| Gold price drops 500,000 VND/tael, experts recommend prioritizing choosing gold rings for investment Gold price drops 700,000 VND/tael, experts recommend investors be cautious when buying gold for "surfing" |

Gold price will rise to 2,175 USD/ounce?

According to early 2024 research by Goldman Sachs - a multinational investment bank in the United States, gold prices will continue to rise as central banks invest in this precious metal and strong retail demand in emerging markets boosts gold prices.

|

| Goldman Sachs believes that gold prices will continue to rise in the coming time. |

According to Nicholas Snowdon (head of metals at Goldman Sachs Commodity Market Research) and analyst Lavinia Forcellese, gold prices are forecast to rise by about 6% over the next 12 months, to $2,175 an ounce (equivalent to more than 30 grams). They point out that gold prices may fluctuate amid uncertainty about the Federal Reserve's interest rate policy. In addition, the downside risk to gold prices is expected to be limited by a number of other factors.

Goldman Sachs is known as an American multinational investment bank, engaged in investment banking, securities, investment management, and other financial services with primarily institutional clients. Goldman Sachs specializes in providing services in investment banking (advising on mergers and acquisitions and restructurings), securities underwriting, asset management and investment management, and prime brokerage.

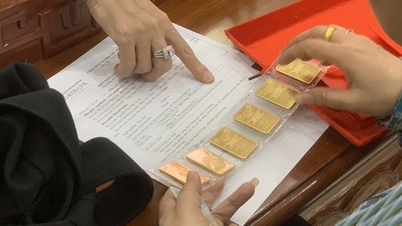

Gold buying activities are taking place vigorously amid geopolitical tensions in the world.

Amid geopolitical tensions, gold buying by central banks, especially from China and India, has helped offset outflows from gold exchange-traded funds.

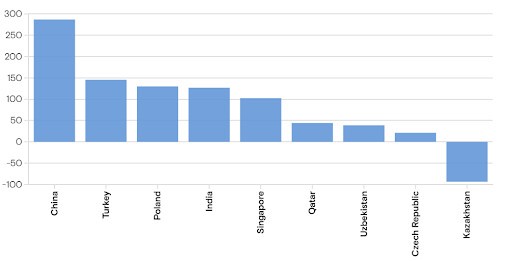

Central banks bought an average of 1,060 tonnes of gold between 2022 and 2023, compared with 509 tonnes bought between 2016 and 2019, according to statistics. The increase came as China shifted its gold reserves away from US dollars and countries like Poland also increased their gold reserves.

|

| Statistics on gold purchases in tonnes by central banks in countries, from 2021 to 2023. Source: Goldman Sachs) |

Strong retail demand for gold could also push prices higher, according to Goldman Sachs. Meanwhile, the “wealth effect” of rising incomes in emerging markets is boosting consumer demand for gold, especially for jewelry, according to Goldman Sachs.

Goldman Sachs said: “The rapidly growing affluent consumer base in India… will drive growth in jewelry consumption. Moreover, gold consumption is also supported by the lack of alternative investments in some countries that have seen major policy changes such as Türkiye and China in the past few years.”

It can be seen that, in the midst of geopolitical tensions in the world , gold buying activities are still taking place vigorously. Surveys show that gold prices on the global market on March 19 have fluctuated. At 4:30 p.m., the spot gold price on Kitco was at 2,151.00 USD/ounce.

|

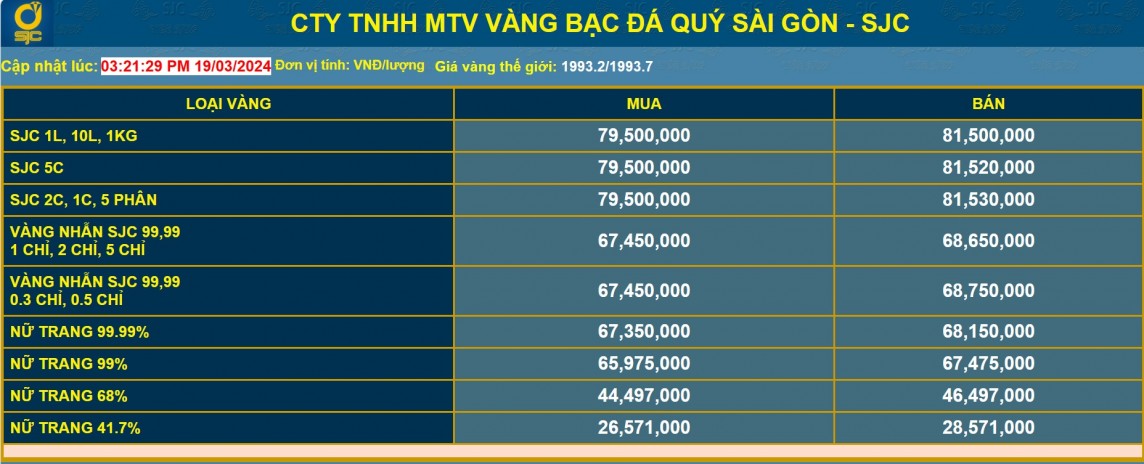

| Gold price at Saigon Jewelry Company at 4:30 p.m. on March 19, 2024 |

Domestically, gold prices have also fluctuated in recent days. In recent weeks, gold prices have continuously fluctuated "shockingly". Specifically, on the afternoon of March 13, the price of gold bars decreased by 2.7 million VND/tael in the selling price compared to the early morning and lost the 80 million VND/tael mark. However, as of this morning, March 19, the gold price increased to 81.8 million VND/tael.

Domestic gold prices in the afternoon session today increased sharply following the upward trend of world gold prices. SJC gold bars were adjusted up from 500,000 VND to 900,000 VND per tael in both buying and selling directions. At Saigon Jewelry Company (SJC), SJC gold increased by 900,000 VND/tael in both buying and selling directions, bringing the gold price close to 82 million VND/tael in the selling direction.

For gold rings and jewelry gold, prices also increased slightly. At Bao Tin Minh Chau Company, the price was listed at 67.96 - 69.16 million VND/tael (buy - sell). Compared to yesterday, the price of gold rings was adjusted by Bao Tin Minh Chau to increase by 100,000 VND/tael for both buying and selling. Similarly, at Saigon Jewelry Company (SJC), the price was listed at 67.5 - 68.7 million VND/tael for buying and selling. Compared to yesterday's trading session, the price of gold rings was adjusted to increase by 200,000 VND/tael for both buying and selling.

Although the domestic gold price has fluctuated in opposite directions and is constantly "dancing", many people still choose gold for investment. However, giving advice to investors and people at this time, some economic experts noted that investors who intend to invest in gold should consider waiting a bit longer because the impacts of government policies, as well as the amendment of Decree 24, can cause the gold price to reverse and decrease.

A representative of the Bao Tin Minh Chau gold brand said that the price of precious metals is currently quite high, investors and people should consider before trading and regularly monitor gold prices on official channels to make the most correct decision.

Source

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)