Big profit when buying gold

Although the difference between buying and selling gold prices is still listed at a high level by businesses, if investors had bought gold at the beginning of the year, they would have made a huge profit.

Specifically, in the trading session on January 1, 2023, DOJI Group listed the buying price at 65.65 million VND/tael; the selling price was 66.65 million VND/tael. The difference between the buying and selling price of gold at DOJI is 1 million VND/tael.

Meanwhile, Saigon Jewelry Company (SJC) listed the buying price of gold at 66 million VND/tael; the selling price is 67 million VND/tael. The difference between the buying and selling price of SJC gold is also at 1 million VND/tael.

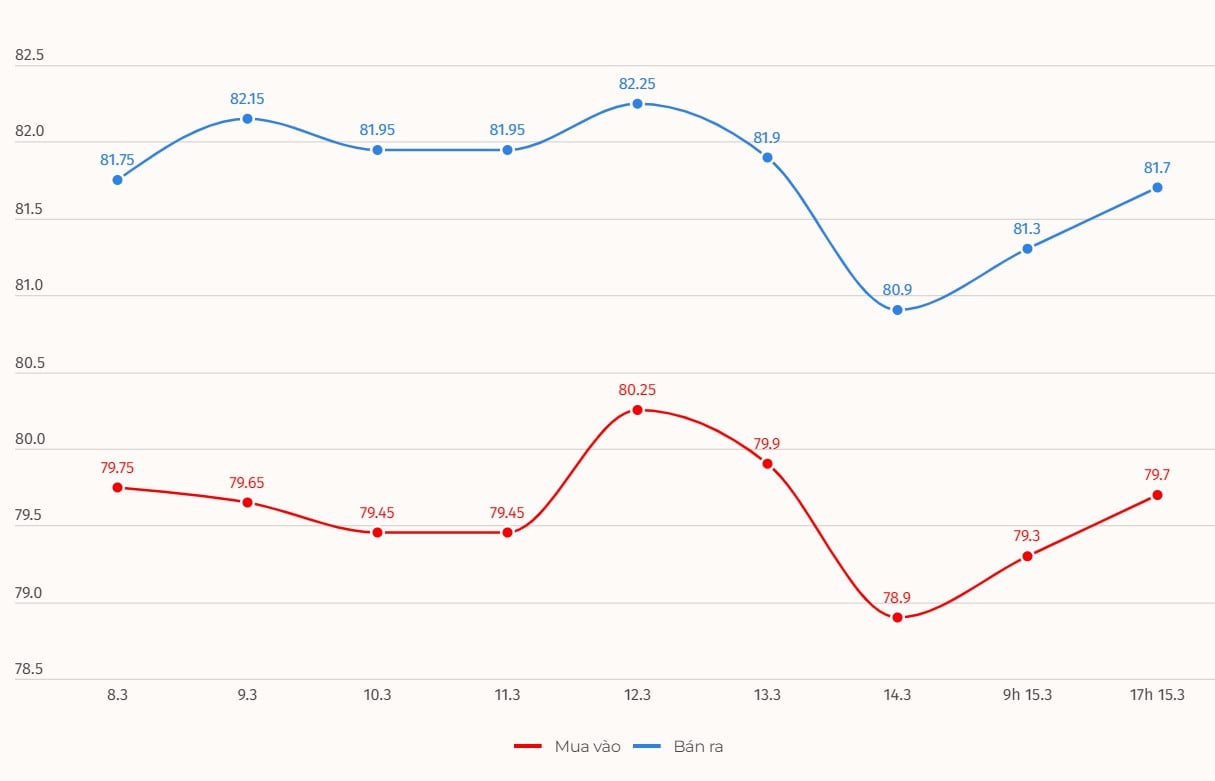

Up to now, the gold price at DOJI Group has increased to 79.7 million VND/tael; the selling price is 81.7 million VND/tael. If sold at this time, investors would have made a profit of more than 13 million VND/tael.

Similarly, the gold price at Saigon Jewelry Company SJC increased sharply to 79.7 - 81.7 million VND/tael (buy - sell). If sold in today's session, investors will also earn a profit of 12.7 million VND/tael.

Currently, the difference between buying and selling SJC gold is listed at around 2 million VND/tael. Experts say that the safe difference for investors is under 300,000 VND/tael. However, in reality, this difference rarely appears.

Not only SJC gold, the price of gold rings is also listed at a very high level. As of 5:00 p.m. on March 15, 2024, the price of smooth round gold rings listed by Bao Tin Minh Chau is 68.28-69.58 million VND/tael (buy in - sell out).

Meanwhile, Saigon Jewelry listed the price at 67.8-69 million VND/tael for buying and selling. Phu Nhuan Jewelry (PNJ) listed the price at 67.9-69 million VND/tael for buying and selling.

In the world market, according to Kitco, from the beginning of 2023 until now, the gold price has increased by more than 345 USD/ounce. As of 5:00 p.m. on March 15, 2024, world gold was listed at 2,169.9 USD/ounce.

Experts make surprising predictions about gold prices

Sharing in an interview with Bloomberg TV, Natasha Kaneva - head of commodities research at JPMorgan Chase - expressed confidence that "a gold price of $2,500 is possible" after the gold price reached an all-time high of $2,195.15 on March 8.

The expert said that factors that could lead to gold prices reaching the $2,500 threshold are data on inflation, employment as well as confirmation that the US Federal Reserve (FED) is indeed cutting interest rates.

The Fed’s shift toward easing monetary policy is expected to boost the appeal of gold compared with other yield-bearing assets such as bonds. Policymakers say they need more evidence that inflation is moving toward their 2% target before reducing borrowing costs.

Meanwhile, Mr. Florian Grummes - CEO at Midas Touch Consulting - commented that the current "dancing" gold price is "signaling the beginning of a big uptrend" in the gold sector.

He said the gold price increase to $2,200/ounce ended a 13-year period in which world gold prices continuously traded between $1,900 and $2,075/ounce.

With increasing risks in the stock market and potential economic uncertainty, it is only a matter of time before investors start to take notice and view gold as a safe haven asset, Mr. Grummes pointed out.

Source

![[Photo] Prime Minister Pham Minh Chinh attends the World Congress of the International Federation of Freight Forwarders and Transport Associations - FIATA](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759936077106_dsc-0434-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh inspects and directs the work of overcoming the consequences of floods after the storm in Thai Nguyen](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759930075451_dsc-9441-jpg.webp)

![[Photo] Closing of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759893763535_ndo_br_a3-bnd-2504-jpg.webp)

Comment (0)