ANTD.VN - Gold prices did not fluctuate much last week, but the state is likened to "balancing on a knife's edge" when ready to fluctuate in response to changes in interest rate expectations.

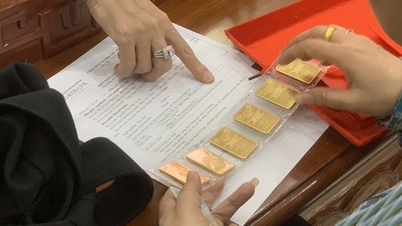

After a strong increase yesterday, domestic gold prices tended to remain stable at the end of the week, with some businesses adjusting prices slightly downward. At 9:30 a.m., Saigon Jewelry Company (SJC) listed the price of gold bars at 74.20 - 76.70 million VND/tael, down 100,000 VND/tael compared to yesterday's closing price.

At DOJI Group, SJC gold kept the buying price unchanged but decreased by 100,000 VND/tael for the selling price, listed at 73.90 - 76.65 million VND/tael;

Meanwhile, Phu Nhuan Jewelry Company (PNJ) kept the gold price unchanged from the end of yesterday's session, at 74.40 - 76.80 million VND/tael.

Similarly, Phu Quy SJC maintained the price at 74.30 - 76.70 million VND/tael; Bao Tin Minh Chau at 74.35 - 76.65 million VND/tael...

|

Gold prices fluctuated little this week |

Non-SJC gold this morning is also stable, unchanged from yesterday's session.

Specifically, SJC 99.99 rings are listed at 62.75 - 63.95 million VND/tael; PNJ Gold is listed this morning at 62.75 - 64.05 million VND/tael; Bao Tin Minh Chau's Thang Long Dragon Gold is 63.73 - 64.83 million VND/tael...

In the world, gold prices are trading around 2,018 USD/ounce, with very little fluctuation during the session. Over the past week, gold prices also traded in a narrow range and slightly decreased by 0.54%. The precious metal reacted more weakly than expected to the most important economic data of the US at the end of the week.

These economic data do not seem to provide analysts and investors with many clues about the upcoming path of the US Federal Reserve.

Accordingly, the deflationary environment facilitated the Fed to loosen its monetary policy in the first quarter of this year; however, solid economic activity acted in the opposite direction.

The possibility of the Fed cutting interest rates next March is still 50/50. Therefore, the price of gold is considered to be "balancing on the edge" of the Fed's interest rate.

Next week, Friday's jobs report will be in focus, as it will provide further data for interest rate expectations. Any weaker-than-expected labor market performance would boost the case for an earlier rate cut.

The Bank of England (BoE) will also hold its first monetary policy meeting of the year. The BoE is in an even more difficult position as the UK economy slows and inflation remains high.

Source link

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)