Falling food price index, Russian economy going against the West's target, Beijing-Moscow increasing cooperation in the Far East, US CPI increasing slightly... are the world economic highlights of the past week.

|

| In 2024, Russia's crude oil exports will reach 239.9 million tons, equivalent to 4.8 million barrels per day, up slightly from 238.3 million tons last year. (Source: The Moscow Times) |

World economy

FAO lowers forecast for global cereal production in 2024

The United Nations Food and Agriculture Organization (FAO) recently released data showing that the world food price index fell slightly in August 2024, as the decline in sugar, meat and cereal prices outweighed the increase in prices of dairy products and vegetable oils.

Specifically, the price index, which is conducted by FAO to track the most traded food items globally, fell to 120.7 points last month, from 121 points (adjusted) in July. Compared to the same period last year, the index fell 1.1% and down 24.7% from the peak reached in March 2022.

The index hit a three-year low in February this year, as food prices fell from a record high in March 2022 after Russia launched a special military operation in Ukraine.

In a separate report, the FAO cut its forecast for global cereal production this year by 2.8 million tonnes to 2.851 billion tonnes, almost the same as last year. The downgrade is mainly due to lower forecasts for coarse grain production in the European Union (EU), Mexico and Ukraine due to hot, dry weather.

In addition, the forecast for world cereal consumption in the 2024/25 season was also reduced by 4.7 million tonnes compared to July to 2.852 billion tonnes, up 0.2% compared to the same period in the 2023/24 season. Meanwhile, FAO also reduced its forecast for cereal stocks at the end of the 2025 season by 4.5 million tonnes to 890 million tonnes.

America

* According to data released by the US Department of Labor on September 11, the country's consumer price index increased slightly in August 2024, while core inflation remained high due to rising rents and costs for some services, increasing the possibility that the Federal Reserve (Fed) will not cut interest rates strongly next week.

The consumer price index (CPI) increased by 0.2% in August 2024, the same as the increase in July. Compared to the same period last year, as of August, the CPI increased by 2.5%, the lowest increase since February 2021, after increasing by 2.9% in July.

China

* According to data released by the General Administration of Customs of China on September 10, in terms of Chinese Yuan (CNY), the total import and export turnover of goods in the country in the 8 months from the beginning of 2024 reached 28,580 billion yuan (about 4,013 billion USD), up 6% over the same period last year . Of which, export turnover reached 16,450 billion yuan (about 2,310 billion USD), import reached 12,130 billion yuan (about 1,703 billion USD), up 6.9% and 4.7% respectively over the same period last year; trade surplus increased by 13.6%.

In August 2024 alone, the total import and export turnover reached 3,750 billion yuan (about 526.6 billion USD), up 4.8% year-on-year. Of which, the export turnover increased by 8.4%, 1.9 percentage points higher than in July 2024; the import turnover remained unchanged compared to the same period last year.

* The Global Times on September 7 quoted the Chairman of the China Overseas Development Association, He Zhenwei, as saying that " the potential for cooperation between China and Russia in the Far East is huge" , in which Chinese investment in Russia's manufacturing sector has become a new bright spot.

According to the official, at the 9th Eastern Economic Forum (EEF) held in Vladivostock, Russia, which ended on September 6, three member companies of the Association discussed with Russian partners about building smart homes and producing robots, and are expected to cooperate further in emerging fields.

