VN-Index trades "weakly" with a blank spot of supporting information, Vietnam Airlines' difficulties are resolved, notable stocks next week, dividend payment schedule,...

VN-Index trades "weakly"

VN-Index experienced a week of sharp declines with a large amplitude, liquidity has decreased significantly compared to the previous week. At the end of the week, VN-Index decreased by 32.68 points (-2.9%), this is the week with the largest amplitude in recent times.

Of which, the biggest contribution came from the first session of last week (June 24) with a sharp decrease of 28 points. By the end of the week, the index continued to decrease by nearly 14 points, slipping below the 1,250 point mark, down to 1,245 points.

Cash flow has also left VN30, typically with technology, banking, securities groups, etc. In addition, foreign investors continued to maintain a net selling status for the 17th consecutive session.

Technology and banking stocks led the market "downward" last week (Photo: SSI iBoard)

Assessing the market developments last week, Mr. Cao Hoai Thanh Bao, senior investment consultant at Mirae Asset Securities, said that VN-Index had a weak trading week in terms of both sentiment and cash flow, which was the result of a long sideways movement and the market's supply becoming stronger as the profits of short-term traders were low as well as the short-term risks of the domestic and international markets.

The information gap along with the end of the trading quarter is also one of the reasons why investors limit "putting money".

A stock goes against the trend, hitting the ceiling in 12 sessions

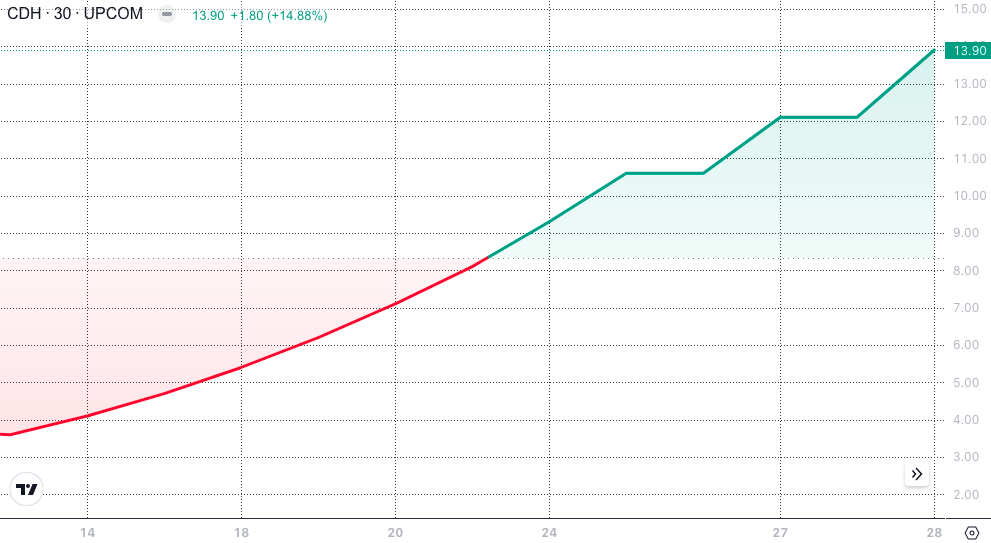

CDH has been increasing continuously in recent times (Photo: SSI iBoard)

While the market reversed and plummeted, CDH stock (Hai Phong Public Works and Tourism Services Joint Stock Company, UPCoM) still defied the odds and increased sharply by 387% in just the last 2 weeks.

At the end of the last trading session of the second quarter, CDH hit the ceiling for the 12th time in the last 13 sessions, reaching a market price of VND 13,900/share. However, it is worth noting that liquidity was quite modest, only a few hundred units.

