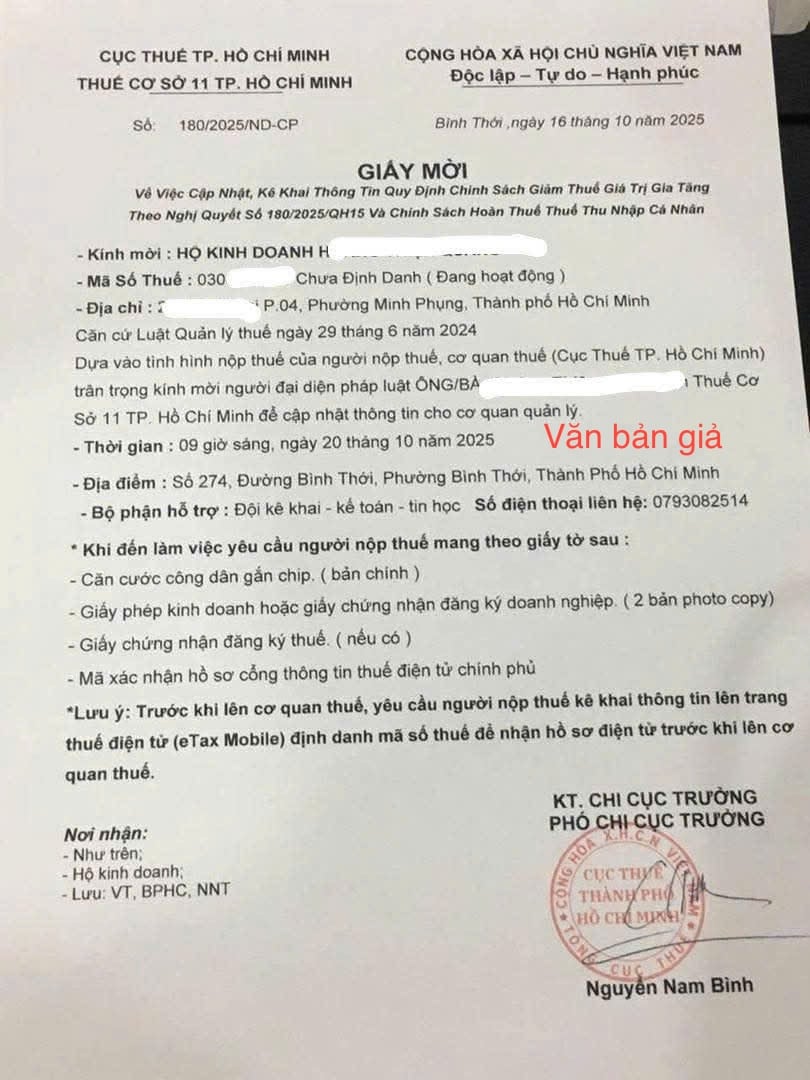

A businessman in Ho Chi Minh City recently shared on his personal Facebook page about having fake tax documents sent to his home.

According to the content of the invitation, Ho Chi Minh City Tax Department 11 (Ho Chi Minh City Tax Department) sent an invitation to business households regarding: Updating and declaring information on regulations on value added tax reduction policy according to Resolution No. 180/2025/QH15 and personal income tax refund policy.

The invitation stated “ Based on the Law on Tax Administration dated June 29, 2024 ”, and requested the legal representative of the business household to go to Tax Department 11, Ho Chi Minh City to update information. Time: 9:00 a.m., October 20; Location: No. 274, Binh Thoi Street, Binh Thoi Ward, Ho Chi Minh City.

The counterfeiters also asked taxpayers to bring chip-embedded citizen identification cards (original); business licenses or business registration certificates (2 photocopies); tax registration certificates (if any); and electronic file confirmation codes on the Government tax information portal.

The document also notes that taxpayers must declare information on the electronic tax website (eTax Mobile) and identify their tax codes to receive electronic documents before going to the tax authority.

