It is not required to adjust information on the business registration certificate - Illustration photo: PQ

Completed updating taxpayer address information on the system

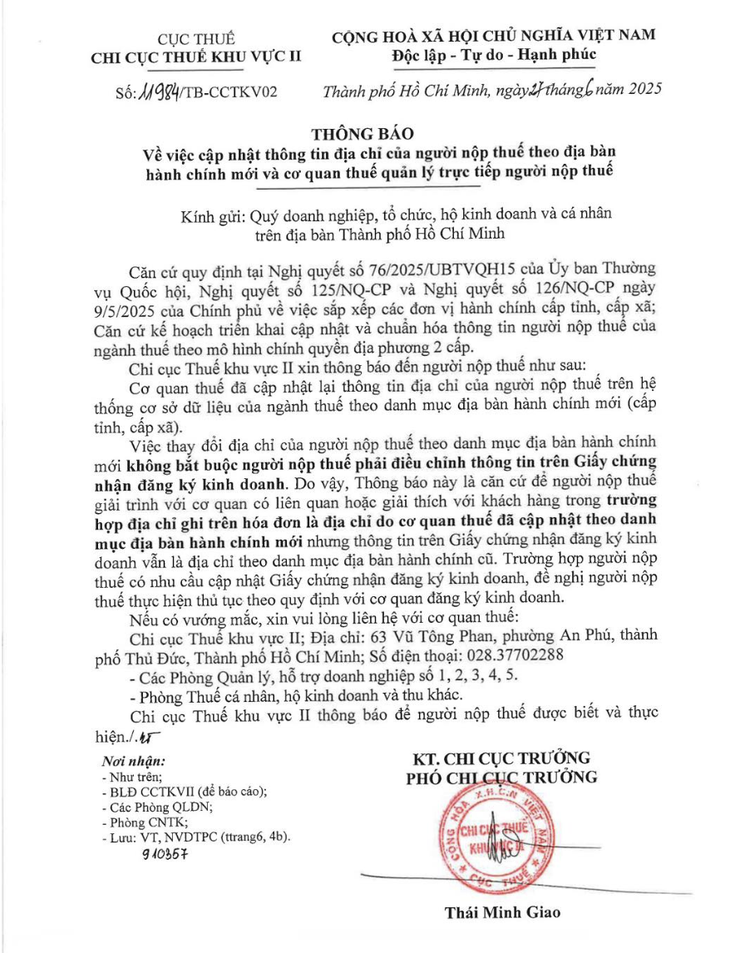

In a notice issued on June 30, the Tax Department of Region II (HCMC) said that the tax authority has completed updating taxpayer address information on the database system, based on the new administrative area list.

This change does not require taxpayers to adjust the information on their business registration certificates.

In case the address on the invoice is the address that has been updated by the tax authority according to the new list, but does not match the address on the business registration certificate, the taxpayer can use this notice as a basis to explain to the relevant authority or partner, customer.

If there is a need to update information on the business registration certificate, taxpayers must carry out procedures as prescribed at the business registration authority.

Notice issued by Tax Department of Region II today - Screenshot

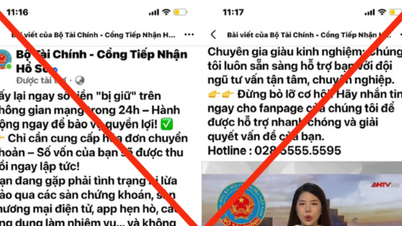

Warning about fake tax agency asking taxpayers to update address information

The Tax Department of Region I also issued a warning about the situation of fake tax authorities asking taxpayers to update address information.

This place affirms that the tax authority does not require organizations, enterprises, and business households to submit citizen identification cards or business registration certificates to update information according to the 2-level local government model.

Taxpayers need to be vigilant against acts of impersonating tax authorities via phone, email, or text messages with the aim of defrauding and profiting. Taxpayers should absolutely not follow instructions from unofficial sources of information.

According to the Tax Department of Region I, the tax authority has reviewed, standardized, and updated the addresses of organizations, enterprises, and business households according to the list of 2-level administrative areas (provincial and communal levels) on the tax sector's database system.

The tax authority will notify the taxpayer of the taxpayer's address according to the new administrative area and information of the tax authority directly managing the taxpayer (via the electronic tax transaction account, taxpayer's email, eTax Mobile application of the legal representative).

Source: https://tuoitre.vn/khong-bat-buoc-dieu-chinh-thong-tin-tren-giay-chung-nhan-dang-ky-kinh-doanh-20250630215411914.htm

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)