(Dan Tri) - The 1,200 point mark was broken once again, however the VN-Index quickly recovered and increased strongly.

QCG hit the floor, securities industry stocks were positive

The upward momentum continued until the end of this afternoon's session (November 20), although at closing time, the VN-Index had lost some height.

The HoSE index increased by more than 1,220 points at one point but closed at 1,216.54 points, recording an increase of 11.39 points, equivalent to 0.95%. The HNX-Index increased by 1.6 points, equivalent to 0.73%, and the UPCoM-Index increased by 0.79 points, equivalent to 0.88%.

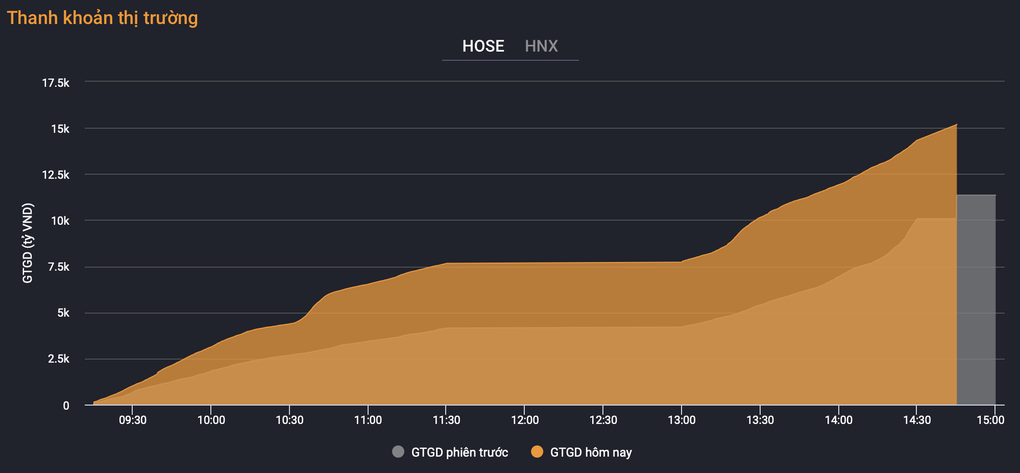

Market liquidity has improved significantly. Trading volume on HoSE reached 767.53 million units, equivalent to VND17,807.02 billion; HNX had 51.81 million shares traded, equivalent to VND885.71 billion and this figure on UPCoM was 26.52 million units, equivalent to VND344.88 billion.

Market liquidity improved strongly (Source: VNDS).

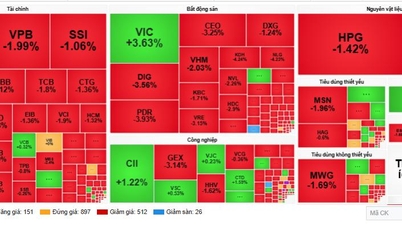

Green covered 517 codes increasing in price on all 3 floors compared to 313 codes decreasing. HoSE alone had 250 codes increasing and 148 codes decreasing.

Most financial services stocks recovered. Among them, DSE shares of DNSE Securities Company achieved the strongest increase, up 6.4% to VND23,250 and only VND100 away from the ceiling price.

DSE shares recovered strongly with liquidity far exceeding previous sessions. The company plans to pay this year's dividend in cash at a rate of 5%, the ex-dividend date is November 28, the expected payment date is December 19. With 330 million shares in circulation, DNSE is estimated to spend VND165 billion on the upcoming dividend payment program.

At the end of 9 months, the securities brokerage revenue of this securities company reached more than 105 billion VND, an increase of 115% over the same period. Operating revenue and profit after tax were more than 573 billion VND and nearly 149 billion VND, respectively, an increase of 15% and 14% over the same period last year. Notably, the number of new customers at DNSE increased sharply, accounting for 20.21% of the market share of newly opened accounts in the whole market in September.

Returning to the general market, although most stocks recovered, there were still some stocks that were sold off and fell sharply in price. Specifically, RDP, CTF, QCG, CIG, TTE all decreased sharply on HoSE and had no buyers. QCG alone hit the floor price of 11,550 VND, with more than 1 million shares matched, and nearly 480,000 units remaining at the floor price.

VN-Index suddenly dropped below 1,200 points

Earlier in the morning session, as expected, VN-Index once again tested the 1,200-point threshold. Before 10:00, the main index of HoSE floor broke through this threshold, falling to 1,197.99 points.

However, the unexpected happened. The decline was only a flash-sale. At this threshold, VN-Index immediately rebounded spectacularly, even reaching a state of quite strong price increase.

VN-Index fell below the 1,200 point threshold but quickly rebounded strongly (Source: Bloomberg).

Specifically, at the end of the morning session, VN-Index increased by 9.62 points, equivalent to 0.8%, to 1,214.77 points; HNX-Index increased by 1.56 points, equivalent to 0.71%, and UPCoM-Index increased by 0.81 points, equivalent to 0.89%.

The number of codes increasing dominated the overall market picture. On all 3 floors, there were 443 codes increasing in price, 18 codes hitting the ceiling compared to 267 codes decreasing, 25 codes hitting the floor. Of which, HoSE alone had 236 codes increasing, nearly double the number of codes decreasing.

The two stocks that hit the ceiling price on HoSE at this time are FIR and VRC, both in the real estate industry. Other stocks such as DXG and PDR also hit the ceiling price at times and are increasing strongly: DXG increased by 6.2%, with 25.7 million shares matched; PDR increased by 5.2%, with nearly 8 million units matched. DXS increased by 5%; HDC increased by 4.8%; NVL increased by 4.7%; DIG increased by 4.3%; TCH increased by 3.3%; HDG increased by 3.1%; KBC increased by 2.8%.

Securities stocks increased simultaneously: FTS increased by 3.3%; CTS increased by 3%; BSI increased by 2.8%; HCM increased by 2.8%; VCI increased by 2.6%... Most banking stocks also reached an increase in price: TPB increased by 2.2%; BID increased by 1.8%; TSTB increased by 1.7%; NBB increased by 1.5%; MSB increased by 1.3%... The rare code that decreased slightly was NAB.

With stocks falling and rising sharply during the session, the larger the price fluctuation amplitude of the stock, the more profit investors who boldly buy stocks at low prices will make.

The deep discount of stocks, causing the VN-Index to fall below 1,200 points, triggered low-price demand. Trading volume on HoSE was nearly 400 million units, equivalent to a transaction value of nearly VND9,175 billion. On HNX, it was 25.65 million shares, equivalent to VND457.6 billion, and on UPCoM, it was 11.4 million shares, equivalent to VND164 billion.

Source: https://dantri.com.vn/kinh-doanh/thung-1200-diem-vn-index-bat-ngo-hoi-phuc-ngoan-muc-20241120132050982.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)