After the incident at the Vietnam National Credit Information Center (CIC) and a series of online frauds in recent times, protecting financial data is considered an urgent task, prompting banks to move from a passive position to proactive inter-sectoral coordination to prevent digital fraud. The signing ceremony of the United Nations Convention against Cybercrime ( Hanoi Convention) hosted by Vietnam on October 25-26 further demonstrates Vietnam's proactive and responsible role in building a safe and transparent digital environment, including cybersecurity in the banking sector.

When financial "lifeblood" becomes the goal

The incident at CIC - the unit that stores data of 52 million individual customers and more than 1.2 million businesses - although it has not caused any actual damage, has sounded the alarm about the risk of data leakage. In the context that 87% of adults have bank accounts and nearly 90% of transactions are conducted via digital channels, just a small loophole in the system can create a chain risk for the entire market. This is also a warning about the scale and level of vulnerability of the national financial infrastructure, especially when cybercriminals are expanding their attacks to the banking sector and personal data.

Mr. Vu Ngoc Son, Head of the Department of Research, Consulting and International Cooperation (National Cyber Security Association), said that international payments are the lifeblood of the global economy , but also an attractive target for cybercriminals. Pointing out five main reasons for the continuous increase in cyber attacks in the financial sector, Mr. Son said that they are due to technical vulnerabilities, human factors, risks from the supply chain, international legal differences and lack of investment in cyber security.

Financial fraud methods are also becoming more sophisticated and diverse, from impersonating state agencies, hiring to open accounts, impersonating banks to defrauding online investments, taking control of mobile devices...

According to the Department of Cyber Security and High-Tech Crime Prevention (Ministry of Public Security), in 2024, Vietnam recorded more than 100,000 cases related to cybercrime, including up to 29,000 ransomware attacks. The attacks targeted government agencies, businesses and financial institutions. The damage caused by online fraud is estimated at about VND12,000 billion.

The above figures show that Vietnam's financial space is becoming a key target of high-tech criminals, in which banks are the front line under the greatest pressure.

Strengthening the cyber security "shield"

To cope with this situation, the State Bank of Vietnam has issued Official Letter No. 7936/NHNN-CNTT, requesting credit institutions and foreign bank branches to thoroughly grasp and strictly implement the regulations of the State and the banking sector on ensuring information system security and safety and data confidentiality. Accordingly, heads of units must be responsible before the law if network security and safety are lost.

Credit institutions are also required to periodically review system vulnerabilities, assess information security with third parties, and deploy measures to prevent supply chain attacks - a type that is increasingly common in the world.

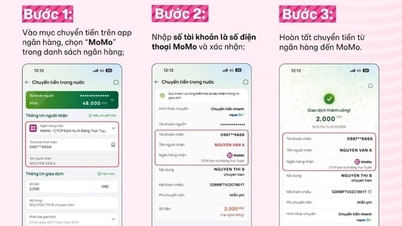

The State Bank is coordinating with the Ministry of Public Security to build a database of suspected fraudulent accounts and test a system to warn customers of fraudulent transactions right on their applications. This is considered a foundation to form an “early warning barrier”, creating a safer and more transparent digital banking ecosystem.

Commercial banks have also proactively invested in technology infrastructure, deployed biometric authentication, transaction encryption and AI monitoring systems. However, experts say that the individual efforts of each bank are not enough without a unified coordination mechanism.

Faced with the increasingly complex reality of financial fraud, the Vietnam Banking Association (VNBA) has just issued a Handbook on coordinating risk handling in transactions suspected of fraud, forgery, and swindling.

Vice President and General Secretary of VNBA Nguyen Quoc Hung said the goal of the Handbook is to establish a unified coordination mechanism among banks, ensuring that when unusual transactions are detected, the system automatically traces and blocks them promptly.

A representative of the Bank for Investment and Development of Vietnam (BIDV) proposed to unify the principle of "holding money suspected of fraud, not returning it, even if the customer requests to close the account". This rule helps avoid inconsistent handling between banks, creating transparency in preventing fraud. Meanwhile, a representative of the Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) proposed to connect data between banks and the Ministry of Public Security to speed up the tracing of fraudulent accounts, expanding monitoring to e-wallets - a transaction channel that is being widely exploited in fraud cases.

From a security perspective, Mr. Hoang Ngoc Bach, Head of Department 4, Department of Cyber Security and High-Tech Crime Prevention (A05, Ministry of Public Security), emphasized that the issuance of the Coordination Handbook is a historic step, creating for the first time a unified action process between banks and investigation agencies. He said that the "golden time" to freeze and recover money is right after the victim reports, so a quick response mechanism and data connection between the parties is needed.

However, in the context of cross-border cybercrime, domestic efforts need to go hand in hand with international cooperation. Accordingly, the signing ceremony of the United Nations Convention against Cybercrime (Hanoi Convention) hosted by Vietnam on October 25-26 is of great significance. This is not only an international commitment but also demonstrates Vietnam's proactive and responsible role in building a safe and transparent digital environment.

The Hanoi Convention is the United Nations' first global legal instrument on preventing and combating cybercrime, helping countries share data, electronic evidence and investigative experience, while creating conditions for Vietnam to harmonize domestic laws with international standards.

Besides its security significance, the Convention also opens up opportunities to attract international investment in the field of cybersecurity, a strategic pillar in the national digital transformation process.

The Hanoi Convention creates an international legal foundation, the VNBA Coordination Manual establishes a domestic mechanism of action, and the training and technology investment efforts of banks create the human and technical pillars. These three elements are forming a "tripod" that helps strengthen the national financial security defense line against the wave of high-tech crime.

Source: https://baotintuc.vn/tai-chinh-ngan-hang/ngan-hang-siet-chat-phoi-hop-chan-gian-lan-tai-chinh-so-20251022084949237.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on nuclear power plant construction](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/22/1761137852450_dsc-9299-jpg.webp)

![[Photo] Award Ceremony of the Political Contest on Protecting the Party's Ideological Foundation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/22/1761151665557_giaia-jpg.webp)

![[Photo] Da Nang: Shock forces protect people's lives and property from natural disasters](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/22/1761145662726_ndo_tr_z7144555003331-7912dd3d47479764c3df11043a705f22-3095-jpg.webp)

![[Photo] Comrade Nguyen Duy Ngoc visited and worked at SITRA Innovation Fund and ICEYE Space Technology Company](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761174470916_dcngoc1-jpg.webp)

![[Photo] General Secretary To Lam and his wife begin their official visit to Bulgaria](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761174468226_tbtpn5-jpg.webp)

Comment (0)