In less than a year, global stock markets have witnessed one of the most hyperbolic and concentrated growth spurts in history, all revolving around two letters: AI. The top 8 tech companies in the field of artificial intelligence have collectively created an incredible $4.3 trillion in new market capitalization since the start of 2025.

To put the scale of this into perspective, consider that it took Warren Buffett nearly 60 years to build Berkshire Hathaway into a trillion-dollar empire. Yet in just over 9 months, a group of 8 AI stocks has created 4 times that value.

This growth is greater than the combined value of giants like Berkshire Hathaway, JPMorgan and Walmart, or the equivalent of 15 Coca-Cola companies or 20 McDonald's chains.

"Unprecedented growth party"

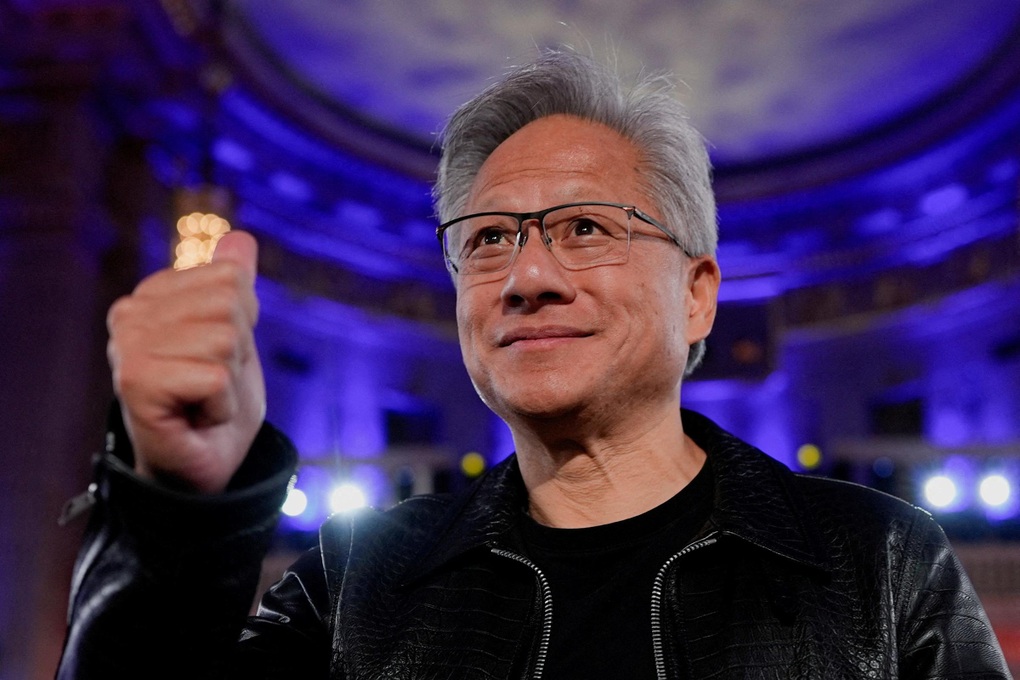

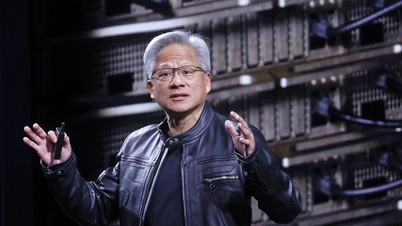

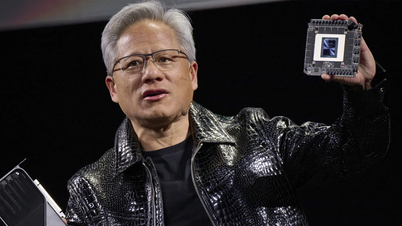

Leading the charge is none other than Nvidia. From being a trillion-dollar company just two years ago, Nvidia has now reached a market capitalization of $4.5 trillion, adding $1.2 trillion this year alone as investors bet on its dominance of the AI chip market.

Other tech giants are also riding the AI tsunami. Microsoft, an early and smart investor in OpenAI (owner of ChatGPT), and Alphabet (parent of Google) with its AI model Gemini, have both seen their stocks rise more than 25%, adding $800 billion and $740 billion to their market capitalizations, respectively.

