The January 31 stock market session started off quite peacefully as the VN-Index opened in the green. However, investors’ positive sentiment did not last long as the VN-Index quickly slid due to selling pressure from investors.

In the morning session, although the electronic trading board was covered in red, the buying pressure was still quite large, limiting the index's decline. However, towards the end of the session, the selling pressure became greater, causing the VN-Index to "free fall" at times.

At the close of the January 31 stock market session, VN-Index fell 15.34 points, or 1.3%, to 1,164.31 points; VN30-Index fell 15.38 points, or 1.3%, to 1,166.33 points. It can be seen that the decline was widely distributed across the entire market and not by the size of the stock group.

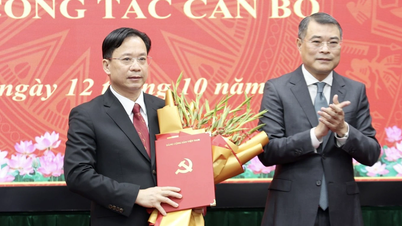

In the January 31 stock market session, investors simultaneously sold off, causing liquidity to reach billions of dollars. Bank stocks became the "culprits" when they fell sharply. Illustrative photo

The entire floor recorded only 101 codes increasing in price, 62 codes remaining unchanged and 393 codes decreasing in price. The VN30 group recorded 26 codes decreasing in price, 3 codes increasing in price and 1 code remaining unchanged.

The focus of the stock market on January 31 was banking stocks. In the first few weeks of 2024, this industry group played a leading role in the market's upward trend. However, in the last session of January 2024, banking stocks were the "culprits", dragging the VN-Index down.

Many bank stocks have a very strong decrease rate such asSHB (down 700 VND/share, equivalent to 5.69% to 11,600 VND/share), VCB (down 2,500 VND/share, equivalent to 2.75% to 88,500 VND/share), STB (down 800 VND/share, equivalent to 2.61% to 29,900 VND/share), BID (down 750 VND/share, equivalent to 1.55% to 47,700 VND/share),...

On the Hanoi Stock Exchange, red also dominated. At the close of the January 31 session, the HNX-Index fell 1.48 points, or 0.64%, to 229.18 points; the HNX30-Index fell 4.74 points, or 0.96%, to 487.34 points.

The liquidity of the January 31 stock market session skyrocketed and reached the billion dollar mark. On the Ho Chi Minh Stock Exchange, more than 1.1 billion shares, equivalent to VND23,315 billion, were successfully traded. Liquidity on the Hanoi Stock Exchange was less active, reaching only VND1,845 billion.

VCBS Securities Company believes that the decline in the stock market on January 31 was just a profit-taking mentality before Tet when liquidity increased sharply during the session and cash flow also shifted to other industries, but there were no signs of withdrawals, indicating that this was just a profit-taking mentality of the market near Tet.

VCBS recommends that investors should not panic when the market experiences correction sessions and take advantage of these opportunities to increase their exposure to sectors that show signs of attracting cash flow, such as stocks.

“The banking group's strong adjustment caused the VN Index to drop sharply, however, money still flowed to other sectors so this is not a worrying thing for the general market,” VCBS commented.

Source

![[Photo] Discover unique experiences at the first World Cultural Festival](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760198064937_le-hoi-van-hoa-4199-3623-jpg.webp)

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the founding of the Korean Workers' Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760150039564_vna-potal-tong-bi-thu-du-le-duyet-binh-ky-niem-80-nam-thanh-lap-dang-lao-dong-trieu-tien-8331994-jpg.webp)

Comment (0)