Europe

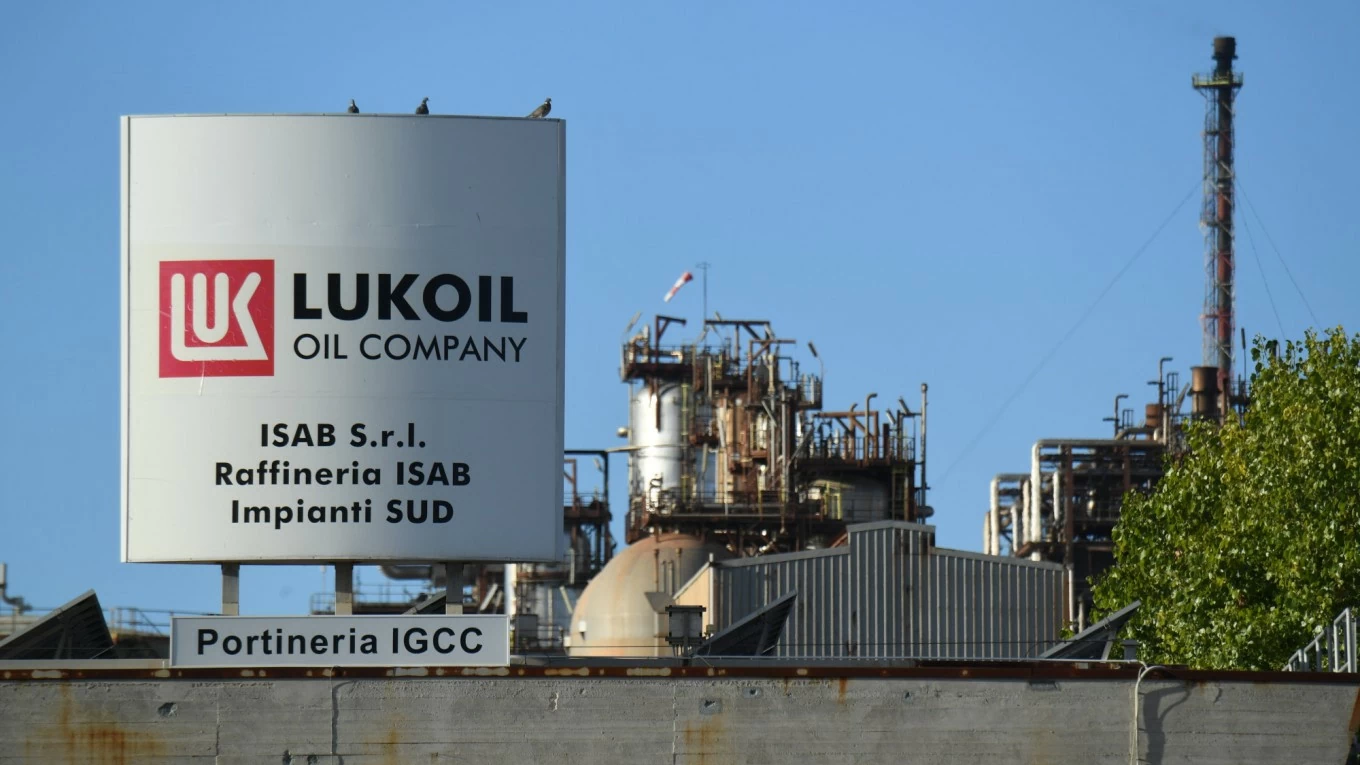

* The Russian Economy Ministry has raised its forecast for oil and gas exports this year by $17.4 billion from its previous estimate to $257.1 billion due to rising fuel prices. Oil and gas are currently the main source of revenue for the country's budget.

Russian Economy Ministry documents show that this year, Russia's crude oil exports will reach 239.9 million tons, equivalent to 4.8 million barrels/day, up slightly from 238.3 million tons last year.

The Russian Economy Ministry also forecasts an average export price of $70 a barrel this year, up $5 from its April estimate. That is higher than last year’s $64.50 a barrel and the $60 a barrel ceiling that the West has imposed on Russian oil. Natural gas prices have also risen, for both European and Chinese customers.

The forecasts run counter to the West’s aim of hammering Russia’s economy after the conflict in Ukraine. Russia says Western sanctions on key sectors will only help it become more self-reliant.

* Europe's largest bank HSBC is considering merging two of its three main divisions , commercial banking and investment banking, to cut costs.

The proposed merger would see the commercial banking division merged with the global banking and markets division. If implemented, the merger would create a new mega-unit within HSBC, which is expected to generate about $40 billion in annual revenue, making it HSBC's largest division.

* The European Central Bank (ECB) is expected to cut interest rates again this week as inflation trends back down to its 2% target, but policymakers have yet to comment further on future moves.

This will be the ECB's second rate cut since 2019. Eurozone inflation fell to its lowest level in more than three years in August 2024, according to official data. Policymakers' confidence in the rate cut has been bolstered by signs that inflation, which has been volatile over the past year, is now on a steady decline.

* German inflation fell to its lowest level in more than three years in August 2024 , which could make it easier for the ECB to cut interest rates this week, according to experts' forecasts.

Inflation in Germany fell to 2.0% in August 2024, the lowest level since June 2021, thanks to lower energy prices. Meanwhile, inflation in July 2024 increased by 2.6% compared to the same period last year.

* The UK is proposing to delay checks on fruit and vegetables imported from the EU by another six months until July 2025, according to the Fresh Produce Consortium.

The next phase, which will cover fruit and vegetables, has been postponed until 31 January 2025, and according to the Fresh Produce Consortium, Defra is proposing to further delay this phase until 1 July 2025.