The date of signing the document is October 16, 2025, the signatory is Deputy Head of the Branch Nguyen Nam Binh (HCMC Tax Department).

According to the representative of the business household, fortunately, the family members went directly to the tax office to verify. If they had done it online according to the instructions in the document, they might have been "trapped".

Mistakes in the fake text

If you read carefully and compare the information on the fake invitation, taxpayers can completely recognize the abnormalities.

For example, the presentation of the document is inconsistent, has spelling mistakes; the place where the document is sent and the place where the document is signed are different; the document lacks numbers, has incorrect citations...

Wrong Resolution: Resolution No. 180/2025/QH15 issued on February 18, 2025, which contains the content of dismissing the position of Member of the Standing Committee of the 15th National Assembly , is completely unrelated to tax policy.

Incorrect legal basis: “Law on Tax Administration dated June 29, 2024 ” does not exist; the current law was promulgated on June 13, 2019, effective from July 1, 2019.

Wrong organizational structure: From July 1, 2025, the name "Ho Chi Minh City Tax Department" will no longer be "Ho Chi Minh City Tax Department" but "Ho Chi Minh City Tax Department" with 29 affiliated units.

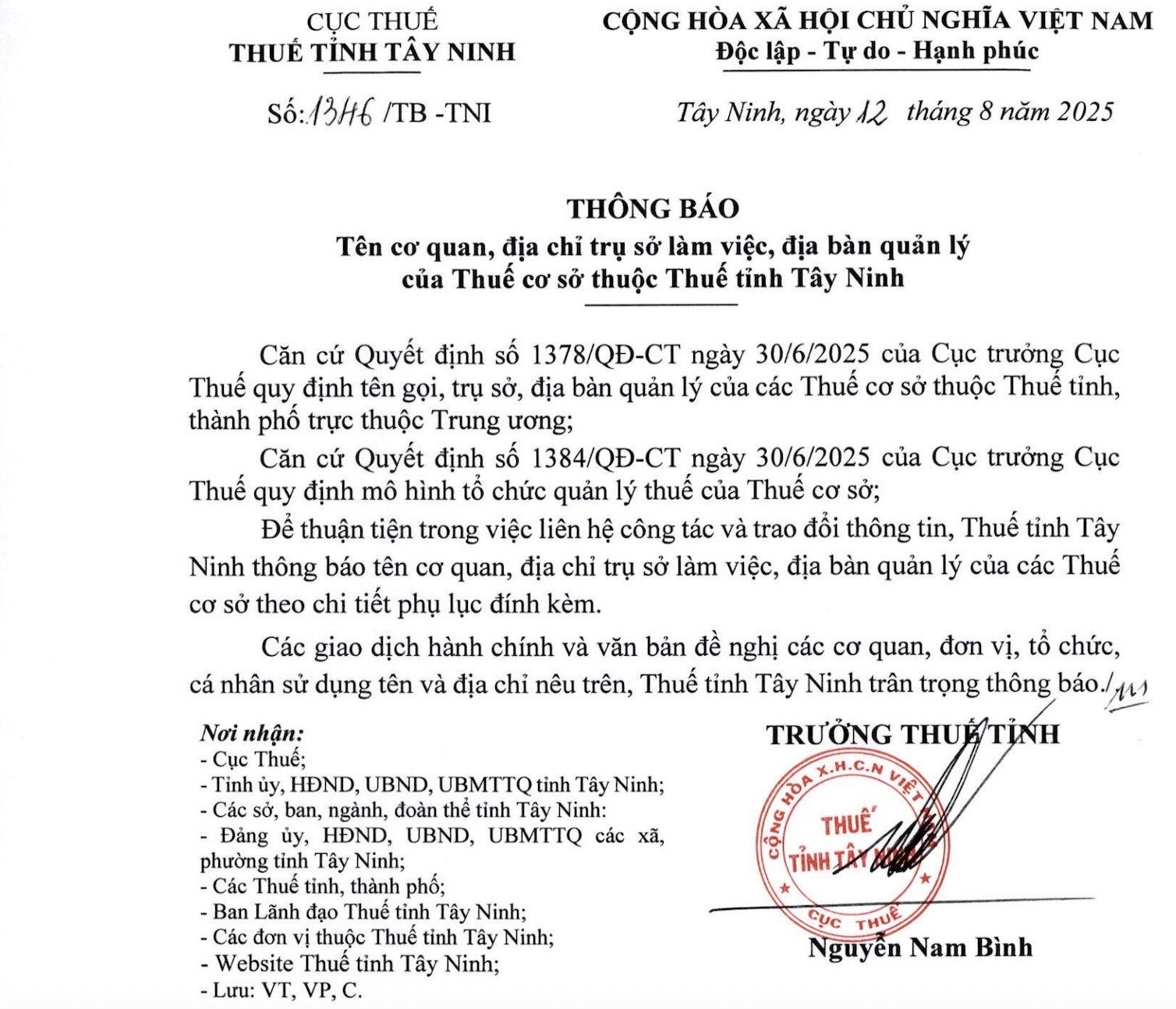

Wrong signatory: Mr. Nguyen Nam Binh is currently the Head of Tay Ninh Tax Department (from July 2025), no longer working in Ho Chi Minh City. Previously, Mr. Binh held the position of Director of Ho Chi Minh City Tax Department (October 2023) and Director of Tax Department of Region II (March 2025).

Speaking to VietNamNet reporter , Mr. Nguyen Nam Binh confirmed that the above document is fake. At the same time, the signature in the document is completely different from his real signature.

Regarding counterfeiting, Ho Chi Minh City Tax Department has issued a warning about the appearance of a Facebook group called "Ho Chi Minh City Tax" impersonating the tax authority, which can easily confuse taxpayers.

This Facebook group used images and information from the tax department, but this is not an official channel. The only official fanpage of Ho Chi Minh City Tax has been verified by Facebook with a blue tick.

In addition, the tax authority is also operating Facebook groups to support taxpayers: Group "Answer - Support for personal income tax settlement"; Group "Support for business households".

