FiinRatings' data on the bond market shows that the issuance value increased dramatically in June 2025, reaching VND105.5 trillion, up 52.4% compared to the previous month. Of which, private issuance in the month accounted for 100% and there was no public issuance.

In the first 6 months of the year, the cumulative issuance value reached VND248.6 trillion, up 71.2% over the same period last year. Of which, privately issued bonds accounted for 88.8% (up 72.4% over the same period) and publicly issued bonds accounted for 11.2% (up 62.3% over the same period).

FiinRatings data shows that the market in June recorded an additional VND4.5 trillion in problem bonds from businesses, bringing the total value to VND23 trillion in the first 6 months of the year. This figure has decreased by 31% compared to the same period last year. Of which, 45.8% of the value of problem bonds came from the Real Estate sector, 16.4% from the Manufacturing sector, 8.7% from the Construction sector and the remaining 28.6% from other sectors.

Notably, many businesses with problem corporate bonds in June have had credit health that has been weak for many years and have had previous payment delays/deferrals, or are in the same ecosystem as organizations that have previously had problem bonds.

In the group of real estate issuers, enterprises have shown signs of business recovery and have made many positive moves in handling violated/postponed bonds thanks to the benefits of legal regulations and the complete land price list. In addition, there are still some bond lots that have recorded the situation of delayed principal/interest payments in the first 6 months of the year because enterprises have not yet recovered liquidity to pay bondholders.

In the final months of the year, FiinRatings expects that late payment and deferral activities will continue, but the value will be lower than the peak period of previous years.

Assessing the new legal regulations related to the bond market, this credit rating unit believes that the application of a debt to equity ratio of no more than 5 times will tighten the financial conditions of bond issuers but will have little significant impact on the supply of privately issued corporate bonds.

|

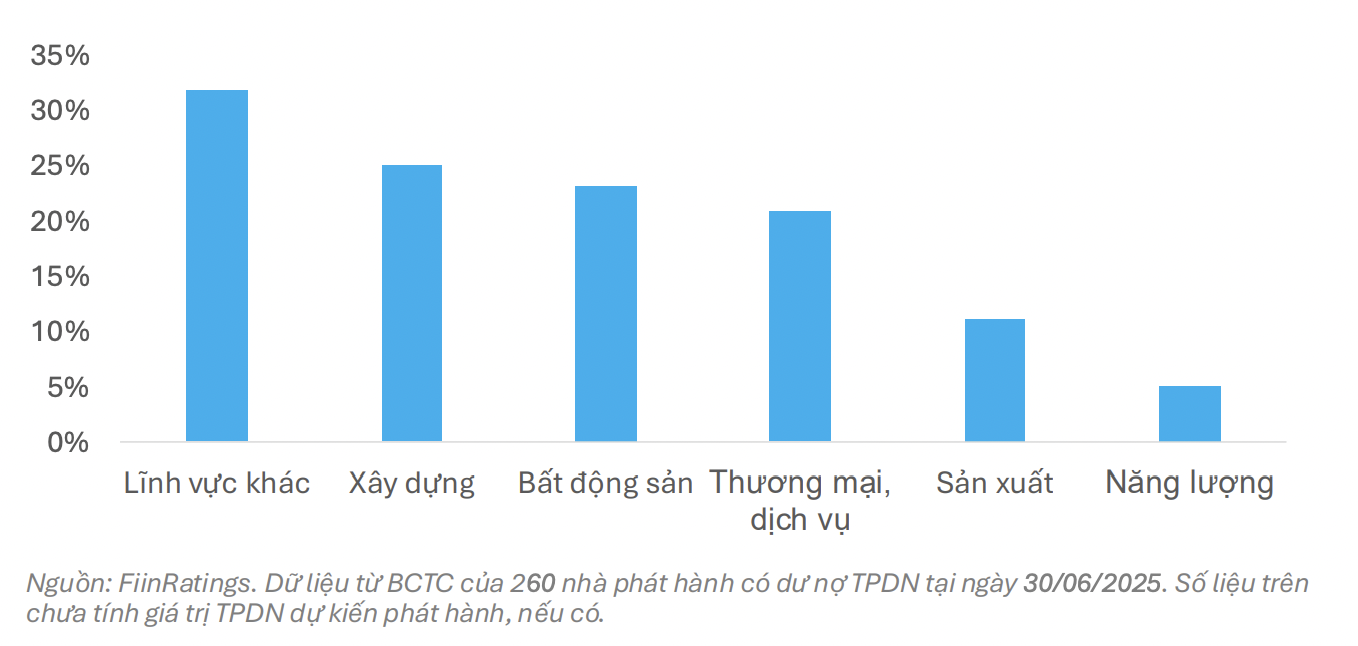

| Percentage of corporate bond issuers with Debt/Equity Ratio greater than 5 times by industry |

For some industries with high financial leverage such as real estate, construction, trade and services ( tourism , entertainment, aviation...) and energy, the rate of issuers in the market exceeding the prescribed threshold is only about 5-25% by industry, mainly issuers with small issuance components in the market.

"Therefore, we believe that the private bond market will remain attractive to industry groups with high and long-term capital needs, which need to mobilize capital through corporate bond channels and reduce dependence on bank loans," FiinRatings assessed.

The new debt ratio regulation will also contribute to increasing the quality of corporate bond products for the market by limiting project companies, newly established and highly leveraged companies from raising capital in the market. At the same time, with this new regulation, the public offering channel is expected to gradually recover in the second half of 2025.

In addition, Decision No. 21/2025/QD-TTg on the Green Classification List, which has just been issued, is also expected to pave the way for a new wave of sustainable investment, creating a boost for the green bond market.

Source: https://baodautu.vn/trai-phieu-doanh-nghiep-chao-ban-ra-cong-chung-se-khoi-sac-vao-nua-cuoi-nam-2025-d330911.html

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee to remove obstacles for projects.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759768638313_dsc-9023-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting of the Steering Committee on the arrangement of public service units under ministries, branches and localities.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759767137532_dsc-8743-jpg.webp)

Comment (0)