Slowing inflation has helped investors stay optimistic, but British people are still under great pressure as commodity prices and interest rates remain high.

Inflation in Britain, where people are under greater pressure to spend than most other rich countries, cooled last month, with consumer prices rising 7.9% in June compared to the same period in 2022, according to the Office for National Statistics (ONS). Inflation in the UK reached 8.7% in May.

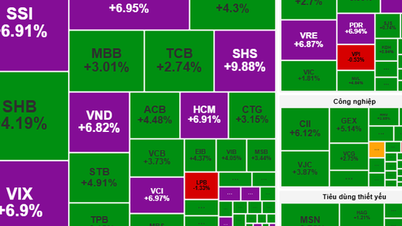

The surprise data sent UK stocks soaring on hopes that the Bank of England (BoE) will not need to raise interest rates as sharply as previously expected. The FTSE 250 index rose nearly 3% on July 19. Investors cut their forecast for the BoE's benchmark interest rate to 5.85% next year, down from 6.5% just two weeks ago, according to Tradeweb data.

Better-than-expected inflation data has prompted markets to reassess the extent to which the BoE will need to raise interest rates to ease inflationary pressures, said Ellie Henderson, an economist at Investec. "UK interest rate expectations have been scaled back significantly," she said.

The stock market is sensitive to small changes in UK inflation data. But behind the changes, UK consumer prices continue to rise at a faster rate than most other rich countries, leading to the biggest fall in real incomes for people in seven decades.

“For families across the country, prices are still rising too fast and there is a long way to go,” said Jeremy Hunt, UK Chancellor of the Exchequer.

Unlike in the US, where mortgage rates are fixed for between 15 and 30 years, mortgages in the UK are typically fixed for just two to five years. Jon Glenister, an electrician living in West London, recently saw his mortgage rates jump to more than 5%, from 1.6%.

"I can barely stand the rising prices and mortgage payments. I don't go out as much, I don't eat out as much. I eat less meat because it's so expensive," Glenister said. According to a survey of 2,156 people conducted by the ONS between June 28 and July 9, nearly a third of Britons are using savings to pay bills, and nearly half are struggling to pay rent and mortgages.

The cost of living crisis is one of the reasons why Prime Minister Rishi Sunak is at risk of political defeat. A YouGov survey from July 10-11 found that 43% would vote for the opposition Labour Party and just 25% for Prime Minister Rishi Sunak. The polls also showed the government was at risk of defeat in the upcoming special elections.

Food prices are the main reason why UK inflation is higher than many other rich countries. Food inflation eased in June but remained at 17.3%. In the US, food prices were 4.7% higher in June than a year earlier.

People buy vegetables and fruits in central London, Britain, August 19, 2022. Photo: Reuters

Faced with rising costs of essentials, workers in the UK have secured larger pay rises than usual in recent decades. According to the ONS, average weekly pay excluding bonuses was 7.3% higher in the three months to May than in the same period a year earlier, the fastest rise on record outside the pandemic.

But even so, workers' spending power still fell 0.8% from a year earlier as real earnings fell when inflation was taken into account. Britain has seen strikes in the health care, transport and education sectors over the past year as workers fought to protect their purchasing power. Last week, the government offered millions of civil servants a pay rise of at least 6% in an effort to end those disputes.

Reduced spending, combined with labor shortages, has taken a toll on some businesses. Andy Kehoe runs a pub in London and has raised beer prices to keep up with higher energy costs. The price shock has put some of his regulars out of business, and he is now struggling to retain staff. “I’m losing money. High prices are keeping people at home, but I have to pay my people and keep going,” he said.

Policymakers at the BoE have long worried about the potential for a price-wage spiral, in which initial price increases trigger wage hikes that force firms to raise prices further. More recently, they have also expressed concern about the role of profits in keeping inflation high. Many argue that firms’ efforts to maintain or increase profit margins keep prices high.

Speaking to bankers last week alongside Bank of England Governor Andrew Bailey, Chancellor Jeremy Hunt said regulators would act to ensure profits did not rise too quickly. "I will continue to work with regulators to ensure the needs of families are prioritised during this difficult time," he added.

However, the main weapon in the fight against inflation remains the BoE's interest rate policy. Policymakers have signaled some caution, with two of the BoE's nine governors voting against further rate increases at recent meetings, arguing that it will take time for the rate hikes to have an effect.

Phien An ( according to WSJ )

Source link

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting of the Steering Committee on the arrangement of public service units under ministries, branches and localities.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759767137532_dsc-8743-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee to remove obstacles for projects.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759768638313_dsc-9023-jpg.webp)

Comment (0)