SJC gold bar price continues to stay high

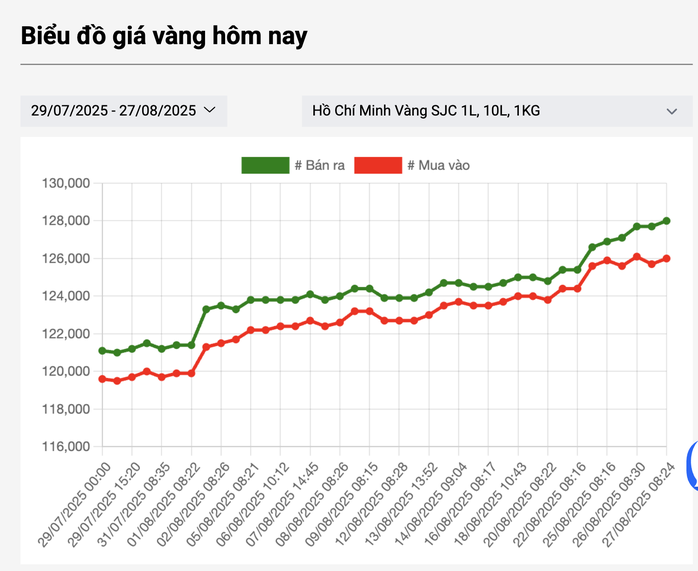

On the morning of August 27, the gold market continued to record unexpected developments. Saigon Jewelry Company (SJC) listed the price of gold bars at 126 million VND/tael for buying and 128 million VND/tael for selling, an increase of 300,000 VND/tael compared to the end of August 26.

Other major gold businesses and commercial banks such as PNJ, DOJI, Eximbank, Sacombank andACB all kept gold bar prices at record peaks.

The difference between buying and selling prices has also widened to VND2 million/tael, instead of only about VND1 million/tael as in previous days. This widening of the range shows that gold trading enterprises are being more cautious in the face of strong fluctuations, and also reflects that market sentiment is still unstable.

SJC gold bar price did not decrease as expected but continued to increase this morning.

Meanwhile, small gold shops in Ho Chi Minh City have proactively adjusted the price of SJC gold bars down to 128 million VND/tael for buying and 129 million VND/tael for selling, about 1 million VND/tael lower than the previous day.

In contrast to this development, the price of 99.99% gold rings and jewelry gold continued to increase. Gold shops, large and small, simultaneously listed the buying price at around VND119.9 million/tael and the selling price at VND122.4 million/tael, an increase of VND200,000 per tael compared to the previous session. The development shows that although SJC gold bars are facing difficulties due to limited supply and the price has reached its peak, gold rings are still popular thanks to a more abundant supply and are more accessible to many people.

What surprised investors was that the market had almost no reaction to Decree No. 232/2025/ND-CP, amending and supplementing Decree 24/2012/ND-CP on the management of gold trading activities that had just been issued. According to the new Decree, the State's monopoly mechanism in the production and import-export of raw gold for the production of gold bars was officially abolished, giving way to a conditional licensing mechanism.

According to analysts, domestic gold prices cannot be reduced immediately because the new regulations need time to be implemented. For the decree to be effective, the State Bank must issue detailed guidance circulars and license qualified businesses and commercial banks to participate in the production and import of raw gold. Only when a truly abundant and competitive supply is created, will the price of gold bars have a basis to cool down and move closer to international prices.

The price difference between SJC gold bars remains at a record level.

On the international market at 9:00 a.m. Vietnam time, the spot gold price was at 3,386 USD/ounce, up more than 12 USD in the past 24 hours. The main reason comes from concerns about US monetary policy instability after President Donald Trump's surprise announcement of firing Ms. Lisa Cook - Governor of the Federal Reserve Board (FED). This shocking move immediately caused global investors to seek gold as a safe haven, pushing prices up.

However, compared to the peak of 3,500 USD/ounce set in April, the world gold price is still significantly lower. On the contrary, the domestic SJC gold bar price has continuously broken records, approaching the threshold of 130 million VND/tael. This creates a paradox: the world gold price has not returned to its peak but the domestic gold price has continuously set new records.

Converted according to the listed exchange rate, the world gold price is currently around 108 million VND/tael. Thus, domestic gold rings are about 14.4 million VND/tael higher than the world price, while SJC gold bars are even 20 million VND/tael higher - a record difference ever.

SJC gold bar price has not stopped increasing

Source: https://nld.com.vn/thi-truong-vang-co-dien-bien-la-sau-quyet-dinh-xoa-doc-quyen-vang-mieng-sjc-196250827085541089.htm

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

Comment (0)