Staples, industrials and energy led the declines

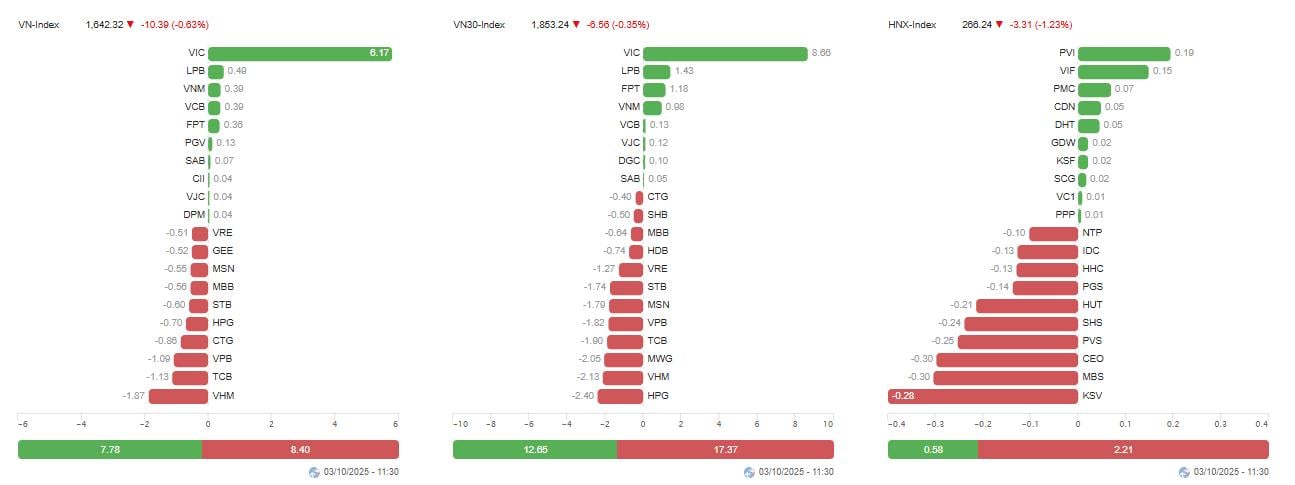

The morning session of October 3 opened in a negative state with red spreading across all three floors. VN-Index lost 10.39 points, falling to 1,642.32 points, a decrease of 0.63%. On the Hanoi Stock Exchange, HNX-Index fell 3.31 points to 266.24 points (-1.23%). UPCoM-Index also fell 0.6 points to 109.19 points (-0.55%).

Total market liquidity reached about VND13,489 billion, equivalent to 515.75 million shares matched. Although the trading value was at an average level, the demand was not strong enough to absorb the selling pressure, especially from foreign investors.

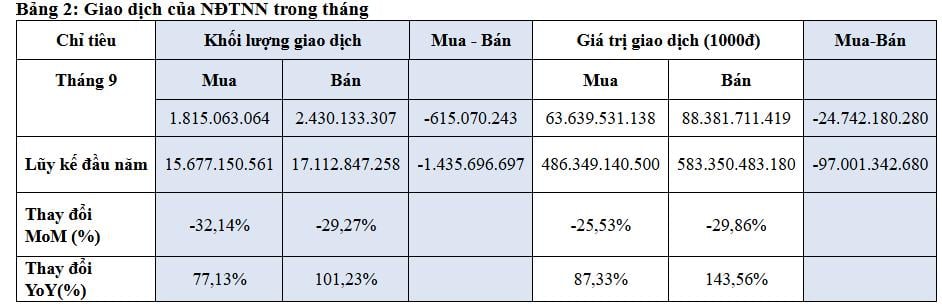

According to published data, foreign investors bought VND1,056.24 billion but sold VND1,981.82 billion, recording a net sale of more than VND925 billion in the morning session of October 3 alone. This was a strong net sale session following September, when foreign investors sold off more than VND24,742 billion on HOSE, bringing the total net sale since the beginning of the year to over VND97,000 billion. This pressure continues to be a burden for VN-Index in the context of domestic liquidity not improving much.