Vietnam Airlines gets relief from difficulties with a loan of 4,000 billion VND

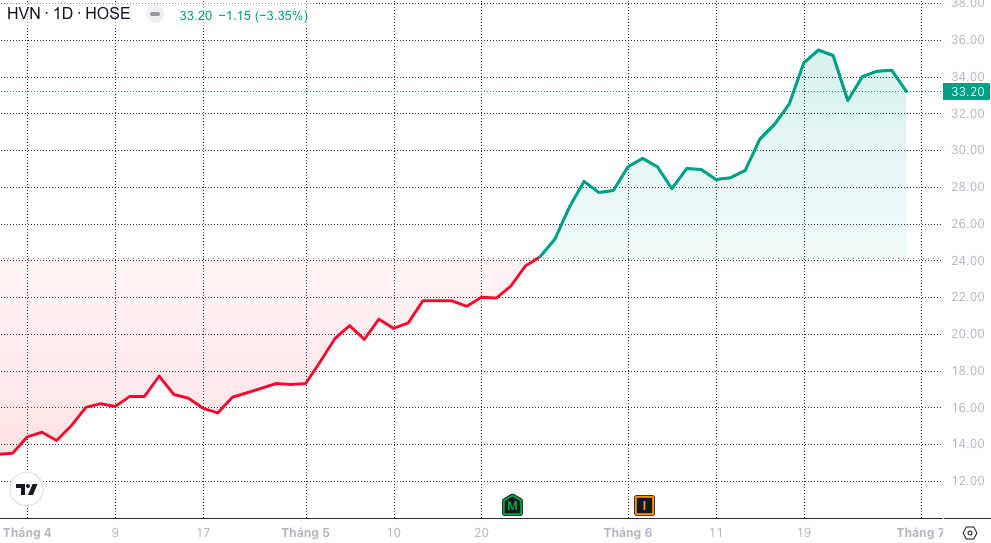

Recently, the National Assembly passed a resolution, agreeing to allow Vietnam Airlines Corporation (HVN, HOSE) to extend the repayment period for the refinancing loan.

Specifically, the National Assembly allows the State Bank to automatically extend the repayment deadline for Vietnam Airlines' VND4,000 billion loan three times to overcome immediate difficulties.

HVN shares increased sharply in the second quarter (Photo: SSI iBoard)

At the same time, the Government is assigned to direct the State Capital Management Committee at enterprises, relevant agencies and Vietnam Airlines to develop a comprehensive development strategy; urgently complete the overall project of solutions to remove difficulties for Vietnam Airlines to soon recover and develop sustainably.

On the stock exchange, HVN shares are priced at 33,200 VND/share, a sharp increase of 2.3 times in just 3 months of the second quarter.

Notable stocks

KDH stock (Khang Dien House Investment and Trading JSC, HOSE) is recommended by DSC Securities to buy with a target price of VND 40,800/share. Thanks to the explosive profits from key projects: Privia Project (An Duong Vuong) (more than 1,000 apartments have been almost sold out since opening for sale in the fourth quarter of 2023). In addition, there is also the "revival" of the Thu Duc project group: Clarita and Emeria will be the two key projects of sales in the period 2024 - 2026.

MWG (Mobile World Investment Corporation, HOSE) shares are recommended by DSC Securities to buy with a target price of VND68,500/share. With the strategy of "reducing quantity, increasing quality" expected to help optimize MWG's costs, DSC said, this could help MWG cut unnecessary costs for inefficient stores, focusing on stores with better growth potential such as Bach Hoa Xanh. Bach Hoa Xanh will be the main growth driver of MWG in the future, especially after the participation of Chinese partners.

VNM (Vietnam Dairy Products Joint Stock Company - Vinamilk, HOSE) stock is recommended to buy by Mirae Asset Securities with a target price of VND 79,500/share, due to strong growth from export channels to key markets: China, Japan, Southeast Asia,... From the business results of the first quarter of 2024, MAS expects the company to successfully complete the 2024 full-year plan.

PC1 shares (PC1 Group Corporation, HOSE) are recommended by SSI Securities to buy at a target price of VND 32,900/share. SSI believes that the company has made efforts to maintain growth in the context of general difficulties in the industry. Based on the business results of the first quarter of 2024, the third consecutive quarter of growth, marking the income from the associated company - Western Pacific. SSI expects that profits in the second quarter will improve strongly with more contributions from Phong IIA Industrial Park in the Western Pacific.