Other names in the "magic eight" also recorded stunning growth: Palantir's stock soared 137%, Oracle and AMD both rose around 70%, Broadcom rose 45%, and even Meta added 22% in value.

This excitement has been fueled by a series of partnerships and lucrative contracts. Nvidia, Oracle, and AMD have announced major deals with OpenAI, prompting Wall Street to raise its growth forecasts and pour money into the market.

But behind the glittering numbers, clouds of skepticism have begun to appear. Steve Hanke, a professor of applied economics at Johns Hopkins University, has warned that it is too early to say whether the wave is justified. “A lot will depend on whether the ambitious revenue projections of AI companies come true,” he said.

And his warning seems to be coming true.

Nvidia - the "AI chip king" - has added $1,200 billion in market capitalization this year alone (Photo: Reuters).

Warning signal from Goldman Sachs

Recently, the leading investment bank Goldman Sachs officially sent a cautious message to investors. According to strategist Ryan Hammond, the "AI wave" seems to be entering a new phase, phase 3 - where the initial excitement has cooled down.

“Unlike Phase 2, this new phase will have winners and losers,” Mr. Hammond wrote. “To truly return to investing, investors need to see a concrete impact on short-term profits.”

In this phase, investors are no longer just looking at long-term potential or compelling stories. Instead, they are starting to demand concrete numbers: how much profit does AI really bring in the short term? Unlike the past when every AI-labeled stock was rising, this new phase will see a clear division: there will be winners and losers.

Goldman Sachs also points out that AI investment as a share of total corporate capital expenditure is approaching its peak, which suggests that market optimism may be running too high. If actual earnings in the coming quarters fall short of the extraordinary expectations already priced into stocks, a major disappointment is inevitable.

The first signs are already there. Nvidia, the brightest star of the party, has fallen 6% in the last five trading sessions as investors reassess growth prospects. Salesforce and Figma have also sold off after reporting earnings that missed expectations, reflecting growing concerns that enterprise AI demand is slowing amid signs of a slowing US economy.

Crazy valuation or still reasonable?

The big question now is whether the market is witnessing a bubble about to burst, similar to the dot-com bubble of 2000.

Stephen Ehikian, founder of C3.AI, offered a scathing assessment: "In today's market, there are companies trading at 100 times revenue... valuations are clearly insane."

However, the Goldman Sachs report offers a more balanced view. According to Mr. Hammond, while the valuations of some individual stocks like Tesla and Palantir are too high, the market as a whole is not.

“The implied market value for long-term earnings growth for the S&P 500 and tech stocks is now only slightly above historical averages, but still well below the 2000 tech bubble or 2021 peak,” he concluded.

This means that while some stocks may correct sharply, a full-blown crash like the one in 2000 is unlikely. The risk now lies not in the overall market, but in investors choosing the wrong stocks.

Advice for investors: Be cautious and focus on real value

The AI boom has created huge fortunes, but the easiest part seems to be over. Goldman Sachs' warning doesn't mean the AI revolution is over, but it does show the game is getting more complicated.

Investors can no longer simply buy any company that has “AI” on it. Instead, the focus needs to shift from potential to effectiveness. The question should not be “Is this company using AI?” but “How much profit is AI helping this company generate and what is the sustainable competitive advantage?”

As Johns Hopkins University professor Steve Hanke has warned, the success of this wave “will depend heavily on whether AI companies’ ambitious revenue projections come true.”

The AI revolution is real, but the road to profitability is not always paved with roses. After the $4.3 trillion party, sobriety and deep analysis will be the key to separating the real winners from the mere craze-seekers.

Source: https://dantri.com.vn/kinh-doanh/co-phieu-ai-sau-bua-tiec-4300-ty-usd-pho-wall-bat-dau-canh-bao-20251008145700336.htm

![[Photo] Prime Minister Pham Minh Chinh attends the World Congress of the International Federation of Freight Forwarders and Transport Associations - FIATA](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759936077106_dsc-0434-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh inspects and directs the work of overcoming the consequences of floods after the storm in Thai Nguyen](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759930075451_dsc-9441-jpg.webp)

![[Photo] Closing of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759893763535_ndo_br_a3-bnd-2504-jpg.webp)

Comment (0)