Last weekend, VN-Index fell more than 15 points, the most since early August, amid rising exchange rate pressure. So what will the market be like in the coming time?

Stock market waiting for price increase momentum - Photo: QUANG DINH

The stock market needs momentum to break through.

* Mr. Tran Thang Long, Director of Analysis, BIDV Securities (BSC):

- The sharp increase in the USD index (DXY) has put domestic exchange rates under pressure. Along with exchange rate risks, foreign investors continue to sell net, affecting market sentiment and affecting the VN-Index.

The sharp correction in the last session of the week was not too surprising. When the market lacked supporting macro information or clearer changes in business recovery, the general trend was sideways, and when there was bad news, it was immediately reflected strongly. This development was completely reasonable and showed the caution of investors.

Mr. Tran Thang Long

However, the stock market's performance cannot be viewed from week to week, but requires a longer-term perspective. The fact that the index has not surpassed the short-term peak cannot confirm a negative trend.

However, 2025 will still be a difficult year with many unknowns that will take time to resolve. Like the issue of rising exchange rates when the USD peaks, this development needs to be closely monitored. At the same time, it is also necessary to observe the management policies and reactions from the monetary management agency on this issue.

When trading cautiously and waiting for the unknowns to be removed, the market will hardly have a breakthrough. The breakthrough must have momentum. In the coming time, the business results for the whole year 2024 are expected to have significant growth, along with the process of upgrading the market, which will still be factors of interest to the market.

Bank stocks under great pressure

* Mr. Doan Minh Tuan - Head of Research and Investment Department, FIDT:

- Over the past week, global pressures related to USD interest rates such as the 10-year US government bond yield and DXY have been complicated. Both short-term risk indicators have reached their highest levels of the year.

Global investment capital is trending towards de-leveraging and flowing to the US due to concerns ahead of President Donald Trump’s inauguration. Global market sentiment is clearly showing caution, as many potentially risky policies from the new administration are unclear.

Domestically, the exchange rate continues to increase to the ceiling, the State Bank has sold billions of dollars in just one month to protect the ceiling exchange rate of 25,500 VND. However, the rapid sale of USD is weakening foreign exchange reserves, which may affect the ability to hedge in the future. This is only a temporary and unsustainable measure.

Mr. Doan Minh Tuan

In the context of increased market risks due to exchange rate pressure and fluctuations in investment capital flows, foreign investors have returned to strong net selling, focusing on pillar industries and key stocks such as information technology (FPT ), banks (VCB, TCB, BID, EIB) and securities (VND, HCM, VIX).

Banking stocks were under the heaviest pressure with large net selling value from both foreign and self-trading investors.

This is the third week in four consecutive weeks that foreign investors have turned to net selling. This trend is considered the main reason why VN-Index failed to accumulate in the 1,270 - 1,280 point zone, forcing the index to quickly turn down to find a new balance zone.

The expected drivers in 2025

* Ms. Nguyen Thi My Lien - Head of Analysis Department, Phu Hung Securities (PHS):

- The story of market upgrading will be a notable highlight for the Vietnamese stock market in 2025, along with the prospect of positive business results. Although Circular 68 has come into effect, this is only a necessary condition.

The official operation of the central counterparty (CCP) model is considered a sustainable solution to meet FTSE's upgrading criteria.

Ms. Nguyen Thi My Lien

According to PHS forecast, FTSE will announce the upgrade results for the Vietnamese stock market in the interim review period in March 2025. The official upgrade is expected to be in the annual review period in September 2025.

In terms of valuation, the Vietnamese stock market is trading at a trailing P/E of around 13.3 times, which is quite attractive compared to other emerging markets in ASEAN and some other developed markets in the world.

With a favorable macroeconomic outlook, we forecast that overall market earnings could grow 18% in 2025 after growing 16% in 2024.

Therefore, the forward P/E for 2025 is forecast to be around 11.3x in the base case, giving investors an opportunity to start making profits in 2025.

Source: https://tuoitre.vn/gia-usd-vot-len-chung-khoan-rot-manh-nhat-5-thang-tuan-moi-the-nao-20250106090416573.htm

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

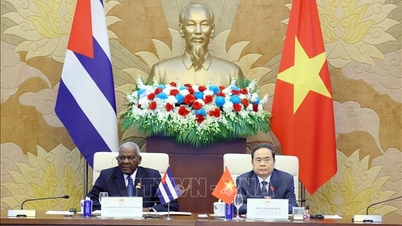

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)