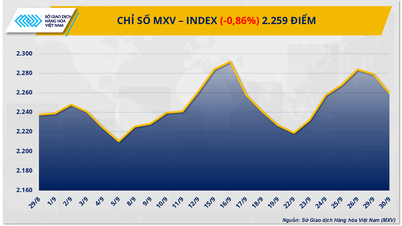

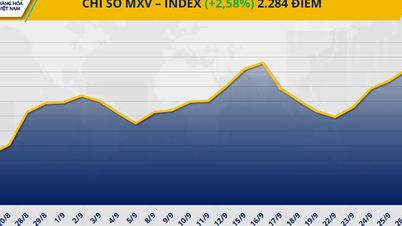

According to the Vietnam Commodity Exchange (MXV), in yesterday's session, green spread across most commodity groups, pulling the MXV-Index up nearly 0.7% to 2,225 points.

Green dominates the market of industrial raw materials. Source: MXV

At the end of yesterday's trading session, 7/9 items in the industrial raw materials market increased in price. Of which, the price of Arabica coffee for December contract increased by 3% to 8,484 USD/ton. The price of Robusta coffee also recorded an increase of more than 2.8% to 4,430 USD/ton.

The world coffee market is facing a shortage of Arabica coffee in the 2025-2026 crop year. According to the latest report by Conab, the production of this type of coffee will decrease by more than 4 million bags (equivalent to 11.2%), down to more than 35 million bags.

According to a report by the Vietnam Customs Department, coffee exports in August increased by 11% compared to the same period last year, reaching 84,000 tons. However, the cumulative amount of coffee exported in the first 11 months of the current coffee crop year (from October 2024 to September 2025) is 45,500 tons lower than the same period last year.

Regarding production, the new coffee harvest in the Central Highlands has begun since the end of August but output is still limited. End-of-season inventories are showing signs of tightening. Coffee transactions in the first week of September were somewhat gloomy, with farmer agents temporarily suspending sales, waiting for price developments.

Green also covered the metal commodity market. Source: MXV

The metal group also recorded green covering most of the commodities. Notably, iron ore prices continued to rise in yesterday's session, increasing 0.55% to 105.42 USD/ton, the highest since late February, marking a series of 5 consecutive increasing sessions.

The metal group also recorded green covering most of the commodities. Notably, iron ore prices continued to rise in yesterday's session, increasing 0.55% to 105.42 USD/ton, the highest since late February, marking a series of 5 consecutive increasing sessions.

The main driver came from market expectations on consumption prospects in China, as the country imported more than 105.2 million tonnes in August, up slightly from July.

In addition, optimism is also reinforced by expectations that Beijing will launch more infrastructure investment stimulus measures to support growth, thereby boosting demand for steel and input materials such as iron ore.

In Vietnam, the international iron ore price remaining above 100 USD/ton over the past month has contributed to the increase in domestic steel prices since September 8, with CB240 coil steel at 13.5 million VND/ton and D10 CB300 rebar steel reaching 13.09 million VND/ton.

Source: https://hanoimoi.vn/thi-truong-hang-hoa-gia-ca-phe-quang-sat-dong-loat-tang-715505.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)