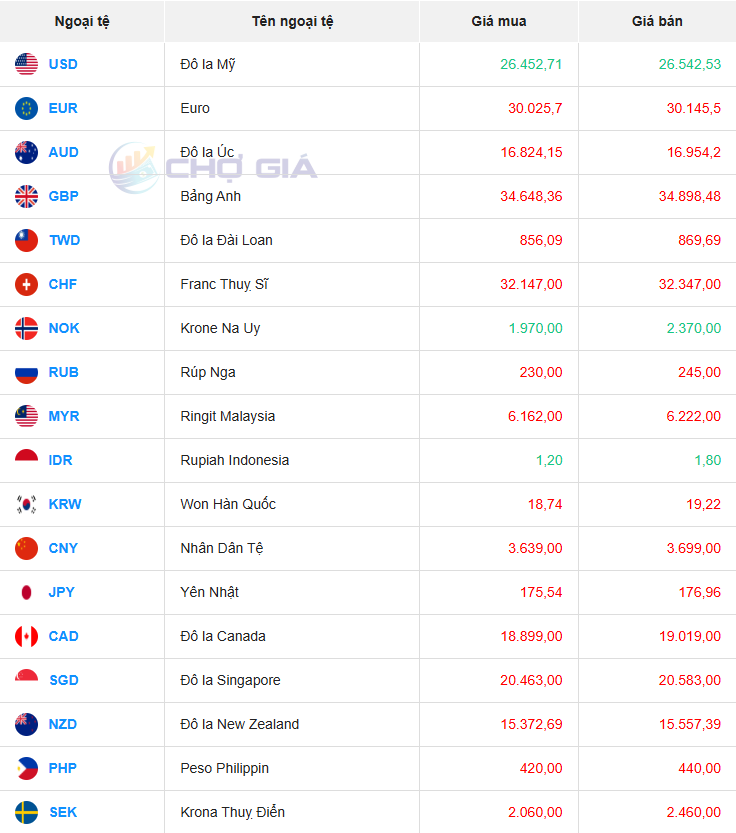

USD exchange rate today August 1, 2025

At the time of survey at 4:30 a.m. on August 1, the central exchange rate at the State Bank was 25,240 VND/USD, an increase of 12 VND compared to yesterday's trading session.

Specifically, at Vietcombank , the USD exchange rate is 25,990 - 26,380 VND/USD, down 10 VND in both directions, compared to yesterday's trading session.

PVcomBank is buying USD cash at the lowest price: 1 USD = 25,720 VND

PVcomBank is buying USD transfers at the lowest price: 1 USD = 25,750 VND

HSBC Bank is buying USD cash at the highest price: 1 USD = 26,086 VND

HSBC Bank is buying USD transfers at the highest price: 1 USD = 26,086 VND

HSBC Bank is selling USD cash at the lowest price: 1 USD = 26,322 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 26,322 VND

PVcomBank is selling USD cash at the highest price: 1 USD = 26,450 VND

ABBank is selling USD transfers at the highest price: 1 USD = 26,440 VND

In the "black market", the black market USD exchange rate as of 4:30 a.m. on August 1, 2025 increased by 23 VND in both directions, compared to yesterday's trading session, trading around 26,452 - 26,542 VND/USD.

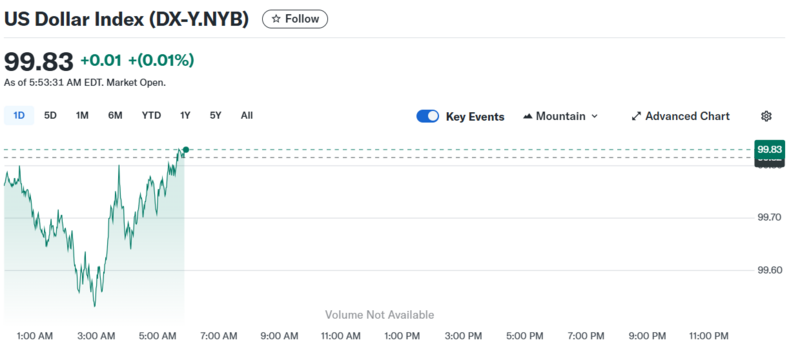

USD exchange rate today August 1, 2025 on the world market

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 99.83 - up 0.29 points compared to July 31, 2025.

At the end of a two-day policy meeting, the BOJ agreed to keep short-term interest rates unchanged at 0.5%, while raising its inflation forecast for the three years to fiscal 2027 and saying risks to the price outlook were now roughly balanced, Reuters reported. The yen initially rose on the news as investors expected a possible BOJ rate hike later this year, but then reversed course and traded almost unchanged during the day.

In the broader market, the dollar continued to hover around a two-month high after Federal Reserve Chairman Jerome Powell said the central bank would be patient in adjusting interest rates and gave no clear signal on the timing of cuts. The rally was also supported by a series of trade deals that helped ease concerns about President Donald Trump's chaotic tariff policies.

The euro, one of the currencies hardest hit by the dollar’s rally this month, has lost nearly 3% of its value as investors retreated from hopes that European markets would offer more opportunities. The European Union’s agreement to impose 15% tariffs on U.S. exports has provided some clarity on the trade environment but also dented investor confidence.

“The euro has been over-optimistic and now reality is pulling it back,” said Jane Foley, a strategist at Rabobank. She said the dollar has not properly reflected the recent rally in US assets, such as the S&P 500 hitting new highs and long-term bond yields falling. “A rebound in the dollar is needed to bring the market back to a more neutral position,” she said.

The euro was up 0.36% at $1.144, after hitting a seven-week low, but still on track for a nearly 3% monthly loss. The dollar index edged down slightly to 99.77 but is still up about 3% for the month.

Source: https://baohatinh.vn/ty-gia-usd-hom-nay-182025-dong-usd-huong-toi-da-tang-dau-tien-trong-nam-post292862.html

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)