On September 9, the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HAGL, stock code HAG) continued to announce unusual information about the implementation of the share issuance dossier to restructure debt. General Director Nguyen Xuan Thang was authorized to direct relevant units to prepare documents and complete procedures to submit to the State Securities Commission.

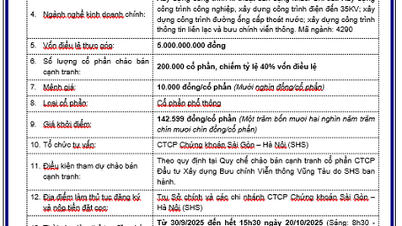

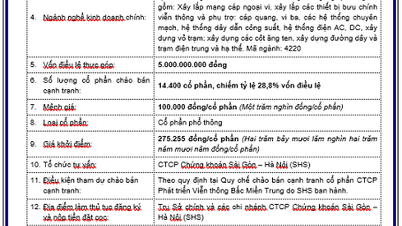

According to the announced plan, HAGL will issue 210 million shares to convert existing debt, and increase charter capital from VND10,574 billion to VND12,674 billion. The total expected debt value to be converted is VND2,520 billion, corresponding to the issue price of VND12,000/share.

The issuance plan will be implemented in 2025, after the company receives the offering certificate from the regulatory agency.

New creditors

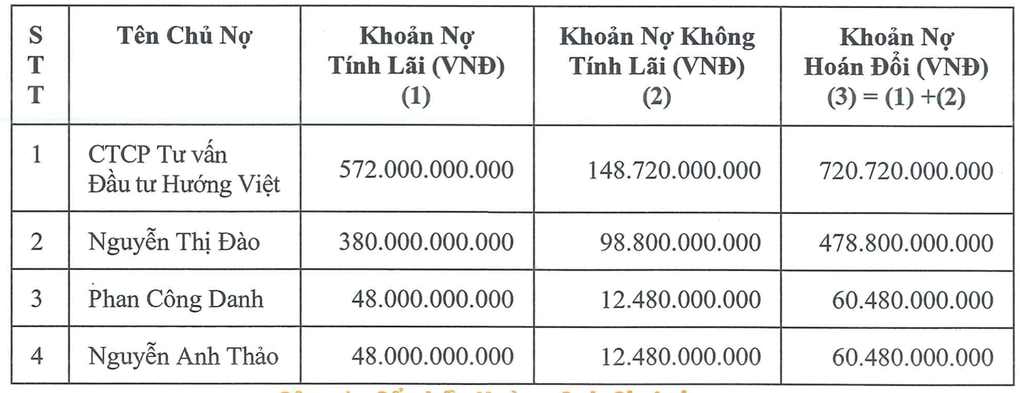

The swapped debt is an interest-bearing debt worth VND2,000 billion and a non-interest-bearing debt worth VND520 billion. These are group B bond debts from BIDV Bank that will be transferred to new creditors.

According to the new list of creditors, Huong Viet Investment Consulting Joint Stock Company (Huong Viet Investment) is the unit holding the largest debt, nearly 721 billion VND. Huong Viet Investment will receive more than 60 million shares, equivalent to 4.74% of charter capital after issuance (higher than the plan to receive 572 billion VND on the financial statement of the second quarter of 2025).

Some domestic individuals also participated in the swap, including Ms. Nguyen Thi Dao with a debt of 479 billion VND.

Mr. Phan Cong Danh and Mr. Nguyen Anh Thao both received a debt of more than 60 billion VND.

Mr. Ho Phuc Truong and Mr. Nguyen Duc Trung received the same debt of 600 billion VND.

List of organizations and individuals receiving back the debt of 2,520 billion VND from BIDV (Photo: Screenshot of HAGL Resolution).

10 years, paid off 1 billion USD in bank debt

In 2016, with a total debt of more than 36,000 billion VND (loan debt accounted for 28,000 billion VND), Mr. Doan Nguyen Duc (Bau Duc), Chairman of the Board of Directors of HAGL, at that time declared "HAGL lost liquidity".

Without cash flow to maintain operations, unable to pay interest and principal, the business faced the risk of collapse... Mr. Duc called it the loneliest moment of his life: "Consider it dead!".

At that time, Mr. Duc was in the last days of his 53 years old, starting a journey of a decade of hard work to pay off his debt.

In 2021, after transferring agricultural company HAGL Agrico to billionaire Tran Ba Duong, HAGL reduced its outstanding debt from VND 35,274 billion (2020) to VND 13,766 billion, of which loan debt was only VND 8,287 billion.

As of June 30, 2025, HAGL's total debt will continue to decrease to VND6,965 billion. If the stock swap is successful, the Group expects to further reduce its bank debt by more than VND2,000 billion, bringing the outstanding bank debt to about VND5,000 billion (a decrease of VND23,000 billion after 10 years, since 2016).

Regarding business, in the second quarter of 2025, HAGL recorded net revenue of VND2,329 billion, up 53% over the same period. Profit after tax reached VND510 billion, up 88% and the highest level in the last 6 quarters.

In the first half of the year, the Group's net revenue reached VND3,707 billion, and after-tax profit reached VND880 billion, up 34% and 76% respectively compared to the first half of last year.

With this result, HAGL has completed more than half of the adjusted business plan announced on July 23, reaching 52.2% of the revenue target and 56.8% of the profit target.

Source: https://dantri.com.vn/kinh-doanh/mot-thap-ky-xoay-xo-bau-duc-sap-tra-duoc-1-ty-usd-no-ngan-hang-20250909123302509.htm

![[Photo] Prime Minister Pham Minh Chinh meets with Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/08ca17cb0c46432dbdb94f9eaf73b47a)

![[Photo] General Secretary To Lam receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/3814a68959e848f586178624b6bd66e5)

Comment (0)