Despite the cautiousness at the beginning of the session, cash flow returned strongly at the end of the session on October 13, focusing on the real estate and banking groups, helping the VN-Index increase by 17.57 points to 1,765.12 points, extending the increasing streak to 4 consecutive sessions and also 4 sessions setting historical peaks.

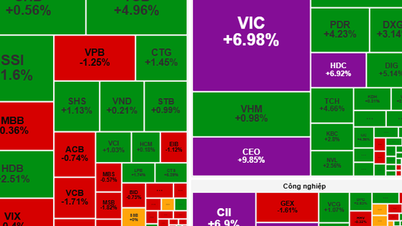

The trading session on October 13 ended with an impressive increase in the market. Specifically, VN-Index increased by 17.57 points to 1,765.12 points; HNX-Index increased by 1.73 points to 275.35 points. Although the index increased sharply, it can be seen that the market is in a state of "green skin, red heart" with 409 stocks decreasing and 273 stocks increasing; in the VN30 basket, green is dominant with 17 stocks increasing, 10 stocks decreasing and 3 stocks remaining unchanged.

Liquidity improved significantly compared to the previous session, showing a strong return of cash flow. Total matched volume on HOSE reached more than 1.23 billion shares, equivalent to VND38,500 billion; on HNX reached more than 130 million shares, worth VND3,200 billion.

In the afternoon session, increased demand helped VN-Index rebound strongly and close at the highest level of the day. VIC, TCB, VRE and VJC were the most positive contributors. On the other hand, VCB, HPG,FPT and VPB were still under pressure to correct but the impact was not significant.

HNX-Index also recorded positive developments, with codes KSV (up 9.96%), CEO (up 9.85%), SHS (up 1.13%), VIF (up 4.52%) contributing to strengthening the uptrend.

By industry group, real estate is the market's leading focus, thanks to the push from VIC (up 6.98%), VHM (up 0.98%), VRE (up 6.57%) and NVL (up 2.56%). Followed by the essential consumer goods and raw materials group.

On the contrary, the information technology group decreased the most, mainly due to FPT (down 2.19%), CMG (down 1.75%), ELC (down 2.67%) and DLG (down 1.43%).

Foreign investors continued to maintain a net selling position of more than VND 1,182 billion on HOSE, focusing on HPG (VND 394.31 billion), VRE (VND 371.99 billion), MBB (VND 306.5 billion) and VHM (VND 279.08 billion). On HNX, this group net bought more than VND 72 billion, mainly at CEO (VND 139.75 billion), DTD (VND 2.03 billion).

Thus, domestic cash flow continues to play a leading role, especially in real estate stocks - a factor that helps the market maintain its upward momentum for four consecutive sessions and strengthens investors' excitement in the early stages of the fourth quarter.

Source: https://baotintuc.vn/thi-truong-tien-te/chung-khoan-lap-dinh-lich-su-nhung-thi-truong-van-xanh-vo-do-long-20251013163602022.htm

![[Photo] Ready for the 2025 Fall Fair](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/14/1760456672454_ndo_br_chi-9796-jpg.webp)

Comment (0)