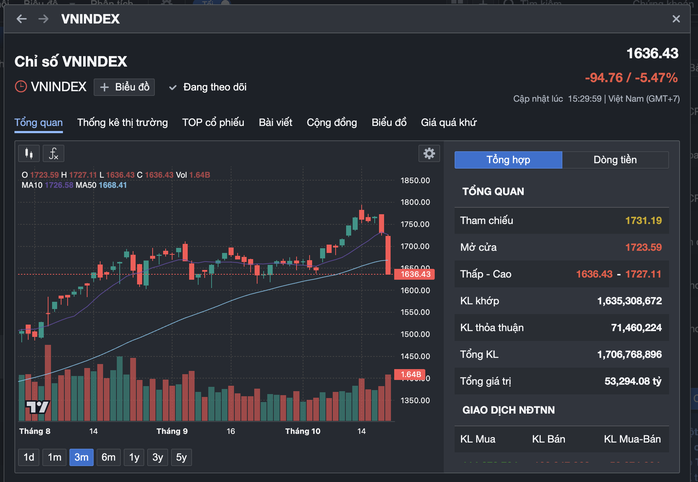

The Vietnamese stock market suddenly suffered a strong sell-off in the session on October 20, losing nearly 95 points (5.47%), pulling the VN-Index down to 1,636 points.

The entire floor recorded more than 770 stocks falling, of which 150 stocks hit the floor, panic prevailed at the end of the session. Many investors were confused about what was happening to the stock market?

The Lao Dong Newspaper recorded the opinions of a number of experts and securities companies on the causes and strategies for investors in the next sessions:

Mr. Tran Quoc Toan, Director of Branch 2 - Headquarters of Mirae Asset Securities Company (MAS):

Large and unusual fluctuations are not uncommon.

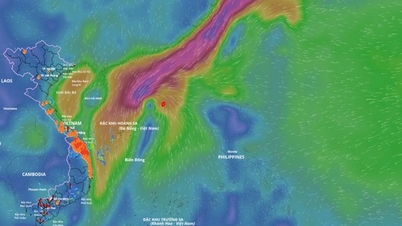

The market suddenly fell sharply, although there is currently no reason from the shocking macro news to explain. The sharp decline of VN-Index reminds us of the time when Vietnam was on the list of reciprocal tariffs imposed by the US in April.

However, large and unusual fluctuations are not uncommon in the Vietnamese stock market over the past years, with investors experiencing many sessions of the strongest increases and the strongest decreases in the world .

It could be the defensive psychology of individual investors when the index has increased by more than 30% since the beginning of the year, the upgrade information has passed and foreign investors have continuously increased the scale of net selling. In the trading session on October 20 alone, net selling was more than 2,100 billion VND. When the index has not found new momentum, the sell-off is happening under the pressure of margin lending scale continuing to reach new peaks.

The stock market had a historic drop.

At this time, investors need to be very alert, short-term declines are always an indispensable part of the financial market, a solid domestic macro foundation will still be the guiding principle supporting market growth. Currently, the P/E valuation of the entire market is at 14.7 after today's decline, with profits of listed enterprises forecast to continue to grow strongly in the last quarter of the year...

This is not the time to sell off without financial leverage pressure. For investors with cash on hand, the correction is an opportunity to buy discounted companies with excellent business results, benefiting from the macro recovery with more attractive valuations…

Mr. Tran Hoang Son, Director of Market Strategy, VPBank Securities Company:

Fast loss, strong recovery

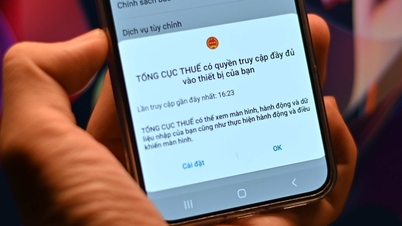

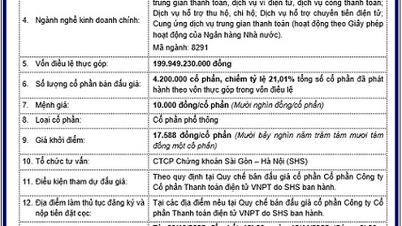

The market had a sudden drop after the news of the conclusion of the inspection of large bond-issuing enterprises such as MSN, NVL, MBB,ACB ... in which NVL (the unit transferring the file to the investigation agency) caused many large-cap stocks to hit the floor.

The sell-off sentiment today was quite strong and unexpected. But normally a deep and rapid decline is easily offset by a technical recovery, but it may take a few sessions to rebalance.

The technical support zone at 1,600 points will be the psychological point in this period, especially when positive business results in the third quarter of 2025 will be a supporting factor for the market in the short term.

Investors panic after record drop of nearly 95 points

Mr. Tran Anh Giau, Investment Consulting Director at Kafi Securities:

Keep calm and act soberly

In the current context, investors need to stay calm and act wisely. Because when the VN-Index drops by about 10%, investors' accounts can drop more than this, especially when holding high-weight stocks or using margin. It is necessary to calmly reassess risks and proactively reduce stock weight when necessary.

Accounts may be affected, but this is also the time for investors to observe, learn and prepare. When the market recovers, the patient and optimistic people will be ready to choose the best and highest quality stocks to invest.

Source: https://nld.com.vn/chuyen-gia-noi-gi-ve-phien-chung-khoan-rot-thang-dung-gan-95-diem-196251020192005949.htm

![[Photo] Chairman of the Hungarian Parliament visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760941009023_ndo_br_hungary-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with Hungarian National Assembly Chairman Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760952711347_ndo_br_bnd-1603-jpg.webp)

![[Photo] Solemn opening of the 10th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760937111622_ndo_br_1-202-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the Hungarian National Assembly Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760970413415_dsc-8111-jpg.webp)

![[Photo] The Steering Committee of the 2025 Fall Fair checks the progress of the organization](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760918203241_nam-5371-jpg.webp)

Comment (0)