Stock market perspective week 26/2 - 2/3: Short-term investors should be cautious

The short-term uptrend is still maintained and after breaking through the psychological resistance zone at 1,200 points, VN-Index has not yet had a chance to retest this support zone.

After rising sharply to the price range of 1,235 points - 1,255 points, corresponding to the peak price range of August and September 2023, VN-Index had a volatile trading week with 3 consecutive sessions of narrow fluctuations below the resistance of 1,235 points. Especially the last session of the week (February 23), the first session of 2024, had a strong fluctuation, suddenly increasing sharply at the beginning of the session, but decreasing sharply at the end of the session.

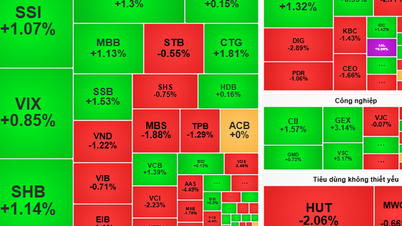

Specifically in this session, banking stocks pushed the index up sharply at the beginning of the session to 1,240 points, then selling pressure increased suddenly in the afternoon session, the adjustment in the large-cap and banking groups was the main reason for the VN-Index to have a strong decline with a very sudden trading volume, more than 1.3 billion shares showing strong short-term distribution pressure. At the end of the week, VN-Index stopped at 1,212 points, still above the psychological price zone of 1,200 points and slightly up compared to the end of last week.

During the week, the total trading value on HoSE reached VND 118,101 billion, a sharp increase and the average trading volume was nearly 1 billion shares/session, of which the trading session on February 23, 2024, the trading volume reached 1,327 billion shares, the highest since the session on August 18, 2023. This development combined with the strong decline at the end of the week showed short-term distribution risks in many codes/code groups when the VN-Index was in the price range of 1,235 points - 1,240 points. Foreign investors increased their trading during the week and strongly net sold VND 1,456.6 billion on HoSE; net sold on HNX with a value of VND 39.69 billion.

As mentioned above, the group that has a big impact on the index is banks, with divergence and sudden liquidity, stimulating short-term cash flow to increase transactions. Many codes still increased strongly, surpassing the old peak such as BID (+7.11%), VAB (+6.25%), TCB (+4.16%)..., the rest mostly decreased with LPB (-4.74%), HDB (-3.43%),OCB (-3.18%), EIB (-2.65%)...

In the last session of the week alone, many groups of stocks fell sharply. Financial services and securities stocks mainly fluctuated within a narrow range, ending the week mostly down with TVB (-7.44%), APG (5.78%), VND (-4.96%), AGR (-4.34%)..., except for IVS (+10.68%), HBS (+3.85%)... Real estate stocks were also the group with the least positive performance compared to the general market when most of them decreased, under strong selling pressure in the last session of the week such as TCH (-6.20%), DIG (-6.10%), PDR (-5.72%), ITC (-5.24%)... in addition to the positive stocks CCL (+13.26%), VRE (+13.11%), PXL (+10.71%)...

The brighter spot was in industrial park real estate and rubber stocks. Despite strong selling pressure at the end of the week, many stocks still increased well at the end of the week, notably TIP (+6.83%), IDV (+6.70%), GVR (+3.38%)... in contrast to LHG (-2.87%), DPR (-2.72%), KBC (-2.70%)...

According to experts, this is a period of adjustment that could be a healthy rhythm before the market balances soon, accordingly, these are also opportunities to increase stocks again. In addition, the fluctuations that need to be considered are the increase in market liquidity balanced in both large-cap groups and returning to the mid-cap group, unlike in early January 2024, liquidity was mainly concentrated, increasing in VN30 and bluechip, then in the past 2-3 weeks, along with the increase in market scores is the balance when cash flow also looks for opportunities in other industry groups besides VN30 and banking.

From a short-term perspective, the market has approached the strong resistance of 1,250 points and has made the right adjustment. The psychological support level of the index is the 1,200 point zone in this adjustment period. Although the market is still likely to have a recovery, it should be noted that because the 6th session is only the first adjustment session, the forecast is still shaky.

In conclusion, although the short-term uptrend is still maintained and after breaking through the psychological resistance zone at 1,200 points, VN-Index has not yet tested this support zone. Therefore, slowing down and adjusting to test this support zone is considered reasonable. The fluctuations and adjustments are still likely to recur in the coming sessions, short-term investors should be cautious at the present stage, because VN-Index is moving at a high score in the medium-term accumulation channel and has sent out correction signals, so short-term risks are increasing.

Therefore, new buying positions should pay attention to these changes in market status to optimize trading positions instead of being influenced by emotional factors and FOMO status to influence investment decisions. It is forecasted that cash flow will continue to revolve around stock groups in industries with positive fundamentals and growth potential in 2024 such as banks, industrial park real estate, seaports, chemicals, oil and gas...

Source

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

Comment (0)