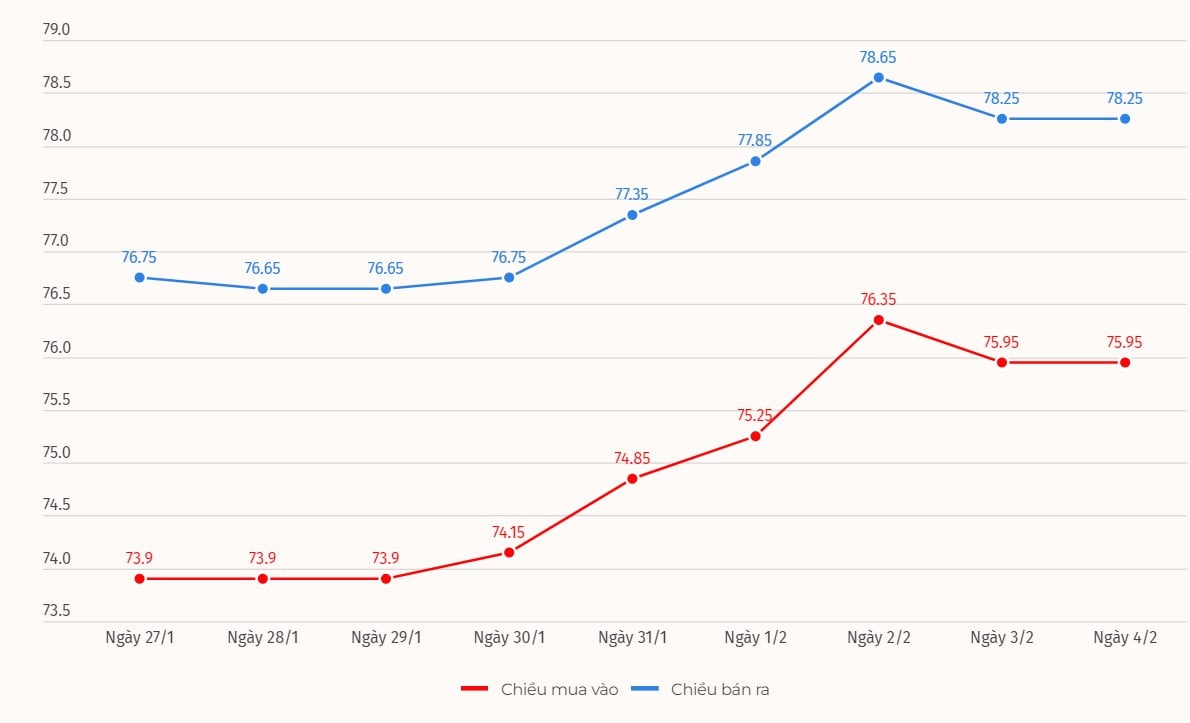

The domestic gold price opening today's trading session (February 4) was listed by DOJI Group at 75.95 million VND/tael for buying; the selling price was 78.25 million VND/tael.

Compared to the closing price of last week's trading session, gold price at DOJI increased by VND 2.05 million/tael for buying and increased by VND 1.6 million/tael for selling.

The difference between buying and selling price of SJC gold at DOJI decreased from 2.75 million VND/tael to 2.3 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the buying price of gold at 75.6 million VND/tael; the selling price is 78.1 million VND/tael.

Compared to the closing price of last week's trading session, the gold price at Saigon Jewelry Company SJC increased by 1.4 million VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold is at 2.5 million VND/tael.

Gold prices increased sharply, however the difference between buying and selling gold last week was too high, causing investors to suffer losses.

Specifically, if buying gold at DOJI Group in the session of January 28 at the price of 76.65 million VND/tael and selling it in today's session (February 4), investors will lose 700,000 VND/tael. Meanwhile, those who bought gold at Saigon Jewelry Company SJC also lost 1.1 million VND/tael.

Currently, the difference between buying and selling gold in the country is still considered too large. This can put buyers at risk of losing money when investing.

