According to GPBank's latest online deposit interest rate schedule applied to individual customers, deposit interest rates for terms from 6 months to 36 months have increased by 0.1%/year. GPBank has kept the same terms under 6 months.

With the above adjustment to increase deposit interest rates, GPBank's latest online deposit interest rate table is as follows: Term from less than 1 week to 3 weeks is 0.5%/year; term 1-2 months is 3.8%/year; term 3-5 months is 3.9%/year.

The latest savings interest rate for 6-8 month term is 5.35%/year; 9 month term is 5.45%/year and 12-36 month term is 5.65%/year. This is the highest savings interest rate listed by GPBank.

GPBank also increased bank interest rates for over-the-counter savings products applicable to individual customers and economic organizations, the interest rate increase is 0.1%/year for terms from 4-36 months.

Accordingly, the interest rate for savings with interest paid at the end of the term for this deposit product is as follows: 1-2 month term is 3.55%/year; 3-month term is 3.65%/year; 4-month term is 3.75%/year; 5-month term is 3.8%/year; 6-8 month term is 4.9%/year; 9-month term is 5%/year and 12-36 month term has interest rate of 5.2%/year.

For GPBank's Phat Tai savings product, this is a ladder savings product, with the bank stipulating different bank interest rates according to 6 different deposit levels, the lowest is under 100 million VND and the highest is from 5 billion VND or more.

With this savings product, GPBank also increased interest rates for terms from 6-13 months, with an increase of 0.1%/year.

Accordingly, the interest rate applied to deposits under VND100 million is as follows: 1-2 month term is 3.55%/year; 3 month term is 3.65%/year; 6 month term is 4.9%/year; 9 month term is 5%/year and 12-13 month term is 5.2%/year.

With an interest rate difference of 0.05-0.1%/year for each different deposit level, the highest interest rate of this savings product is 5.45%/year, applied to deposits of 5 billion VND or more, with a term of 12-13 months.

Previously, GPBank announced a reduction in interest rates from 0.15-0.4%/year for many terms on all deposit products. Immediately after that, this bank also announced an additional interest rate of up to 0.8%/year for VIP customers.

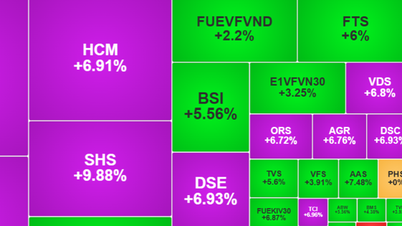

| INTEREST RATE TABLE FOR ONLINE DEPOSITS OF BANKS ON OCTOBER 3, 2025 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.4 | 3 | 3.7 | 3.7 | 4.8 | 4.8 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.1 | 3.8 | 5.3 | 5.4 | 5.6 | 5.4 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 4 | 4.3 | 5.4 | 5.45 | 5.5 | 5.8 |

| BAOVIETBANK | 3.5 | 4.35 | 5.45 | 5.5 | 5.8 | 5.9 |

| BVBANK | 3.95 | 4.15 | 5.15 | 5.3 | 5.6 | 5.9 |

| EXIMBANK | 4.3 | 4.5 | 4.9 | 4.9 | 5.2 | 5.7 |

| GPBANK | 3.8 | 3.9 | 5.35 | 5.45 | 5.65 | 5.65 |

| HDBANK | 3.85 | 3.95 | 5.3 | 5.3 | 5.6 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.1 | 5.2 | 5.5 | 5.45 |

| LPBANK | 3.6 | 3.9 | 5.1 | 5.1 | 5.4 | 5.4 |

| MB | 3.5 | 3.8 | 4.4 | 4.4 | 4.9 | 4.9 |

| MBV | 4.1 | 4.4 | 5.5 | 5.6 | 5.8 | 5.9 |

| MSB | 3.9 | 3.9 | 5 | 5 | 5.6 | 5.6 |

| NAM A BANK | 3.8 | 4 | 4.9 | 5.2 | 5.5 | 5.6 |

| NCB | 4 | 4.2 | 5.35 | 5.45 | 5.6 | 5.6 |

| OCB | 3.9 | 4.1 | 5 | 5 | 5.1 | 5.2 |

| PGBANK | 3.4 | 3.8 | 5 | 4.9 | 5.4 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.6 | 3.9 | 4.8 | 4.8 | 5.3 | 5.5 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.6 | 5.8 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| SHB | 3.5 | 3.8 | 4.9 | 5 | 5.3 | 5.5 |

| TECHCOMBANK | 3.45 | 4.25 | 5.15 | 4.65 | 5.35 | 4.85 |

| TPBANK | 3.7 | 4 | 4.9 | 5 | 5.3 | 5.6 |

| VCBNEO | 4.35 | 4.55 | 5.6 | 5.45 | 5.5 | 5.55 |

| VIB | 3.7 | 3.8 | 4.7 | 4.7 | 4.9 | 5.2 |

| VIET A BANK | 3.7 | 4 | 5.1 | 5.3 | 5.6 | 5.8 |

| VIETBANK | 4.1 | 4.4 | 5.4 | 5.4 | 5.8 | 5.9 |

| VIKKI BANK | 4.25 | 4.45 | 5.8 | 6.1 | 6.1 | |

| VPBANK | 3.7 | 3.8 | 4.7 | 4.7 | 5.2 | 5.2 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-3-10-2025-dong-loat-tang-ky-han-6-36-thang-2448588.html

![[Photo] Opening of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/6/d4b269e6c4b64696af775925cb608560)

Comment (0)