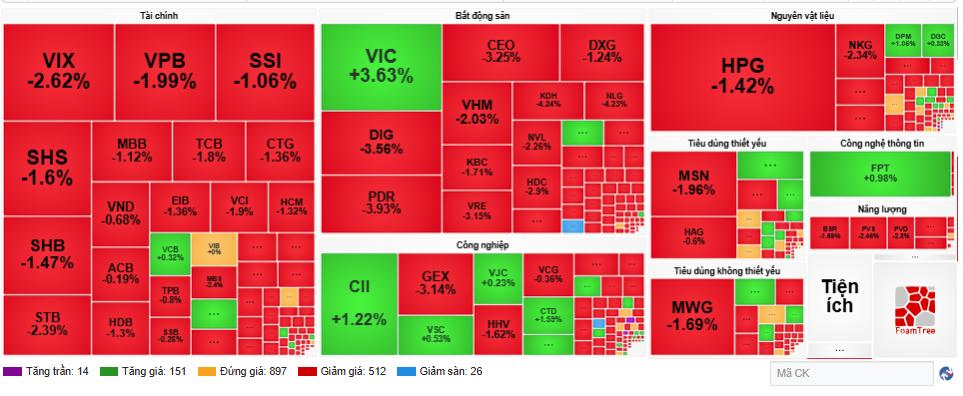

In the large-cap group, VIC became a rare bright spot when it increased by 3.63% and contributed positively to preventing the VN-Index from falling further. However, most of the remaining blue-chip stocks plummeted. VPB fell 1.99%, TCB lost 1.8%, CTG fell 1.36%. The securities group did not fare any better when VIX lost 2.62%, SSI fell 1.06%. HPG of Hoa Phat Group, a large-cap stock in the steel industry, fell 1.42% to VND27,700/share.

According to statistics, all 15 major industry groups on the HOSE traded below reference. The sharpest declines were in essential goods trade (-2.66%), industrial goods (-1.69%) and energy (-1.57%). The financial sector, which accounts for a large proportion of the VN-Index, also fell 1.47%, thereby creating double pressure on the general index.

In terms of trading value, the leading stocks areSHB (VND 1,448 billion), SSI (VND 1,116 billion), HPG (VND 1,088 billion), FPT (VND 975 billion). Of which, FPT is a rare stock that went against the trend, increasing by 0.98% thanks to stable demand. CII also attracted attention when it increased by 1.22% with liquidity of VND 767 billion. In contrast, VHM continued to decrease by 2.03% to VND 96,600/share, under net selling pressure from foreign investors.

A broader view of trading in September 2025 shows a worrying trend. VN-Index closed the month at 1,661.7 points, down 1.22% compared to August. Liquidity dropped sharply, averaging only 1.167 billion shares/day with a value of VND34,007 billion/day, down more than 30% compared to the previous month. Of which, foreign investors bought 1.815 billion shares but sold 2.430 billion shares, a difference of more than 615 million units, reflecting overwhelming selling pressure.

This development shows that the pressure from foreign capital is not only short-term but also long-term, making domestic investors more cautious, especially when the market has not found new momentum.

Short-term correction risks are increasingly clear.

Faced with the reality of the market constantly shaking, securities companies all give cautious assessments.

Saigon - Hanoi Securities Company (SHS) commented that VN-Index is accumulating in a narrow range, losing the short-term support level around 1,660 points (corresponding to the 20-session moving average). To escape this state and break out to a higher level, the market needs strong enough momentum with significantly improved liquidity.

According to Tien Phong Securities Company (TPS), the VN-Index chart has formed a Bearish Engulfing candlestick pattern, which is often considered a bearish reversal signal. The 1,630 point threshold is considered a key level; if broken through, the index may fall deep to the 1,530 point zone. TPS warns investors to pay special attention to this support zone.

Vikki Digital Bank Securities Company (VikkiBankS) believes that the VN-Index is likely to return to test the 50-day SMA line, in the context that the MACD indicator still maintains a sell signal. VikkiBankS recommends limiting the use of margin, keeping buying power waiting for a clearer signal when the market stabilizes.

