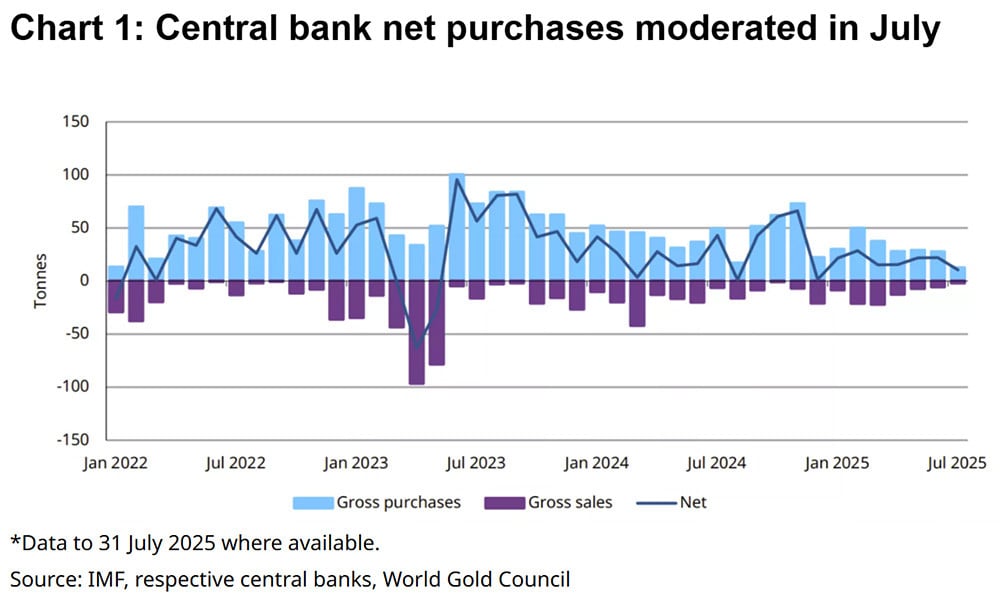

According to the World Gold Council (WGC), global central banks bought a net 10 tons of gold in July. Although this figure is significantly lower than previous months, it still affirms the stable demand of large financial institutions, especially emerging markets.

