Disappointment enveloped the market on November 15, bringing the VN-Index to 1,218.6 points and many stocks were in red. With the inertia of decline over the past few days, BSC Securities analysts are concerned that the VN-Index could fall to 1,200 points.

VN-Index continues to fall more than 13 points: Is the day to return to the 1,200 mark near?

Disappointment enveloped the market on November 15, bringing the VN-Index to 1,218.6 points and many stocks were in red. With the inertia of decline over the past few days, BSC Securities analysts are concerned that the VN-Index could fall to 1,200 points.

|

After a deep drop of up to 14 points, the selling pressure at the beginning of the trading session on November 15 was not too strong, but weak demand continued to push the indices down below the reference level.

After about 10 hours, selling pressure increased and widened the decline of the indices. VN-Index fell to 1,217 points in the morning session and recovered slightly in the early afternoon session, but sellers continued to lose patience and pushed the market down. Stronger selling pressure occurred about 15 minutes before the regular order matching session to determine the closing price, once again completely erasing the recovery effort. For the entire session today, VN-Index traded in red.

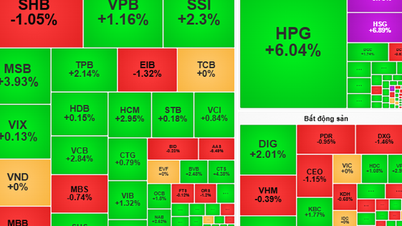

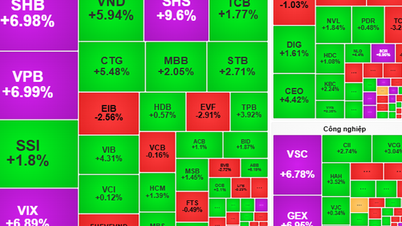

At the end of the trading session, VN-Index stood at 1,218.57 points, down 13.32 points (-1.08%). HNX-Index fell 2.29 points (-1.02%) to 221.53 points. UPCoM-Index fell 0.54 points (-0.59%) to 91.33 points. The entire stock market on November 15 had 543 stocks falling in price, 776 stocks remaining unchanged and only 219 stocks increasing in price. Despite the negative market fluctuations, 27 stocks hit the ceiling, while the number of stocks hitting the floor was 37.

Securities stocks continued to attract attention when they plummeted, making investors' sentiment much more pessimistic. VDS fell 4.88%, CTS fell 4.6%, BVS fell 4.1%, and AGR fell 4.1%.

Similarly, other stock groups such as steel, retail, oil and gas... also fell. Industry groups that had positive trading periods in the previous sessions such as seaports - maritime transport, textiles, chemical fertilizers, seafood... also fell in price.

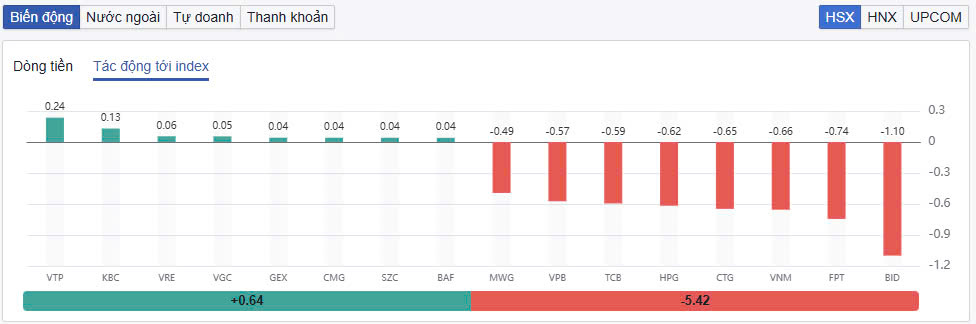

In the VN30 group today, only 3 codes remained green, namely VRE, SSB and BVH. Along with VJC maintaining the reference level. Meanwhile, there were 26 codes that decreased in price. Stocks such as BID,FPT , VNM, CTG, HPG, TCB... were all in red and were on the list of stocks with the most negative impact on the VN-Index. BID decreased by 1.76% and took away 1.1 points. FPT also decreased by 1.54% and took away 0.74 points...

According to Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy, VNDIRECT Securities Joint Stock Company, the fact that the central exchange rate was continuously adjusted upwards last week and the interbank exchange rate almost returned to its mid-year peak, combined with the interbank interest rate rising again to over 5%, has had a negative impact on investor sentiment. The performance of banking, securities, and steel stocks, which are highly sensitive to fluctuations in exchange rates and interest rates, has therefore also been strongly affected.

|

| Top 10 stocks strongly impacting VN-Index on November 15. |

On the other hand, VTP continued to surprise investors by hitting the ceiling despite the negative fluctuations in the general market. VTP was even in a state of excess buying at the ceiling price and no selling. VTP was also the code with the most positive impact on the VN-Index when contributing 0.24 points. In addition, some industrial park stocks such as KBC, VGC or SZC... also went against the general market. KBC increased by 2.44%, SZC increased by 2.3%, VGS increased by 1.15%.