Comments and recommendations

Mr. Cao Hoai Thanh Bao, senior investment consultant at Mirae Asset Securities, commented that the market experienced a not-so-positive trading week during the "information-free" period. Therefore, when macroeconomic and corporate data gradually become available, the market will likely have a more positive trend.

It is expected that this week, the market will be better thanks to the psychology of escaping the information depression along with positive signals of the economy when growing compared to the same period last year, which will stimulate cash flow to return, looking for opportunities in some industry groups that benefit from positive information. Experiencing a week of sharp decline also makes it easier for industry groups to increase after shaking off short-term supply. Industry groups to pay attention to: Seaports: VSC (Container Vietnam, HOSE), GMD (Gamadept, HOSE), Electricity: POW (PV Power, HOSE), PGV (EVNGENCO 3, HOSE),...

TPS Securities believes that, with low liquidity but increasing at the end of the session, it shows concerns about continued declines when selling pressure appears in all three groups of large, medium and small capitalization. VN-Index is likely to find deeper price zones in the coming time, the support level is 1,180 - 1,220 points. Investors should continue to observe, reduce account proportion and only trade when there are signs of weakening selling side.

KB Securities said that the signals are showing that the downward momentum is likely not over yet, the index may fall back to the support zone of 1,200 points. Investors are advised to avoid buying too early, only disbursing a small proportion of the positions they are holding when the index falls back to the support zone mentioned above.

Dividend payment schedule

According to statistics, there are 22 businesses that have dividend rights this week, of which 17 businesses pay in cash, 2 businesses pay in shares, 2 businesses issue additional shares and 1 business pays combined dividends.

The highest rate is 55%, the lowest is 1.3%.

Southern Basic Chemicals Joint Stock Company (CSV, HOSE) pays a combined dividend in cash and additional issuance. With the additional issuance, the ex-right date is July 1, at a rate of 150%.

Tourism Investment and Aquaculture Development JSC (DAT, HOSE) pays dividends in shares, ex-dividend date is July 1, rate 10%.

Tin Viet Finance Joint Stock Company (TIN, UPCoM) pays dividends by exercising purchase rights, ex-dividend date is July 2, rate 30%.

Ba Ria - Vung Tau Water Supply Joint Stock Company (BWS, UPCoM) pays dividends by exercising the right to receive shares, the ex-dividend date is July 4, at a rate of 11.1%.

GCL Group Corporation (KDM, HNX) pays dividends in shares, ex-dividend date is July 5, rate 7%.

Cash dividend payment schedule this week

*Ex-dividend date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to buy additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | Education Day | Day TH | Proportion |

|---|---|---|---|---|

| CSV | HOSE | 1/7 | July 16 | 10% |

| CSV | HOSE | 1/7 | 7/10 | 15% |

| TID | UPCOM | 1/7 | July 12 | 5% |

| S55 | HNX | 1/7 | July 31 | 15% |

| ADP | HOSE | 1/7 | July 18 | 8% |

| NJC | UPCOM | 1/7 | 1/8 | 10% |

| ISH | UPCOM | 2/7 | July 30 | 10% |

| DHA | HOSE | 2/7 | July 12 | 20% |

| MCH | UPCOM | 2/7 | July 12 | 55% |

| VNC | HNX | 3/7 | July 26 | 15% |

| DTT | HOSE | 4/7 | July 22 | 8% |

| APF | UPCOM | 4/7 | July 19 | 25% |

| VSA | HNX | 4/7 | July 15 | 32% |

| SZB | HNX | 4/7 | 5/8 | 23% |

| GVT | UPCOM | 4/7 | July 16 | 36% |

| SAB | HOSE | 5/7 | July 31 | 20% |

| SAS | UPCOM | 5/7 | July 18 | 10.3% |

| LBC | UPCOM | 5/7 | July 17 | 12% |

| NS2 | UPCOM | 5/7 | July 25 | 1.3% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-dau-thang-7-vn-index-thieu-dong-luc-tang-du-bao-giao-dich-tai-vung-1200-diem-20240701073514861.htm

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)