Gold falls sharply, USD probes bottom waiting for signals on monetary policy and tariffs

At the end of the fourth week of June, the world gold price suddenly fell sharply in the last trading hours of the week, breaking the 3,300 USD/ounce mark and closing at 3,297 USD/ounce. This is the second consecutive week of decline for gold and also recorded the lowest level since mid-June, down more than 1% compared to the end of last week. Similarly, the price of gold futures for the nearest term on the Comex floor also fell to 3,286.1 USD/ounce.

The easing of tensions in the Middle East has helped reduce demand for safe haven assets. Meanwhile, investors are still waiting for new information in the period approaching the deadline for the end of the reciprocal tariff suspension on July 9. This is the time when President Trump's 90-day tariff suspension on most trading partners will end, while China's tariff suspension will expire on August 12. Negotiations are ongoing with 18 countries, including the European Union, Japan, India, Vietnam, Malaysia...

With only 10 days left until the July 9 deadline, new developments related to tariff negotiations are likely to gradually be revealed but are still a big unknown. Recently, regarding trade negotiations with Canada, US President Donald Trump on June 28 suddenly announced the end of negotiations - a move related to Canada's digital services tax (DST) targeting US technology companies.

At the same time, investors are reassessing the prospects of interest rate cuts by the US Federal Reserve (Fed). Fed Chairman Jerome Powell said this week that the Fed could accelerate the easing cycle if there is no new inflationary pressure from tariffs . The fact that the US has not imposed new tariffs will help maintain low inflationary pressure, thereby creating conditions for the Fed to carry out multiple interest rate cuts if high tariffs are not activated after July 9.

Additionally, reports suggest that President Trump could announce his nominee for Fed chairman as early as September or October and would likely favor a candidate who favors looser financial conditions.

Last week, data showed the US economy contracted 0.5% in the first quarter of 2025, a faster-than-expected decline amid sluggish consumer spending due to concerns about the impact of tariffs on imported goods from the Trump administration. Meanwhile, the personal consumption expenditures (PCE) price index, the Fed's preferred inflation measure, rose 0.1% month-on-month and 2.3% year-on-year. Economists surveyed by Dow Jones had forecast a similar increase.

Meanwhile, the USD in the international market continues to anchor at a low level. The USD Index (DXY) fell to 97.3 points, the lowest level since the beginning of 2022. The weakening USD has pushed the EUR/USD exchange rate to 1.17, the highest since 2021.

NATO's decision to increase defense spending from 2% to 5% of GDP by 2035 has raised expectations that countries, especially Germany, will increase borrowing to meet the target. This week, Germany approved its 2025 budget and 2026 fiscal framework, which include record investment plans to stimulate growth with increased spending and faster implementation than initially expected. Meanwhile, analysts continue to expect the European Central Bank (ECB) to cut interest rates by 25 basis points before the end of the year. After cutting rates in early June, ECB President Lagarde said the bank was approaching the end of its cycle.

|

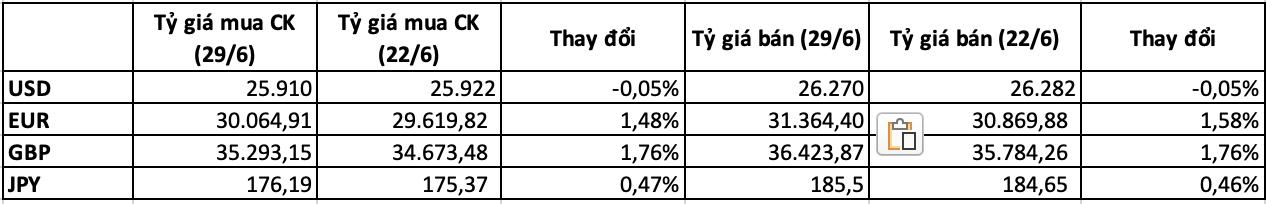

| Changes in some exchange rate pairs at Vietcombank last week. Unit: VND |

Closing last week, the central exchange rate announced by the State Bank was 25,048 VND/USD, down 10 VND/USD compared to the peak recorded on June 24, but still 17 VND/USD higher than the end of last week . Meanwhile, the exchange rate at Vietcombank at the end of the week was listed at 25,910 - 26,270 VND/USD (buying by transfer - selling), down about 20 VND compared to last week. At some sessions during the week, banks raised the USD buying price to 26,000 VND for 1 USD.

Meanwhile, the exchange rates with some other foreign currencies increased quite strongly. In particular, the EUR/VND and GPB/VND exchange rates both increased by more than 1%, as the euro and the British pound both appreciated against the dollar. At Vietcombank, the EUR/VND selling rate was approximately 31,400 VND to 1 euro. The JPY/VND exchange rate also increased by 0.46%, each Japanese yen is being sold by Vietcombank at 184.65 VND.

|

| Price of SJC gold bars and gold rings at Bao Tin Minh Chau in the country last week. Source: BTMC |

In the domestic market, the price of SJC gold bars was under pressure to decrease following the world trend. At the end of the week, the price of SJC gold bars at SJC Company was listed at 117.2 million VND/tael (buy) and 119.2 million VND/tael (sell), recording the lowest selling price since June 13 under the pressure of decreasing world gold. During the week, the selling price reached 120 million VND/tael on Thursday.

The Vietnam Chamber of Commerce and Industry (VCCI) has just sent a dispatch to the State Bank of Vietnam requesting comments on the Draft Decree amending and supplementing a number of articles of Decree 24/2012/ND-CP on the management of gold trading activities. In particular, VCCI recommends removing the gold import-export license and the single import-export license because it will create many "sub-licenses", increasing administrative procedures and compliance costs for businesses. The amendment of Decree 24/2012/ND-CP is expected to be completed in the near future.

In addition to the opinion from VCCI, the Vietnam Gold Business Association previously proposed allowing enterprises with charter capital of 500 billion VND to produce gold bars instead of 1,000 billion VND. Along with the capital factor, the production capacity of the enterprise, business efficiency, business reputation, brand in the market, design, quality of gold bar products; the situation of compliance with state regulations related to gold trading should also be considered.

Source: https://baodautu.vn/vang-roi-xa-moc-3300-usdounce-cho-doi-chuyen-dong-moi-trong-dam-phan-thuong-mai-d316343.html

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[Photo] Solemn opening of the 8th Congress of the Central Public Security Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/f3b00fb779f44979809441a4dac5c7df)

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)