Liquidity increased as red continued to dominate. Total trading volume on HoSE reached 751 million shares, equivalent to a trading value of VND18,650 billion, up 15.6% compared to the previous session). Negotiated transactions accounted for VND2,448 billion on HoSE. Trading values on HNX and UPCoM were VND1,213 billion and VND493 billion, respectively.

FPT is the stock with the largest trading value in today's session with 878 billion VND. Next, HPG and VHM have matched values of 721 billion VND and 688 billion VND respectively.

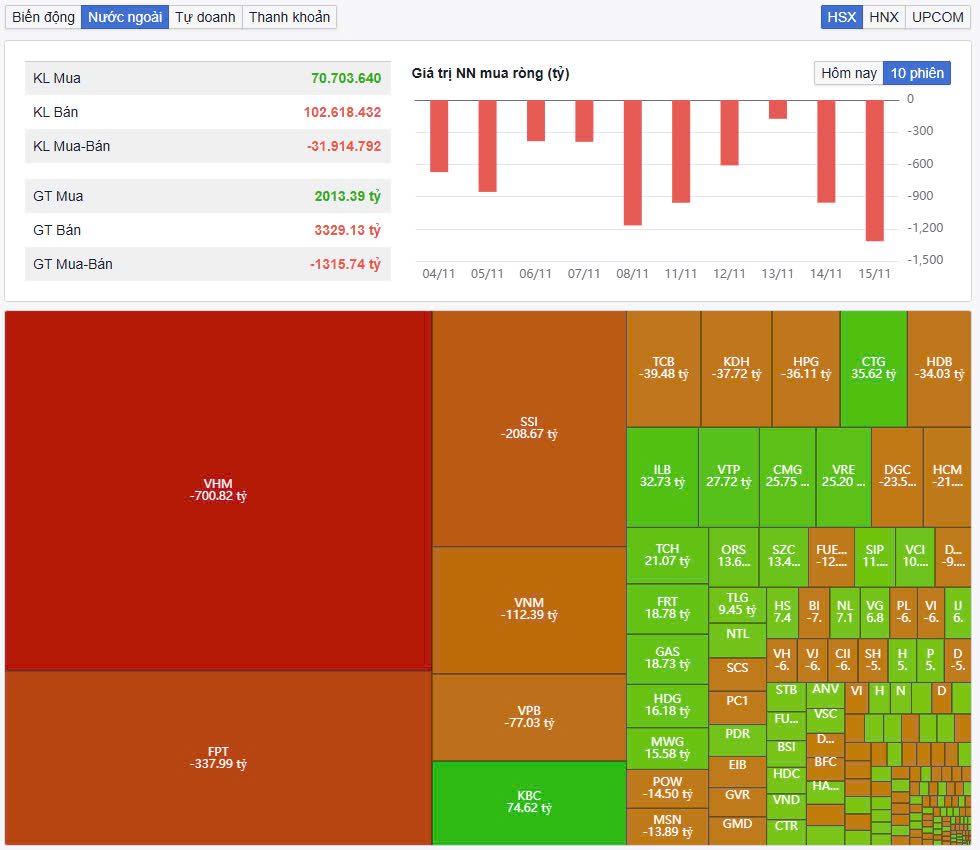

Foreign investors increased their net selling to VND1,315 billion in the whole market. On the HoSE floor alone, foreign investors net sold VND1,429.54 billion, the highest since November.

|

| Foreign investors' net selling suddenly focused on VHM and FPT stocks. |

Foreign investors sold VHM with a net value of 701 billion VND. FPT continued to be sold net with 338 billion VND. SSI and VNM were sold net with 209 billion VND and 112 billion VND respectively. In the opposite direction, VPB was bought the most with 75 billion VND. CTG was behind but the net purchase value was only 36 billion VND.

The downtrend is still ongoing. In a report sent to investors, analysts from BSC predicted that the VN-Index could move towards the support zone of 1,200 points.

Source: https://baodautu.vn/vn-index-tiep-tuc-giam-hon-13-diem-ngay-ve-moc-1200-can-ke-d230160.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

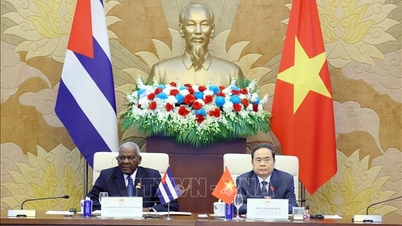

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)