Journey to follow father's career

Mr. Tran Hung Huy was born in 1978, has a bachelor's degree, master's degree in Business Administration from Chapman University, and a PhD in Business Administration from Golden Gate University.

Mr. Huy is the son of Mr. Tran Mong Hung - one of the founders of Asia Commercial Joint Stock Bank (ACB ). From 1994 to 2008, Mr. Tran Mong Hung held the position of Chairman of the Board of Directors of ACB.

Following in his father's footsteps, in 2002, Mr. Huy began his journey of dedication at ACB as a financial market research specialist. From 2004 to 2008, he held the position of Marketing Director at ACB.

In 2006, Mr. Huy was a member of the Board of Directors of ACB and from 2008 to September 2012, he held the role of Deputy General Director and member of the Board of Directors of the bank.

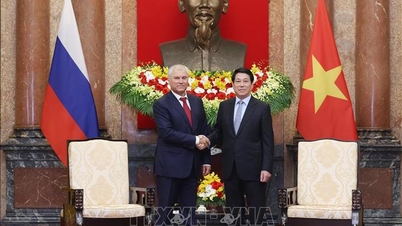

ACB Chairman Tran Hung Huy.

However, in 2012, a major incident occurred at ACB, Mr. Nguyen Duc Kien (Bau Kien) was caught up in the law, Mr. Tran Hung Huy, who was only 34 years old at that time, suddenly sat in the "hot seat" of ACB Chairman, becoming the youngest chairman in the history of the banking industry. To date, after more than 10 years, Mr. Huy is still holding the role of Chairman of the Board of Directors of ACB.

Recently, ACB has just announced the list of shareholders owning more than 1% of charter capital. Accordingly, Mr. Huy currently owns more than 153 million shares, equivalent to 3.427% ownership ratio.

Mr. Huy's related parties are holding 367 million shares, equivalent to 8.218% of the capital. Thus, Mr. Huy and his related parties are owning a total of 11.6% of the capital at the bank.

In addition, Mr. Huy's mother - Ms. Dang Thu Thuy, a member of the Board of Directors of ACB, also owns more than 53.3 million shares, equivalent to 1.194% of the bank's capital. People related to Ms. Thuy own 467 million shares, equivalent to 10.457% of the bank's capital.

ACB after the "Mr. Kien" incident

Regarding ACB, the bank officially started operating in 1993 with an initial charter capital of 20 billion VND. Under Mr. Huy's father, Mr. Tran Mong Hung, ACB has continuously grown, affirming its position.

In 1996, ACB became the first joint stock commercial bank in Vietnam to issue the ACB-MasterCard international credit card. In 1997, the bank was the first unit in Vietnam to establish an Asset-Liability Management Council (ALCO)...

From 2010 to mid-2012, ACB was one of the leading commercial joint stock banks in Vietnam with total assets recorded on June 30, 2012 in the audited consolidated financial statement of VND 255,942 billion.

However, after the incident in August 2012, the bank's total assets dropped sharply to 176,308 billion VND. At the same time, the bank's profit also dropped sharply from nearly 3,208 billion VND the previous year to 784 billion VND. Not only that, in the fourth quarter of 2012, ACB lost after tax nearly 159 billion VND, while in the same period it made a profit of 1,349 billion VND.

In the following years, ACB's asset size continued to shrink and grow slowly. It was not until 2015 that ACB's total assets exceeded VND200,000 billion again. By the end of the second quarter of 2024, the bank's total assets were VND769,679 billion, nearly 4 times larger than 7 years ago.

At the same time, ACB also struggled to increase profits. While before 2012, there were times when ACB's profits were always maintained at the level of 2,000 to 3,000 billion, it was not until 2015 that ACB's profits returned to the 1,000 billion mark.

And since 2017, the bank's business results have really improved when its profit exceeded the 2,000 billion VND mark and continuously broke its own profit peak. In 2023, ACB reported a profit after tax of 16,045 billion VND, 20 times higher than the profit in 2012.

At the end of the first 6 months of 2024, ACB recorded net interest income of VND 13,833 billion, an increase of 11% compared to 2023. The bank reported pre-tax net profit of VND 10,491 billion and after-tax profit of VND 8,374 billion, an increase of 4.7% compared to the first 6 months of 2023.

In 2024, ACB set a pre-tax profit target of VND22,000 billion. Thus, by the end of the second quarter of 2024, the bank had completed 47.7% of the set target.

At the same time, before the incident, the total bad debt at ACB was 918 billion VND, the ratio of bad debt/outstanding loan of the bank was 0.89%.

However, by the end of 2012, the bank's bad debt had jumped to VND2,570 billion, a rate of 2.5%, and exceeded 3% by the end of 2013.

Of which, the bank's bad debt (group 5 debt) increased from VND297 billion in 2011 to more than VND1,150 billion. According to ACB's financial statement explanation, the bank's bad debt during that period was mostly related to the outstanding debt of the group of 6 companies under investigation after Mr. Kien was arrested.

It was not until 2015 that the bad debt ratio at ACB was brought down to below 2%. By 2018, ACB's financial statements no longer explained the outstanding debt to the group of companies related to Mr. Nguyen Duc Kien.

In the first half of 2024, ACB's total bad debt is about VND 8,123 billion, an increase of nearly 38% compared to the end of 2023 at VND 5,887 billion.

Of which, substandard debt (group 3 debt) increased by 37% to nearly VND 1,286 billion, doubtful debt (group 4 debt) increased by 24.8% compared to the previous year to VND 1,309 billion; and debt with the possibility of losing capital (group 5 debt) increased by 41.8% to nearly VND 5,526 billion. As a result, the ratio of bad debt/outstanding loans increased from 1.22% to 1.49%.

According to VNDirect, ACB's credit growth will reach 16% year-on-year in 2025, higher than the 14.3% previously forecast for 2024.

DSC Securities' ACB analysis report forecasts that the bank will achieve VND36,671 billion in total operating income (up 12% year-on-year) and VND23,402 billion in pre-tax profit (up 12.2%) in 2024.

Source: https://www.nguoiduatin.vn/chu-tich-acb-tran-hung-huy-va-hon-10-nam-vuc-day-de-che-a-chau-204240820195221941.htm

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

Comment (0)