Mr. Luong Van Noi, Director of the Bank for Agriculture and Rural Development of Vietnam (Agribank) Bac Giang Branch, said that seriously implementing the direction of the Government and the State Bank of Vietnam, Agribank immediately issued a document directing branches to deploy support solutions for customers who suffered losses in terms of human life, property, materials, crops, livestock, and production and business establishments in the provinces and cities directly affected by the storm, including Bac Ninh province.

|

Customers come to transact at Agribank Bac Giang Branch. |

Accordingly, for existing outstanding loans (including VND and USD) as of September 30, 2025 (excluding loans applying other preferential interest rate programs at Agribank), based on the level of damage of customers, Agribank will reduce the loan interest rate by 0.5% to 2%/year, not collect late payment interest, and adjust the overdue interest rate to the loan interest rate within the period from October 1 to December 31, 2025.

For new loans arising from October 1 to December 31, 2025, Agribank reduces the loan interest rate by 0.5%/year compared to the interest rate applied at the time of disbursement, applicable for a maximum period of 6 months from the date of disbursement.

It is known that according to Official Dispatch No. 8622/NHNN-TD dated October 2, 2025, the State Bank of Vietnam requested credit institutions and foreign bank branches in Vietnam to review and assess the level of damage to customers borrowing capital in areas affected by natural disasters. On that basis, the units will consider restructuring the debt repayment period, maintaining the debt group, exempting or reducing loan interest, and continuing to provide new loans so that customers have capital to restore production and business, rebuild houses, and stabilize their lives.

The State Bank of Vietnam also assigned the State Bank branches in the provinces to closely coordinate with local authorities, closely monitor the situation and guide commercial banks to implement timely and appropriate support policies. In case of difficulties arising beyond their authority, the branches must synthesize and report to the State Bank of Vietnam for consideration and handling.

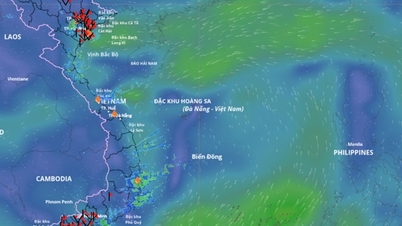

Implementing the direction of the State Bank of Vietnam, Agribank has pioneered in implementing support solutions for customers affected by storms No. 10 and 11 and widespread floods. Currently, many large commercial banks such as Vietnam Investment and Development Bank (BIDV), Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank), Vietnam Joint Stock Commercial Bank for Foreign Trade (VietcomBank) ... are also considering issuing practical support policies. Mr. Nguyen Trung Kien, Director of BIDV Bac Giang Branch, said that based on the direction of the superior bank, the bank is currently reviewing customers affected by natural disasters, on that basis, it will have timely support measures according to the general regulations of the whole system.

Source: https://baobacninhtv.vn/nganh-ngan-hang-trien-dei-cac-giai-phap-ho-tro-khach-hang-bi-thiet-hai-do-bao-lu-giay-ra-postid428645.bbg

![[Photo] Opening of the World Cultural Festival in Hanoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760113426728_ndo_br_lehoi-khaimac-jpg.webp)

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the founding of the Korean Workers' Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760150039564_vna-potal-tong-bi-thu-du-le-duyet-binh-ky-niem-80-nam-thanh-lap-dang-lao-dong-trieu-tien-8331994-jpg.webp)

![[Photo] Discover unique experiences at the first World Cultural Festival](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760198064937_le-hoi-van-hoa-4199-3623-jpg.webp)

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

Comment (0)