According to the State Bank of Vietnam (SBV) report on the developments in the money market during the week of September 22-26, the overnight, 1-week and 2-week interbank interest rates were respectively at 4.57%, 5.63% and 5.79%, up 0.68%, 1.55% and 0.88% compared to the previous week.

During the week, the SBV injected a net VND29,315 billion on the OMO channel. Specifically, through the term purchase transaction, the SBV injected a new VND79,814 billion (terms of 7, 14, 28, 91 days, interest rate of 4%/year), while the VND50,499 billion issued previously matured.

With the net injection of the State Bank, Bao Viet Securities Company (BVSC) believes that interbank interest rates may decrease slightly in the coming time.

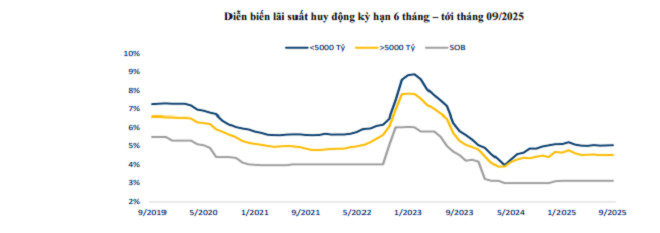

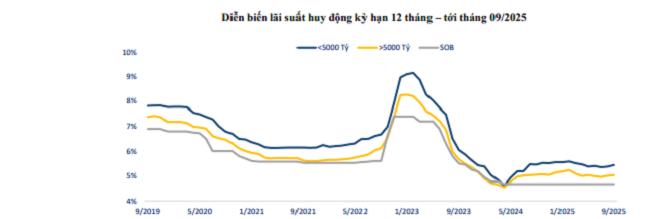

However, according to BVSC statistics, deposit interest rates increased slightly in September. Thus, the general deposit interest rate has been on a slight upward trend since bottoming out in May 2024.

In the deposit interest rate market, although interest rates have not been officially increased, some banks, including Big 4 banks, have launched preferential interest rate programs by adding interest rates for depositors, or giving away lucky draw codes worth up to billions of dong when depositing savings.

Currently, VCBNeo is the market leader in interest rates for deposits with terms under 6 months.

Accordingly, the online deposit interest rate for 1-2 month term is listed by VCBNeo at 4.35%/year; 3-4 month term is 4.55%/year and the highest is 4.7%/year for 5 month term.

For 6-month savings interest rates, the highest savings interest rate belongs to Vikki Bank, up to 5.8%/year.

Vikki Bank is also the bank listing the highest interest rate for online deposits with terms from 12-36 months, up to 6.1%/year.

| INTEREST RATE TABLE FOR ONLINE DEPOSITS AT BANKS ON OCTOBER 2, 2025 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.4 | 3 | 3.7 | 3.7 | 4.8 | 4.8 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.1 | 3.8 | 5.3 | 5.4 | 5.6 | 5.4 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 4 | 4.3 | 5.4 | 5.45 | 5.5 | 5.8 |

| BAOVIETBANK | 3.5 | 4.35 | 5.45 | 5.5 | 5.8 | 5.9 |

| BVBANK | 3.95 | 4.15 | 5.15 | 5.3 | 5.6 | 5.9 |

| EXIMBANK | 4.3 | 4.5 | 4.9 | 4.9 | 5.2 | 5.7 |

| GPBANK | 3.8 | 3.9 | 5.25 | 5.35 | 5.55 | 5.55 |

| HDBANK | 3.85 | 3.95 | 5.3 | 5.3 | 5.6 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.1 | 5.2 | 5.5 | 5.45 |

| LPBANK | 3.6 | 3.9 | 5.1 | 5.1 | 5.4 | 5.4 |

| MB | 3.5 | 3.8 | 4.4 | 4.4 | 4.9 | 4.9 |

| MBV | 4.1 | 4.4 | 5.5 | 5.6 | 5.8 | 5.9 |

| MSB | 3.9 | 3.9 | 5 | 5 | 5.6 | 5.6 |

| NAM A BANK | 3.8 | 4 | 4.9 | 5.2 | 5.5 | 5.6 |

| NCB | 4 | 4.2 | 5.35 | 5.45 | 5.6 | 5.6 |

| OCB | 3.9 | 4.1 | 5 | 5 | 5.1 | 5.2 |

| PGBANK | 3.4 | 3.8 | 5 | 4.9 | 5.4 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.6 | 3.9 | 4.8 | 4.8 | 5.3 | 5.5 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 5.8 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| SHB | 3.5 | 3.8 | 4.9 | 5 | 5.3 | 5.5 |

| TECHCOMBANK | 3.45 | 4.25 | 5.15 | 4.65 | 5.35 | 4.85 |

| TPBANK | 3.7 | 4 | 4.9 | 5 | 5.3 | 5.6 |

| VCBNEO | 4.35 | 4.55 | 5.6 | 5.45 | 5.5 | 5.55 |

| VIB | 3.7 | 3.8 | 4.7 | 4.7 | 4.9 | 5.2 |

| VIET A BANK | 3.7 | 4 | 5.1 | 5.3 | 5.6 | 5.8 |

| VIETBANK | 4.1 | 4.4 | 5.4 | 5.4 | 5.8 | 5.9 |

| VIKKI BANK | 4.25 | 4.45 | 5.8 | 6.1 | 6.1 | |

| VPBANK | 3.7 | 3.8 | 4.7 | 4.7 | 5.2 | 5.2 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-2-10-2025-lai-suat-huy-dong-tang-tro-lai-2448239.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)