Mr. Tran Anh Tuan, Chairman of the Board of Directors of MSB at the "Bank of the Year 2023" award ceremony of The Banker@Financial Times

Positive business results in volatile context

In the first 9 months of the year, MSB's total net revenue reached VND 9,567 billion, up 19% over the same period in 2022. Of which, net interest income reached more than VND 6,800 billion, up 9% over the first 9 months of last year. The ratio of non-interest income to total income reached nearly 29%, up more than 6% over the same period. This also shows MSB's efforts in transforming and diversifying its revenue structure. At the end of the 9 months, MSB's consolidated pre-tax profit reached VND 5,223 billion, equivalent to 83% of the yearly plan.

As of September 30, 2023, the Bank's total assets reached over VND 249,000 billion, up 17% compared to the end of 2022. Total accumulated customer loans for the first 9 months reached nearly VND 141,244 billion, up 17% compared to the beginning of the year. Customer deposits reached VND 129,618 billion, up 11% compared to the end of the previous year. The ratio of non-term deposits to total deposits (CASA) reached 27.71%, among the leading banks in the market.

In the third quarter of 2023, responding to the direction of the State Bank, MSB reduced interest rates for customers three times. Although this directly affected the bank's net interest margin (NIM), MSB still maintained this index at 4.11%, only slightly down compared to 2022.

Affirming its solid and effective capital position, MSB's consolidated capital adequacy ratio (CAR) remained stable at 12.6%.

Strengthening digitalization of products and services

The Digital Factory (DF) project is considered the "backbone" in MSB's digitalization orientation. Directly impacting 3 processes: customer approach, approval and post-approval, DF has deployed many customer journeys (CJ) that are almost completely digitized, helping to improve user experience, while minimizing paperwork, procedures, and saving fuel arising from internal processes. The most typical and also rated 86/100 CSAT (satisfaction level) by customers is M-Power - a super-fast online unsecured loan solution with a limit of up to 15 billion VND. MSB is one of the first banks to provide this solution in the Vietnamese market.

The solution allows customers to proactively look up the expected limit granted in just 30 seconds; submit documents completely online; use digital signatures to streamline documents; proactively monitor loan processing progress. MSB conducts appraisal and approval within 3 working days, much more optimal than the traditional method. To successfully deploy M-Power, MSB has applied and simultaneously combined the leading modern technologies today. Typically, the scoring model with a design based on a separate risk appetite is integrated right on the page https://vaydoanhnghiep.msb.com.vn/ to help the system quickly return the results of the expected approved loan; OCR - Optical Character Recognition has the function of automatically extracting data from customer records or Artificial Intelligence (AI) combined with Natural Language Processing (NLP) to allow identification and handling of counterfeit elements.

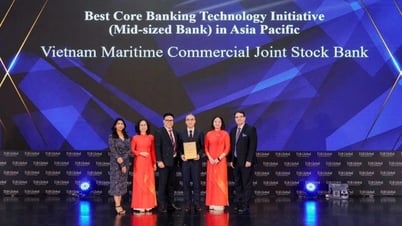

Mr. Tran Anh Tuan, Chairman of MSB received the award in the presence of Prime Minister of Gibraltar Fabian Picardo

Enhancing risk management on the digital journey

The bank has built and deployed pre-approval, auto-approval, income prediction, behavioral analysis and fraud prevention models to quickly make loan approval decisions. In addition, the early warning system has also shifted to a data-driven model, allowing risks to be warned more frequently and at the same pace as user transactions. In parallel, to minimize the provision of customer profiles and increase the accuracy and efficiency of the model, MSB aims to use alternative data sources from behavioral data, customer transaction history, etc. Model building techniques currently use machine learning algorithms to increase productivity and quality.

Regarding fraud risk management on the digital journey, MSB applies a four-layer filter funnel model with a modern technology platform. Typical examples include AI with a face vectorization function that allows document images to be compared with real-life identification images; liveliness helps check living entities; or logical rules that help compare the logic of information on identity records. MSB also offers a self-fraud scoring mechanism (Fraud Score), which maximally supports the bank's decision-making when customers access digital products.

From the model platform and management method, MSB aims for a straight approval mechanism without human intervention, aiming to maximize the number of customers who can borrow capital in the shortest time in each fully automated approval.

The award recognizes MSB's efforts on the journey to "reach new heights" with customers in all financial transactions. Mr. Nguyen Hoang Linh - General Director of MSB said: "This is the first year MSB has participated and won the award, thereby affirming the Bank's position, and at the same time creating motivation for MSB to continue bringing beneficial values to society. We hope to accompany the success, prosperity, and new experiences of customers, shareholders, partners, and investors."

Source link

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

Comment (0)