Financial experts say the results of the US presidential election will directly affect the price outlook of the Bitcoin cryptocurrency.

Bitcoin hits 3-month high

Bitcoin, the world's largest cryptocurrency by market capitalization, has recorded a three-month high, reaching nearly $68,000 in mid-October 2024. One of the main drivers of this surge was the US approval of Bitcoin spot exchange-traded funds (ETFs). This is a big step forward for the cryptocurrency market, as it allows investors to access Bitcoin more easily without having to own it directly. ETFs help simplify the process of investing in Bitcoin and attract many large institutional investors, thereby significantly increasing market demand. Bitcoin ETFs have been expected for a long time, and the official approval of these ETFs in the US has created a positive wave in the financial market. These ETFs will be listed on major exchanges, allowing investors to easily buy and sell Bitcoin like regular stocks. This not only helps boost capital inflow into the crypto market but also increases Bitcoin liquidity.

These ETFs will be listed on major exchanges, allowing investors to easily buy and sell Bitcoin like regular stocks. Photo: Watchguru.

Bitcoin and the US election

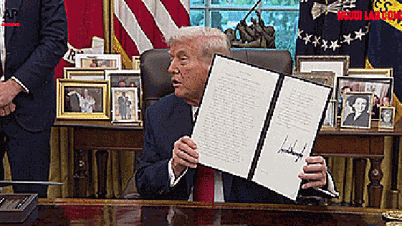

The rise in Bitcoin prices is also closely linked to the political situation in the US, especially predictions about the upcoming presidential election in 2024. Some experts believe that if former President Donald Trump is elected, the price of Bitcoin could continue to rise, even surpassing the $90,000 mark. This is explained by the fact that Trump's policies tend to be friendly to the financial market and cryptocurrencies, creating favorable conditions for investors. During his previous term, he reduced corporate taxes and loosened financial regulations, which helped boost growth in the stock market. With this trend, investors can expect that Trump will continue to facilitate investments, including cryptocurrencies like Bitcoin.

If former President Donald Trump is elected, Bitcoin prices could continue to rise, even surpassing the $90,000 mark. Photo: cryptoslate.

Earlier this week, US Vice President Kamala Harris, a presidential candidate, pledged to significantly improve the regulatory environment for cryptocurrency companies in the US. This is a rare time for Ms. Harris to publicly speak out on this field, while her Republican opponent Donald Trump has repeatedly expressed his ambition to turn the US into the "cryptocurrency capital of the world". Under President Biden, the US Securities and Exchange Commission (SEC) has adopted a strict regulatory policy on the cryptocurrency industry, taking more than 100 regulatory actions against companies in the industry, creating many challenges for crypto businesses.

Baogiaothong.vn

Source: https://www.baogiaothong.vn/gia-bitcoin-nin-tho-ngong-ket-qua-bau-cu-my-2024-192241021221600795.htm

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

Comment (0)