Meanwhile, Beta Securities commented that the previous decline caused the VN-Index to fall below MA10 and MA20, two important moving averages, increasing the risk of a short-term correction. Technical indicators such as MACD, DI+ and DI- continued to send negative signals, signaling the possibility of further fluctuations or declines. The 1,620 - 1,625 point area is currently considered the closest support for the VN-Index.

Asean Securities Company (Aseansc) assessed that fluctuations and fluctuations will be the main state of the market in the short term. “Supply pressure around the historical peak, combined with net selling pressure from foreign investors and the psychology of waiting for information on market upgrade will cause the VN-Index to fluctuate in the range of 1,640 - 1,670 points,” Aseansc commented.

However, Yuanta Vietnam Securities Company (YSVN) has a more optimistic view. According to YSVN, the group of small and medium-cap stocks has reached the oversold zone, which can stimulate demand at low prices. This opens up the possibility of a short-term recovery for the VN-Index in the coming sessions. However, the company also admits that investors' pessimism is still prevalent, making the possibility of a strong breakout not much.

In the current context, experts advise investors to be cautious. The proportion of stocks in the portfolio should be kept at a safe level, avoiding margin abuse. Short-term investors can take advantage of the adjustment period to restructure the portfolio, prioritizing stocks with solid fundamentals and positive third-quarter business results. On the contrary, for long-term investors, maintaining a high cash position is still a safe solution to wait for clearer opportunities.

Foreign investors continued to be the highlight when they net sold more than VND24,742 billion, with the selling volume exceeding the buying volume by more than 615 million shares. Since the beginning of the year, foreign capital has withdrawn net over VND97,000 billion. This is a big pressure in the context of domestic cash flow not improving significantly. By industry, only real estate, health care and raw materials recorded increases, respectively 12.33%, 4.96% and 0.62%. In contrast, information technology and finance decreased the most, respectively 7.91% and 5.94%.

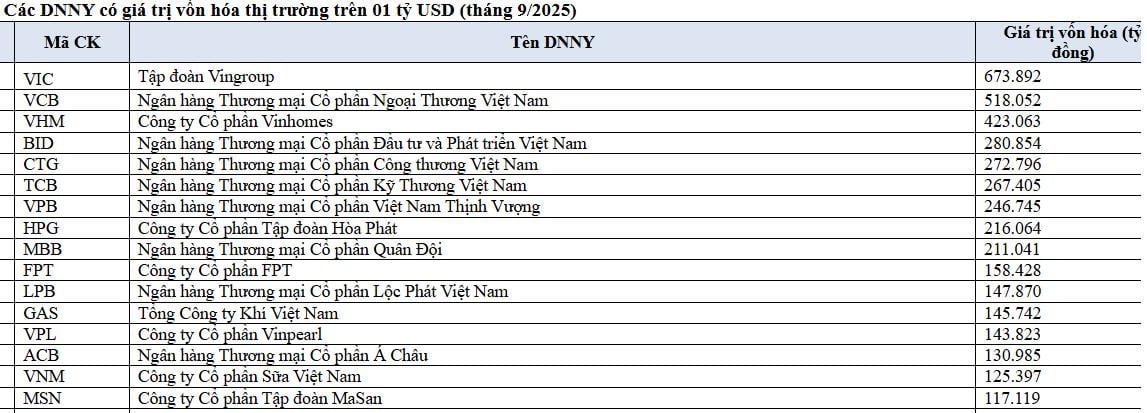

In terms of scale, the stock capitalization on HOSE reached VND7.20 trillion, equivalent to 62.6% of GDP in 2024 and accounting for 94.6% of the total market capitalization. There are 50 enterprises with capitalization of over 1 billion USD, of which six names exceeded the 10 billion USD mark, including VIC, VCB, VHM, BID, CTG and TCB.

Source: https://baotintuc.vn/thi-truong-tien-te/ap-luc-co-phieu-bluechip-lao-doc-chung-khoan-cuoi-tuan-do-lua-20251003120334986.htm

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)