Gold prices today, November 29, 2024, on the international market increased rapidly again due to the geopolitical situation at hot spots. Domestic SJC gold bars and rings also 'danced', rebounding despite the previous plunge.

Gold price on Kitco floor at 9:00 p.m. (November 28, Vietnam time) was trading at 2,647.1 USD/ounce, up 0.24% compared to the beginning of the session. Gold futures price for December 2024 delivery on Comex New York floor was trading at 2,663.7 USD/ounce.

At the beginning of the trading session, world gold prices increased again due to market concerns about geopolitical risks remaining high as the war escalated in Russia-Ukraine, while the ceasefire between Israel and Hezbollah has not yet taken effect.

Israel's retaliatory measures continue to heighten tensions in the Middle East, said Aneeka Gupta, director of macroeconomic research at WisdomTree.

In addition, gold continues to be well supported by the weakening USD, when the DXY index fell to its lowest level in the past 2 weeks, reaching 106.2 points. Accordingly, gold is regaining its attractiveness to investors after a sharp decline, moving away from the support level of 2,700 USD/ounce.

However, the precious metal's recovery was limited as recent data showed slowing inflation, suggesting the US Federal Reserve may be cautious about cutting interest rates.

Americans' spending rose sharply in October and is likely to continue to rise in the coming months, according to the report, suggesting that the pace of disinflation is slowing.

The weakness in the greenback and expectations that the US central bank will cut interest rates in December are helping gold extend its slight recovery after a sharp decline earlier in the week, said Han Tan, a market analyst at Exinity Group.

Minutes from the most recent policy meeting released a few days ago showed uncertainty about the direction of the economy, which has increased market expectations for a December rate cut. According to the CME FedWatch tool, the market now sees a 70% chance of a 25 basis point rate cut, up from 50% just over a week ago.

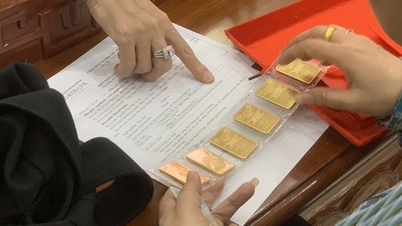

In the domestic market, at the end of the session on November 28, the price of 9999 gold bars at SJC and Doji was 82.9 million VND/tael (buy) and 85.4 million VND/tael (sell).

SJC announced the price of 1-5 ring gold at only 82.5-84.4 million VND/tael (buy - sell). Doji listed the price of 9999 round smooth ring gold at 83.5-84.7 million VND/tael (buy - sell).

Gold price forecast

Phillip Streible, chief market strategist at Blue Line Futures, predicts gold prices could hit $3,000 an ounce in the first two quarters of 2025, unless a spike in inflation forces the Fed to raise interest rates.

According to Darin Newsom, market analyst at Barchart.com, gold prices may fall slightly in the short term due to market correction. However, in the long term, he believes that gold will continue to increase in price.

Swiss bank UBS believes that gold prices could reach the target of $2,900/ounce by the end of 2025. The report emphasizes that gold is a safe investment channel, helping to prevent risks in the context of geopolitical instability and fiscal problems.

Source: https://vietnamnet.vn/gia-vang-hom-nay-29-11-2024-tang-nhanh-nhan-tron-va-mieng-sjc-tiep-da-hoi-phuc-2346686.html

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

Comment (0)