* Italy plans to draft regulations allowing the use of new nuclear power technologies as early as 2025 , signaling a possible reversal of the country's current ban on nuclear power generation, Energy Minister Gilberto Pichetto Fratin said on September 8.

Minister Pichetto Fratin recently tasked Professor Giovanni Guzzetta with looking into how power plants based on new nuclear technologies could be exempted from the ban. These technologies include small modular reactors (SMRs) and advanced modular reactors (AMRs), which the government believes could support its green energy transition.

In its energy and climate plan (PNIEC), Prime Minister Giorgia Meloni's right-wing government estimates that nuclear power could meet up to 11% of domestic energy needs by 2050.

Japan and South Korea

* Ms. Junko Nakagawa, an official of the Bank of Japan (BoJ), has just reiterated the bank's view that it will continue to raise interest rates if Japan's economic and inflation developments are in line with expectations.

Junko Nakagawa's comments pushed the yen to its highest level against the dollar since December 2023, reaching more than 140 yen per dollar in Tokyo, and signaled the BoJ is preparing for further tightening after raising interest rates twice since early 2024.

The BoJ is scheduled to hold a two-day policy meeting starting on September 19 to determine whether further rate hikes are needed.

* Japanese chemical giant Nippon Shokubai will build a 37.5 billion yen ($263 million) plant to produce a material that can extend the life of electric vehicle batteries. (EV) add about 60%.

The plant is expected to start production of lithium bis(fluorosulfonyl) imide (LiFSI) - a new type of lithium-ion battery electrolyte - in 2028.

* For the first time, more than 10 non-financial companies in South Korea are expected to receive A-grade credit ratings (A-, A3 or higher) from the world's three leading credit rating agencies - Standard & Poor's (S&P), Moody's and Fitch Ratings.

An analysis by The Dong-A I lbo on September 10 of data from the Financial Supervisory Service's electronic information disclosure system showed that as of the first half of 2024, nine companies, excluding finance, insurance and investment companies, had been rated A by the three leading credit agencies. Five years ago, only seven companies were rated so.

The increase was due to upgrades to Hyundai Motor, Kia, Hyundai Mobis and POSCO Holdings, which experts attributed to the Korean companies' crisis management amid the pandemic, supply chain disruptions and geopolitical uncertainty.

As long-time A-rated companies such as Korea Electric Power Corporation (KEPCO) and Korea Gas Corporation are scheduled to be rated in the second half of the year, the number is likely to increase to more than 10 for the first time. The number of A-rated Korean companies has so far remained below 10, ranging from seven in 2014 to nine in 2023.

ASEAN and emerging economies

* The Indonesian government is expected to reopen sea sand exports in October 2024, after the Ministry of Trade amended two ministerial regulations, allowing mining companies to be licensed to ship the commodity abroad.

The amendment, proposed by the Ministry of Maritime Affairs and Fisheries, will take effect on October 8, lifting a decades-old ban, said Isy Karim, director general of the Ministry of Foreign Trade. He said the export of marine sediments, including sand, could only be carried out after ensuring sufficient supply to meet domestic demand and following relevant laws.

* The Thai Revenue Department is planning to impose an additional 15% tax on transnational companies operating in the country starting from 2025, a requirement to meet global minimum tax (GMT) regulations. However, the new tax policy will pose a major challenge for the Thai government, as the country continues to seek ways to maintain competitiveness and attract foreign direct investment (FDI).

According to experts, if Thailand does not apply the above regulation, multinational companies operating in this country will still have to pay GMT in their "home" country or in other countries where they are registered as legal entities. This could cause Thailand to lose potential tax revenue, as the additional tax will be collected elsewhere instead of benefiting the Thai economy.

* According to data from the Philippine Department of Agriculture, the country's rice imports from January to August 2024 will total 2.8 million tons , 19% higher than the 2.3 million tons in the same period in 2023.

In its latest report, the Philippine Plant Health Bureau (BPI) under the ministry said that in August 2024 alone, the country's rice imports increased to 296,350 tons from 167,403 tons in July 2024. However, this figure is still lower than the monthly average of 400,000 tons recorded in previous months.

Source: https://baoquocte.vn/kinh-te-the-gioi-noi-bat-6-129-nga-di-nguoc-muc-tieu-cua-phuong-tay-diem-sang-moi-cua-hop-tac-bac-kinh-moscow-cpi-my-tang-285974.html

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee on overcoming the consequences of natural disasters after storm No. 11](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1759997894015_dsc-0591-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs the Conference to deploy the National Target Program on Drug Prevention and Control until 2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1759990393779_dsc-0495-jpg.webp)

Comment (0)