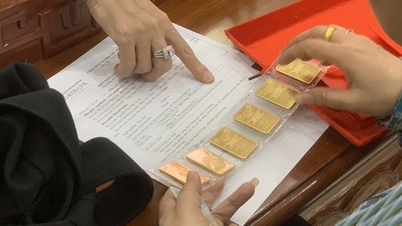

ANTD.VN - Domestic SJC gold prices fell in the first trading session of the week, while the world market continued to increase. Businesses also narrowed the difference between buying and selling prices.

After a week of strong increase of up to 2 million VND/tael, dozens of times higher than the world gold price (increased by less than 5 USD/ounce in the week), the domestic SJC gold price turned down again when opening the new week's trading session.

At 10:00 a.m., Saigon Jewelry Company (SJC) listed the price of gold bars at 74.00 - 76.52 million VND/tael, the buying price was equivalent to the closing price of last weekend but down 500,000 VND/tael on the selling price.

DOJI Group is also listing the buying price of SJC gold at the same level as last weekend, but down 500,000 VND per tael on the selling price, listed at 73.95 - 76.45 million VND/tael.

|

Gold prices are getting support from safe-haven demand |

Meanwhile, PNJ reduced the buying price by 100,000 VND/tael and the selling price by 600,000 VND/tael, listed this morning at 74.40 - 76.90 million VND/tael.

At Phu Quy, SJC gold increased by 100,000 VND for buying and decreased by 350,000 VND for selling per tael, buying and selling at 74.05 - 76.50 million VND/tael.

Bao Tin Minh Chau increased 350 thousand VND/tael for buying, decreased 100 thousand VND/tael for selling, trading at 74.35 - 76.75 million VND/tael...

The decrease in SJC gold price was due to the excessive increase last week, when this gold brand increased by 2 million VND/tael, while the world market almost did not increase significantly.

Meanwhile, non-SJC gold continued its upward trend with an increase of about 200,000 - 300,000 VND per tael.

Specifically, SJC 99.99 rings are listed at 62.65 - 63.75 million VND/tael; PNJ Gold is listed this morning at 62.70 - 63.80 million VND/tael; Bao Tin Minh Chau's Thang Long Dragon Gold is 63.74 - 64.84 million VND/tael...

In the world, the spot gold price is currently trading above the 2,055 USD/ounce mark, up nearly 7 USD since the opening of trading.

Gold is still receiving support from safe-haven demand as the Middle East conflict escalates. Along with that, expectations of a Fed rate cut in March are also increasing, thereby causing the USD and bond yields to go down, acting as a gentle lever for gold prices.

The latest Kitco News weekly gold survey shows that last week's sentiment continues, with half of retail investors predicting gold prices will rise next week, while more than two-thirds of market analysts are bullish on the yellow metal's near-term prospects.

According to many experts, if the Middle East conflict continues to escalate, gold prices could soon regain the record level achieved in December, and may even set a new record.

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)