Previously, the Tax Department also warned that there was a phenomenon of some subjects impersonating tax authorities to request organizations, enterprises, and business households to update information according to the 2-level local government model.

To avoid the above situation, the Tax Department reminds taxpayers:

Firstly , the tax authority affirms that it does not require organizations, businesses, and business households to submit their citizen identification cards, business registration licenses, or tax registration certificates to update information. Therefore, taxpayers need to be vigilant against acts of impersonating tax authorities via phone, email, or text messages to defraud and profit.

Second , based on the updated tax registration database, the tax authority will send a notice to organizations, enterprises, and business households about the updated address of the taxpayer according to the new administrative area and information of the directly managing tax authority.

Third , taxpayers need to be vigilant and not follow instructions from unofficial sources of information.

Fourth , taxpayers, if they need to update their address according to the new administrative boundaries on the Business Registration Certificate, should contact the business registration authority for instructions.

Fifth , when having problems, taxpayers contact the hotline or email of tax officials for support, which is listed on the Ho Chi Minh City Tax Electronic Information Portal.

Source: https://vietnamnet.vn/truong-thue-tay-ninh-xac-nhan-bi-gia-mao-van-ban-2454529.html

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the Hungarian National Assembly Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760970413415_dsc-8111-jpg.webp)

![[Photo] Chairman of the Hungarian Parliament visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760941009023_ndo_br_hungary-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with Hungarian National Assembly Chairman Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760952711347_ndo_br_bnd-1603-jpg.webp)

![[Photo] Solemn opening of the 10th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760937111622_ndo_br_1-202-jpg.webp)

![[Photo] The Steering Committee of the 2025 Fall Fair checks the progress of the organization](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760918203241_nam-5371-jpg.webp)

Comment (0)