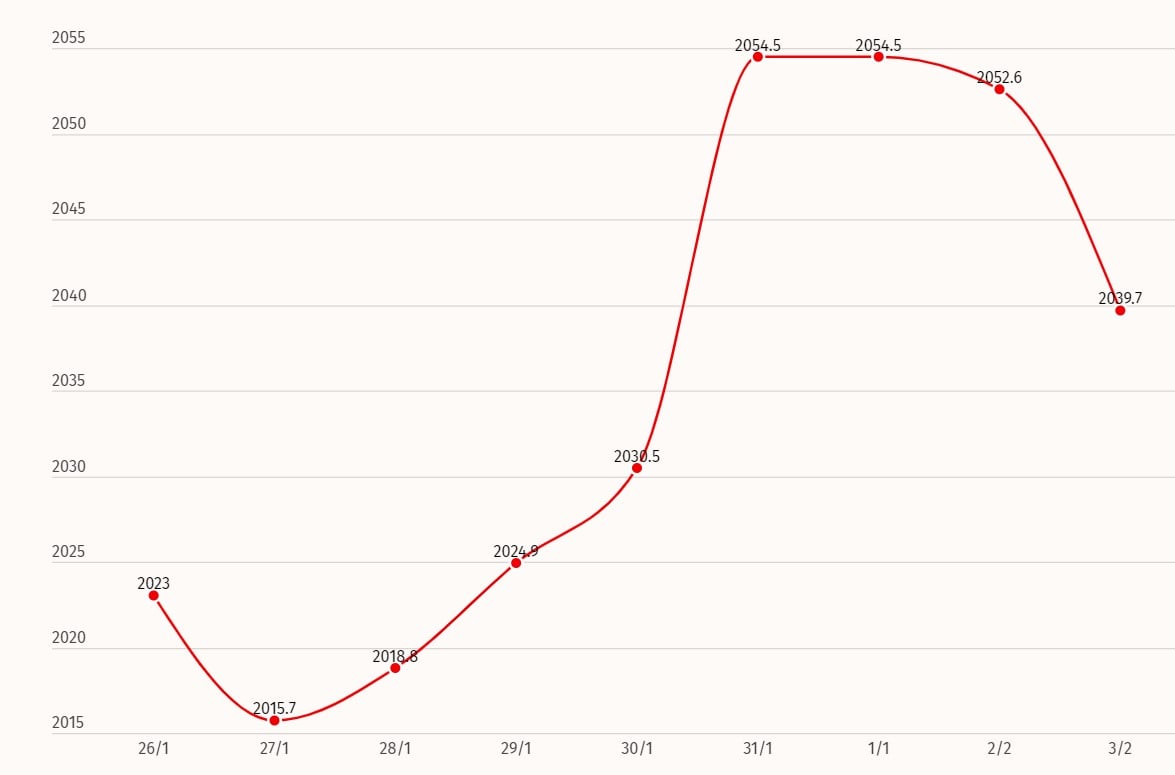

The world gold price closed the trading session of the week listed on Kitco at 2,039.7 USD/ounce, up 10.5 USD/ounce compared to the closing session of the previous week.

Gold price forecast

Investors now see a 78% chance of a rate cut by May 2024, down from a 92% chance before the Labor Department data, according to the CME Fed Watch tool. Lower interest rates increase the appeal of the precious metal.

Kitco News' latest weekly gold survey shows that two-thirds of experts have lost confidence in the precious metal, while most retail investors still expect prices to rise next week.

Twelve analysts participated in the Kitco News Gold Survey, and Wall Street sentiment appears to have turned sharply bearish on the precious metal’s near-term outlook. Only two experts, or 17%, predict gold prices will rise next week, while eight analysts, or 66%, predict gold prices will fall. Another two experts, or 17%, predict gold prices will be flat next week.

Meanwhile, 123 votes were cast in Kitco’s online poll, with the majority remaining bullish. 66 retail investors, or 54 percent, expect gold to rise next week. Another 27, or 22 percent, predict lower prices. Meanwhile, 30 respondents, or 24 percent, are neutral on the precious metal’s near-term outlook.

Source

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[Photo] Solemn opening of the 8th Congress of the Central Public Security Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/f3b00fb779f44979809441a4dac5c7df)

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)