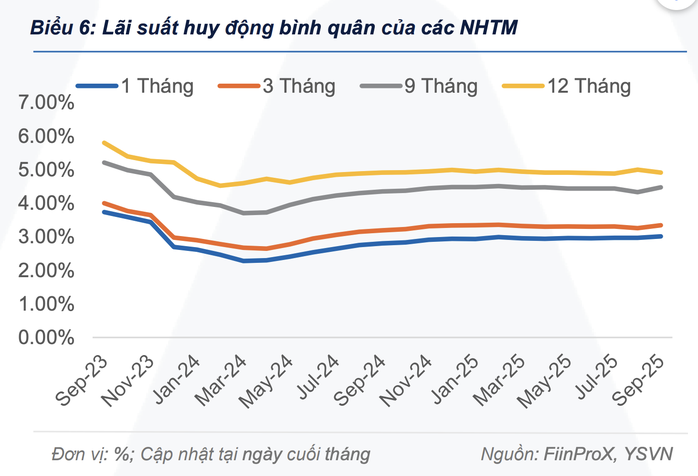

According to statistics from Yuanta Vietnam Securities Company, the mobilization interest rate level in the market increased slightly at some banks at the end of September 2025.

Currently, the average deposit interest rate for 1-9 month terms at commercial banks has increased by about 0.03 - 0.16 percentage points compared to the previous month; while the long term of 12 months has increased by about 0.3 percentage points.

Banks such as ABBANK, BVBank, Kienlongbank, PG Bank, Eximbank, OCB,SHB ... mobilize interest rates for 6-month terms of about 4.9 - 5.3%/year. For the same term, interest rates at Vietcombank, VietinBank, Agribank are about 1.9 - 3.5%/year.

Deposit interest rates have increased in the context of credit growth across the system reaching more than 13.3% compared to the end of last year (data up to the end of September) - the highest in the past 15 years.

Input interest rates have increased as commercial banks are stepping up capital mobilization for year-end lending. Many people said they continue to choose savings for their idle capital, despite the attractiveness of stocks and gold.

Interest rates begin to rise

Ms. Thanh Nga (residing in Bay Hien ward, Ho Chi Minh City) said that she had just closed the 6-month term deposit of 500 million VND, and she decided to continue depositing it for the same term, with the current interest rate at a medium-sized joint-stock commercial bank of about 4.9-5.3%/year.

If you deposit savings at some digital banks, the interest rate can be from 5.9-6%/year. As for online savings, the interest rate is higher than at the counter - the same bank - about 0.1-0.3 percentage points.

"I usually choose to deposit for a 6-month term, so that when needed, I can pay off part or all of it. With an interest rate of about 5%/year, the interest after 6 months will be 12.5 million VND; if the interest rate is 5.9%/year, the interest will be higher - about 14.5 million VND" - Ms. Nga said.

According to the latest statistics of the State Bank by the end of June 2025, the deposit of individuals in the banking system reached more than 7.69 million billion VND, an increase of more than 8.91% compared to the end of last year. Deposits of economic organizations reached 8.1 million billion VND, an increase of 5.7% compared to the end of last year. In the first half of this year, deposits in banks continued to increase (reaching over 15.7 million billion VND).

Forecasting interest rates at the end of the year, many experts said that although there are signs of a slight increase, deposit interest rates will only increase slightly in the last months of the year, while lending interest rates will remain low to support the economy.

Credit growth of the banking system is the highest in many years.

Average deposit interest rates at banks have increased, but are still low compared to previous years.

Source: https://nld.com.vn/co-500-trieu-dong-gui-tiet-kiem-ngan-hang-nao-6-thang-lay-lai-12-trieu-dong-196251007085106458.htm

![[Photo] General Secretary To Lam attends the opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760321055249_ndo_br_cover-9284-jpg.webp)

Comment (0)