Mixue’s Snow King has become a familiar symbol to young people across Asia. People assume it is the mascot of milk tea and ice cream cones that cost only a few tens of thousands of dong. But what if one day, you see this mascot holding a cold glass of draft beer?

That seemingly joke is becoming a reality. In early October, Mixue Group - a milk tea empire with more than 53,000 stores worldwide - officially announced a sensational deal, spending nearly 297 million yuan (about 40 million USD) to acquire 53% of the shares of Fulu - the company that owns the FULU Fresh Beer takeaway chain.

This spectacular foray immediately raised a big question for the market. That is, why did a brand that dominated the soft drink industry for young people suddenly branch out into a seemingly unrelated field like draft beer?

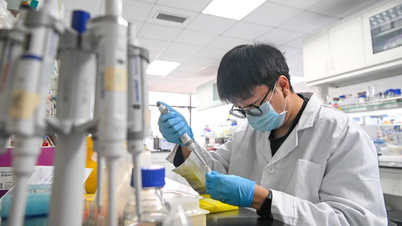

China's famous milk tea company Mixue Group is expanding into the beer sector by buying a controlling stake in a domestic beer chain (Photo: AFP).

The "two swords combined" move

In theory, milk tea and beer are two different worlds . But looking deeper into the business model, Mixue's decision is surprisingly reasonable.

Fulu, founded in 2021, has quickly expanded to 1,200 stores across China thanks to a formula very similar to Mixue: quality products at extremely accessible prices. A 500ml glass of Fulu draft beer costs just 6-10 yuan (about 21,000-35,000 VND). This "reasonable price" philosophy is the DNA that has made Mixue a miracle success.

Instead of building a beer brand from scratch, Mixue opted for a faster path by acquiring a “clone” of its own in the beer industry. They didn’t buy a product, but a proven business model that was fully compatible with their ecosystem.

The core and most interesting point of this deal is not the product, but the customers. Mixue's loyal customer base is mainly students, university students, and young people. Meanwhile, draft beer is a popular drink for a more mature consumer group, which is office workers and middle-aged men.

This move is considered a smart strategy to expand the market. Mixue is looking to "conquer" the parents of its current customers. Instead of trying to sell a new flavor of milk tea to a saturated customer base, they are looking to a whole new ocean, a demographic group with more stable spending power.

The deal also marked an important transformation for Mixue, from a beverage brand for young people to a mass beverage group, serving all ages.

"Mixing" the draft beer industry

So what will Mixue do with Fulu? They will most likely apply their successful formula to "Mixue-ize" this beer chain.

First, replicate the model. With experience in managing and optimizing the supply chain for tens of thousands of stores, expanding Fulu from 1,200 points of sale to 10,000 or 20,000 is within Mixue's reach.

The second is product innovation. Fulu is already famous for its creative beer lines such as tea-mixed beer, milk beer, or fruit beer. The combination with a "master" of trends like Mixue promises to create more unique product lines, attracting even those who are not used to drinking traditional beer.

An interesting detail revealed in the deal documents is that Ms. Tian Haixia - the current major shareholder of Fulu - is the wife of Mr. Zhang Hongfu - CEO of Mixue. This shows that this is not a normal investment decision, but a strategic move that has been carefully calculated from within the top management.

Clearly, Mixue does not see draft beer as a walk in the park but as a carefully calculated gamble, an arrow aimed at many targets: expanding its product portfolio, conquering new customer bases and making full use of its strengths in supply chain and low-cost model.

The "milk tea king" seems to be showing its ambition to become a force in the alcoholic beverage industry.

Source: https://dantri.com.vn/kinh-doanh/mixue-lan-san-ban-bia-tham-vong-hay-lieu-linh-20251015093623067.htm

![[Photo] Many dykes in Bac Ninh were eroded after the circulation of storm No. 11](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760537802647_1-7384-jpg.webp)

![[Photo] General Secretary To Lam attends the 18th Hanoi Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760581023342_cover-0367-jpg.webp)

![[Photo] Conference of the Government Party Committee Standing Committee and the National Assembly Party Committee Standing Committee on the 10th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760543205375_dsc-7128-jpg.webp)

![[Video] TripAdvisor honors many famous attractions of Ninh Binh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/16/1760574721908_vinh-danh-ninh-binh-7368-jpg.webp)

Comment (0)