Investment comments

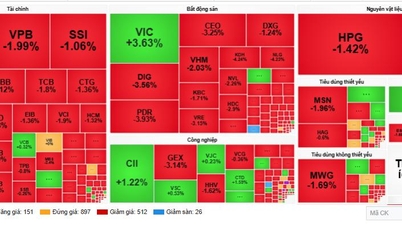

KB Securities Vietnam (KBSV) : Although the uptrend is still being maintained and the opportunity for recovery is still open, the weakening of demand and the lack of a leading group will cause the probability of VN-Index surpassing the peak to decrease and the risk of reversal to increase.

Investors are recommended to avoid chasing buys during recovery sessions, can partially sell to take profits and reduce the proportion of trading positions when the index approaches the next resistance zone around 1,300 (+/-10 points).

Vietcombank Securities (VCBS) : In a positive scenario, VN-Index will continue to trade sideways with an amplitude of 40 points and this strong decline can be considered an ST session (secondary test) in a flat correction wave.

Investors should be cautious and not panic and sell stocks in strong sessions like March 18. Investors should take advantage of the opportunity to disburse stocks in sectors that are still attracting stable cash flow and maintaining support areas such as real estate, banking, and securities.

BIDV Securities (BSC) : In the coming sessions, VN-Index may trade in the range of 1,220 - 1,245 points. Investors can watch this adjustment to restructure their portfolios.

Stock news

- The Fed is expected to keep interest rates unchanged at its March meeting: This will be a particularly interesting indicator. This week, the US Federal Reserve (FED) meeting will be the focus. Due to some hot inflation data, the FED is likely to keep interest rates unchanged after its policy meeting on March 20.

But what investors are paying more attention to is the central bank’s updated dot plot, which shows the forecasts of each member of the interest rate-setting committee. While most expect the Fed to keep its expected three rate cuts this year, some are worried the central bank will cut less after seeing a series of hot inflation reports.

- Forecast for September 2025 FTSE Russell to officially upgrade Vietnam's stock market? BSC has just made a forecast on the progress of upgrading Vietnam's stock market. According to BSC, in March 2024, FTSE will have an assessment period and by September 2024, FTSE will likely consider officially upgrading Vietnam's stock market. And by September 2025, FTSE will officially upgrade Vietnam's stock market to emerging market. Meanwhile, it is likely that by June 2025 it will be included in MSCI's watchlist .

Source

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee on overcoming the consequences of natural disasters after storm No. 11](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1759997894015_dsc-0591-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs the Conference to deploy the National Target Program on Drug Prevention and Control until 2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1759990393779_dsc-0495-jpg.webp)

Comment (0)