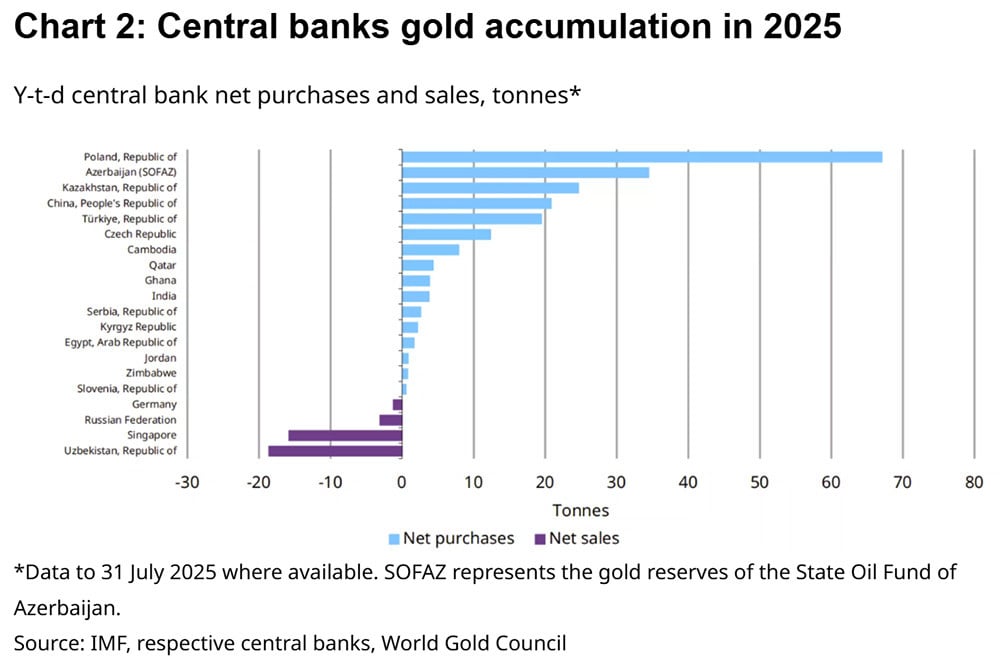

Specifically, the National Bank of Kazakhstan added 3 tons, bringing the total amount of gold purchased since the beginning of the year to 25 tons, ranking 3rd in the list of banks buying the most.

The Central Bank of Türkiye, the People's Bank of China and the Czech National Bank each bought 2 tonnes more, continuing their steady buying streak.

Turkey has been a net buyer for 26 consecutive months since June 2023. The Czech Republic has been buying gold for 29 consecutive months since March 2023. The People's Bank of China continued its gold buying streak for the ninth consecutive month, with a total purchase volume of 36 tonnes during the period.

The National Bank of Poland remains the largest net buyer of gold in 2025, with 67 tonnes so far this year, despite having made almost no additional purchases of the precious metal since May.

In another notable development, the Central Bank of Uganda announced a two- to three-year pilot program to purchase domestic gold from artisanal miners. The initiative is aimed at building official reserves and reducing dependence on traditional foreign currency assets, following the bank’s announcement that it would begin purchasing locally produced gold.

Ms. Marissa Salim, Senior Research Team Leader at WGC, assessed that although the pace of net purchases has slowed, central banks still maintain a net buying status even in the current high price range.

Central banks around the world continue to add gold to their reserves, a strategic move to diversify assets and protect national economies from unpredictable fluctuations in global financial markets.

Gold is considered an effective hedge, especially in times of rising inflation, geopolitical tensions and US dollar volatility.

Holding gold helps reduce the risk of traditional assets such as government bonds or foreign currencies losing value. Moreover, storing this precious metal also helps strengthen confidence in the national currency and demonstrates the economic strength of a country.

Central banks have been net buyers of more than 1,000 tonnes of gold for three consecutive years (2022 to 2024), a pace of purchases not seen since the 1970s. This demand is more than double the annual average from 2010 to 2021.

Gold prices continue to rise sharply

The gold market is witnessing a strong rally, with gold prices setting a new record amid weak US economic data, raising expectations of loose monetary policy from the Federal Reserve (Fed).

In the latest report, nonfarm payrolls increased by just 22,000, far below the 75,000 economists had forecast, indicating a sudden and severe slowdown in hiring.

The unemployment rate rose to 4.3%, up from 4.2% the previous month. While the increase was in line with forecasts, it still confirmed a trend of tightening in the labor market.

The report also raised concerns as the employment data for the previous two months were revised downwards. Specifically, the June figure showed a decline of 14,000 jobs, while the July figure was revised up only slightly. In total, the number of jobs in these two months was 21,000 lower than originally announced. These numbers reinforced expectations that the Fed will soon cut interest rates to support the economy.

As the likelihood of a Fed rate cut increases, the dollar tends to weaken. Lower interest rates also reduce the opportunity cost of holding gold, making the precious metal more attractive to investors.

Many major banks and financial institutions have raised their gold price forecasts, with some experts even targeting as high as $4,000 an ounce in the near future if current trends continue.

Commerzbank and UBS both believe that prices of $3,600/ounce to $3,700/ounce are entirely achievable by the end of this year.

Mr. Aakash Doshi, an expert at State Street Investment Management, predicts that gold prices could reach $4,000/ounce in the next 3-6 months if the US economy falls into stagflation.

Source: https://vietnamnet.vn/gia-vang-cao-ky-luc-ong-lon-ngan-hang-cat-ket-them-10-tan-vang-2439745.html

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

Comment (0)