(NLDO) - The highest interest rate for savings deposits with terms over 24 months mobilized by banks is 7.2%/year.

This is the latest data on interest rate developments of credit institutions just announced by the State Bank.

Accordingly, the average VND deposit interest rate of domestic commercial banks is at 0.1-0.2%/year for demand deposits and deposits with terms of less than 1 month; 3-3.8%/year for terms from 1 to less than 6 months; 4.4-5.1%/year for terms from 6 to 12 months.

The highest interest rate is 6%/year for term deposits from 12 months to 24 months; interest rate is up to 6.8-7.2%/year for term over 24 months.

Meanwhile, USD deposit interest rate is 0%/year.

Savings interest rates have increased recently.

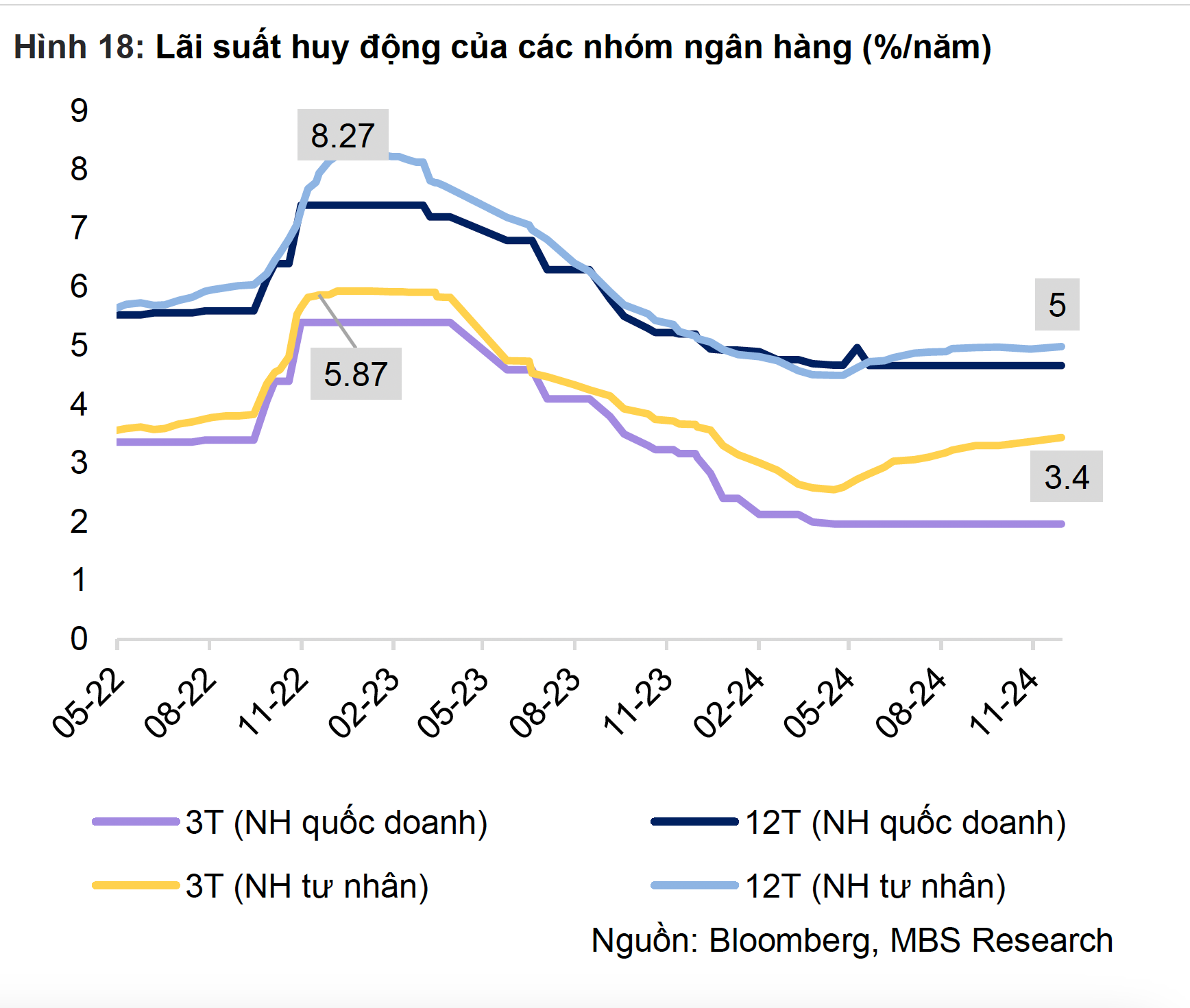

Statistics from MBS Securities Company show that by the end of November 2024, the average 12-month interest rate of the commercial bank group was 5%/year (0.14 percentage points higher than at the beginning of the year). Interest rates of state-owned commercial banks remained at 4.7%, 0.26 percentage points lower than at the beginning of the year. Input interest rates are forecast to increase slightly by 0.2 percentage points, fluctuating around 5.1%-5.2%/year.

According to the reporter of Nguoi Lao Dong Newspaper, the interest rate on savings deposits has continued to increase since the beginning of December. Many banks have adjusted the interest rate for deposits at different terms. Some banks are mobilizing for long terms of over 24 months such as BVBank with interest rate of 6.2%/year; Saigonbank 6%/year; Oceanbank 6.1%/year; DongABank 6.02%/year...

To enjoy the interest rate of 7.2%/year, customers must deposit a large amount of money for a long time, without withdrawing it before the due date. For example, at MSB, for newly opened savings books or automatically renewed savings books with a deposit term of 13 months or more, the amount of VND 500 billion or more enjoys an interest rate of up to 8%/year.

The 12-month interest rate level of joint stock banks remains around 5%.

At HDBank , in the latest interest rate table, the bank said the interest rate for 12-month term with interest received at the end of the term, type 1 is up to 7.7%/year, applied to deposits of 500 billion VND or more. If customers deposit savings for 13 months or more, receiving interest at the end of the term will enjoy an interest rate of 8.1%/year.

Another bank that applies an input interest rate of over 7%/year is DongABank. Customers will enjoy an interest rate of 7.5%/year when making a 13-month term deposit with interest at the end of the term, with an amount of VND 200 billion or more.

The highest interest rate currently recorded is up to 9.5%/year at PVCombank. The condition to enjoy this sky-high interest rate is that customers must deposit at the counter, 12-month term, amount from 2,000 billion VND, receive interest at the end of the term.

Source: https://nld.com.vn/lai-suat-hom-nay-28-12-gui-ngan-hang-nao-huong-lai-72-nam-196241228095211229.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)