The growth potential for securities companies this year may come from the bond and margin segments, after a 2024 that recorded positive profit growth momentum.

The growth potential for securities companies this year may come from the bond and margin segments, after a 2024 that recorded positive profit growth momentum.

|

| In 2025, profit growth of securities companies may improve thanks to cutting operating costs |

Profits continue recovery trend

Statistics on the business results of securities companies in 2024 show that most companies have significant profit growth, reflecting the general market level when the first half of the year is optimistic and continues to be quiet in the second half of the year.

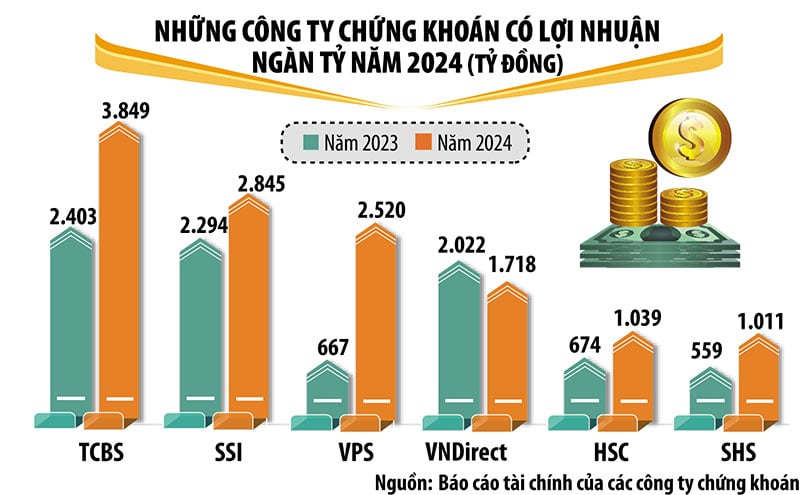

2024 will see 6 securities companies achieve profits of over a thousand billion VND, including familiar and prestigious names in the industry including TCBS, SSI, VPS, VNDirect, HSC and SHS. Leading the industry in terms of profit is TCBS with after-tax profit in 2024 of nearly 3,850 billion VND, an increase of 60% compared to 2023.

Compared to 2023, VPS, HSC and SHS have strong profit growth, entering the trillion-dollar profit group. Meanwhile, although profits decreased slightly, it was enough to make VPBankS fall out of the group. Except for VNDirect, whose profits decreased by 15%, securities companies with profits over trillions all had double-digit growth.

In 2024, companies backed by banks such as SHS, HDBS, TPS, KAFI and some newly restructured securities companies such as LPBS, UPSC all recorded high profit growth.

Margin lending and proprietary trading activities still contribute the main proportion to the revenue of securities companies, while income from securities brokerage decreased due to competition in service fees as well as a decline in transaction value in the market in the second half of the year.

In the period 2021 - 2024, securities companies all increased their capital, creating a more stable buffer in the increasingly fierce competition period. In particular, the capital scale of the group of securities companies related to banks has grown strongly.

The expectation that the Vietnamese stock market will be upgraded in 2025 creates a positive sentiment and expectations for stronger growth among securities companies this year. However, besides opportunities, there are also many challenges and the growth potential of each securities company is not entirely the same.

|

Growth potential from bonds and deposits

SSI's Analysis Team estimates that securities companies' revenue growth will be somewhat limited in 2025, but profit growth may improve thanks to cutting operating costs.

Specifically, the estimated fee/commission income of the securities brokerage segment is almost unchanged in 2025 while the slight increase in transaction value may partially offset the downward trend in transaction fees due to fierce competition among securities companies. The significant capital increase in 2024 and the 2025 plan will continue to support margin lending revenue, although growth is unlikely to break out in volatile market conditions. In addition, the net interest margin (NIM) may decrease due to competition and rising interest rate environment.

SSI estimates that the investment banking segment will gradually recover thanks to a number of ongoing IPOs and the bond underwriting segment may increase when the corporate bond market recovers. For the proprietary trading segment, revenue from certificates of deposit/valuable papers is expected to maintain a large proportion.

VIS Rating also believes that the profitability of the securities industry in 2025 will improve thanks to increased income from margin lending and bond investment. VIS Rating expects that in 2025, the creditworthiness of Vietnamese securities companies will improve slightly compared to the previous year, mainly thanks to higher profits from growth in margin lending and bond distribution.

According to VIS Rating, investor sentiment in 2025 will be supported by strong economic growth and improved overall corporate financial health. Continued efforts to improve market infrastructure will help attract investors to the domestic stock and bond markets.

Private banking affiliates will drive industry earnings growth of around 25% in 2025. These companies can leverage their parent bank’s customer base and capital base. As bond issuance increases in 2025, bond investment income and advisory fees will increase, thanks to the bank’s strong customer relationships and extensive distribution network.

However, VIS Rating also believes that the profit growth potential for foreign companies will be limited due to the lack of scale advantages in brokerage and margin lending activities and modest customer base.

The sector’s holdings of high-risk assets, mainly corporate bonds, will increase, especially for companies affiliated with private banks. Banks and their affiliates work closely together to lend to large companies. These securities companies may also commit to more bond buybacks as they step up their distribution of bonds to individual investors.

However, industry credit losses will remain stable due to lower delinquencies. Strong business conditions will support corporate cash flows and debt servicing.

Private bank affiliates tend to focus their margin lending on a few large clients and are therefore exposed to higher risks. However, asset risk is generally well controlled through substantial collateral. Leverage levels in the industry remain low thanks to new capital raisings.

In particular, companies affiliated with private banks will maintain higher capital increases than their peers thanks to capital support from banks to promote asset growth. On the other hand, foreign securities companies can increase short-term loans from banks to expand margin lending activities. The refinancing risk is limited when companies maintain good access to various sources of capital.

Source: https://baodautu.vn/do-du-dia-tang-truong-cua-cac-cong-ty-chung-khoan-d245463.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)