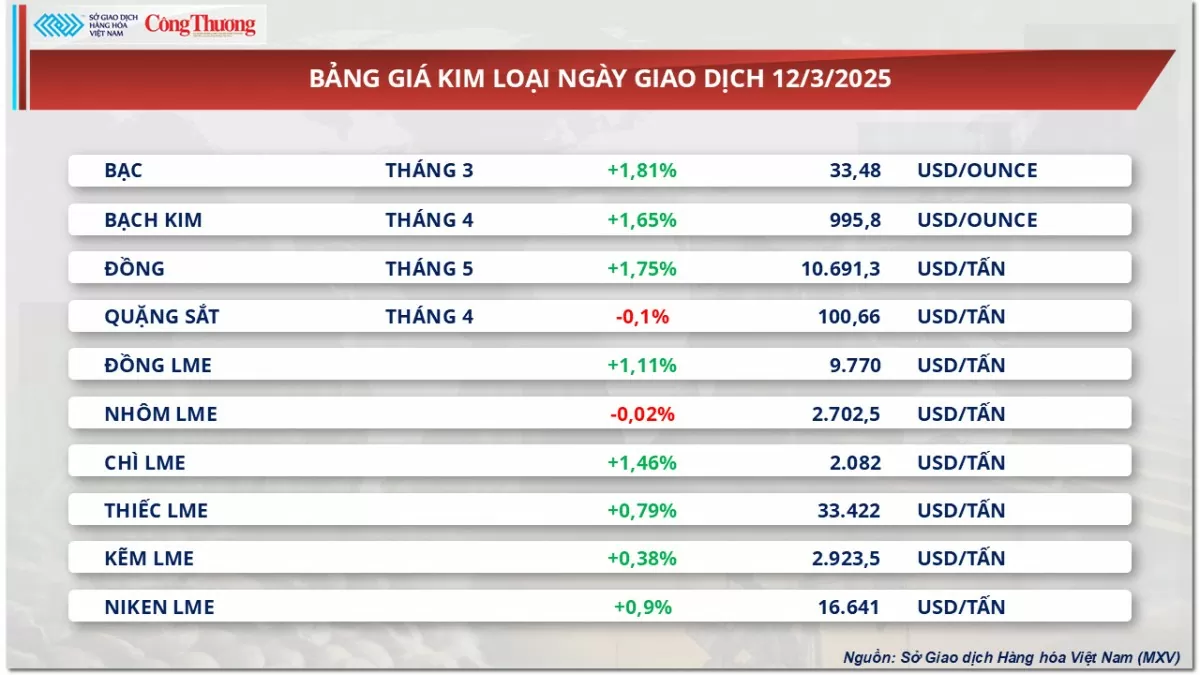

| Metal price list |

|

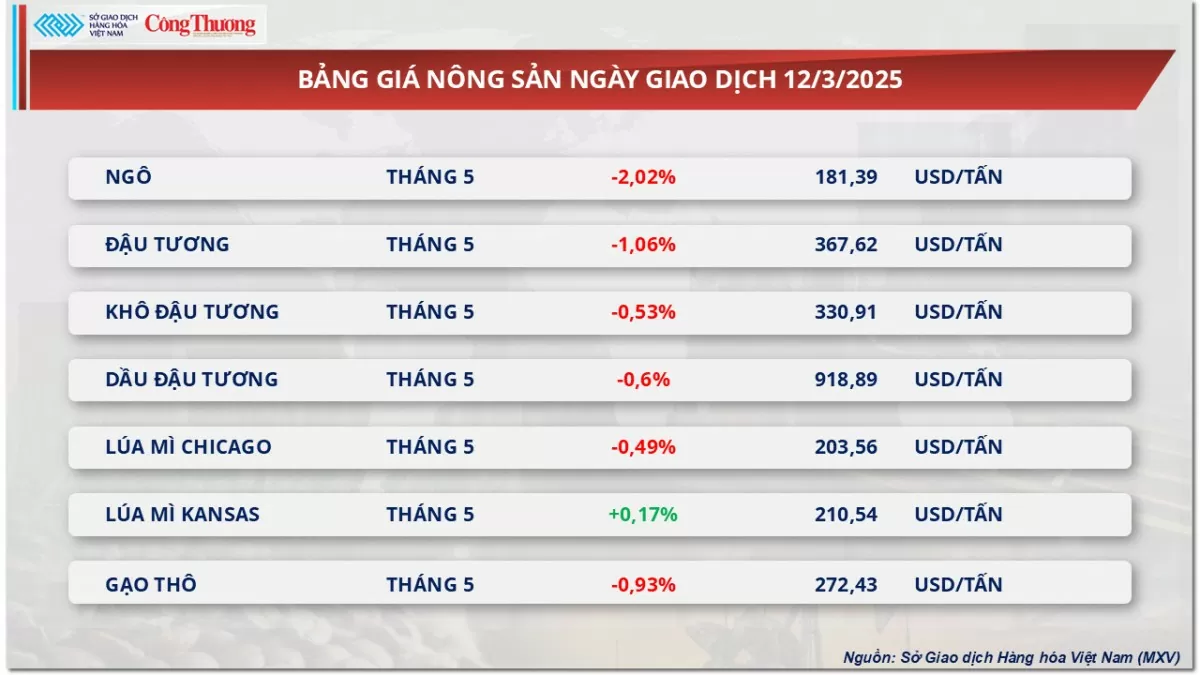

| Agricultural product price list |

Source: https://congthuong.vn/gia-ca-phe-robusta-giam-ve-muc-5508-usdtan-378023.html

![[Photo] Soldiers guard the fire and protect the forest](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/7cab6a2afcf543558a98f4d87e9aaf95)

Comment (0)