Hoa Phat Chairman Tran Dinh Long's assets evaporated 2,000 billion VND the day US President Donald Trump imposed tariffs on imported steel. However, HPG shares have recovered. What is the impact of US policies on Vietnamese steel enterprises?

In the trading session on February 10, shares of Hoa Phat Group (HPG) and many other steel industry codes fell sharply. HPG fell nearly 4.7%, thereby causing the assets of Hoa Phat Chairman Tran Dinh Long to decrease by more than VND2,000 billion, down to VND42 trillion.

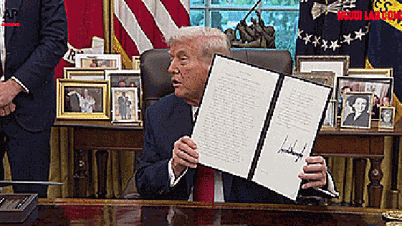

Billionaire Long's family assets evaporated nearly 2,800 billion VND after US President Donald Trump announced a 25% tax on all steel and aluminum imported from countries, including Vietnam. In the early morning of February 11 (Vietnam time), Mr. Trump signed this decree.

Other steel industry stocks also fell sharply in the session on February 10, such as: HSG of Hoa Sen Group (down 4.52%), Nam Kim Steel down 3.6%...

The news of Mr. Trump’s tax hike has had a strong impact on the psychology of many investors. However, the potential impact is not considered much.

According to SSI Securities, President Trump signed proclamations to increase tariffs on steel and aluminum imports to a flat 25% and eliminate all exemptions for all countries. This is an extension of the Section 232 tariffs issued by Mr. Trump in 2018, which initially set a flat 25% tariff on steel imports but included exemptions for some countries such as Canada, Mexico, Brazil, South Korea and the United Kingdom.

Mr. Tran Dinh Long's assets increased again after losing 2,000 billion VND on February 10. Photo: HH

In the new order, Washington maintains the Section 232 tax and eliminates all exemptions. The new law will take effect on March 4.

For Vietnam, steel imports into the US have been taxed at 25% since 2018 under Section 232, so Vietnam's steel is not affected by this tax increase.

SSI Securities believes that there is little impact on the Vietnamese steel industry regarding exports to the US. In fact, the new tax action may be somewhat positive for the Vietnamese steel industry because it puts Vietnam's import tax rate (before taking into account other protective taxes) on par with other countries.

Vietnam’s steel exports to affected countries such as Mexico and Canada are also relatively small (as of December 2024). These countries are not among the top 10 steel export markets of Vietnam, according to data from the Vietnam Steel Association (VSA).

However, it will take time to see the final impact because the decree is complex. Accordingly, there are a number of other duties such as CVD (countervailing duty) and AD (anti-dumping duty), of which AD is still under investigation.

The US recently released the results of its preliminary investigation and preliminary CVD duties on corrosion-resistant steel from Vietnam, with Hoa Sen Group (HSG) and Ton Dong A (GDA) receiving minimal duties (approximately 0.13% and 0%). The preliminary AD results are expected to be released in the coming months.

In the trading session on February 11, HPG shares recovered quite strongly, increasing nearly 2.8%, helping Mr. Tran Dinh Long's family regain more than half of the assets lost in the previous session.

However, HSG and GDA still went down, with shares falling 0.9% and 1.24% respectively.

Regarding the steel industry, according to SSI Securities, the outlook for 2025 remains positive based on bottomed steel prices, stronger domestic demand from the recovery of the real estate industry and public investment. SSI also expects anti-dumping duties on HRC hot-rolled coil steel from China and India.

HPG is forecast to have increased revenue thanks to the Dung Quat 2 complex coming into operation.

In 2024, HPG recorded a 17% increase in revenue to over VND140 trillion. Profit after tax increased by 77% to over VND12 trillion.

The stock market session on February 11 recorded the VN-Index increasing by 5.2 points to 1,268.45 points. The HNX-Index increased by 0.9 points to 228.87 points. The Upcom-Index increased slightly by 0.12 points to 96.75 points. Liquidity on the 3 floors reached 15.5 trillion VND.

10 USD billionaires in Vietnam: Mr. Tran Dinh Long firmly holds the top spot? Billionaire Tran Dinh Long's Hoa Phat Group recorded positive signals after the shock in 2022. But can the steel tycoon maintain this position and break out to become the richest person?

Source: https://vietnamnet.vn/ong-trump-ap-thue-thep-ty-phu-tran-dinh-long-mat-nghin-ty-tac-dong-ra-sao-2370471.html

![[Photo] Delegation attending the Government Party Congress visited President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/12/1760240068221_dsc-3526-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man attends the 725th anniversary of the death of National Hero Tran Hung Dao](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/12/1760285740475_ndo_br_bnd-8978-jpg.webp)

![[Photo] The 1st Government Party Congress held a preparatory session.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/12/1760257471531_dsc-4089-jpg.webp)

Comment (0)