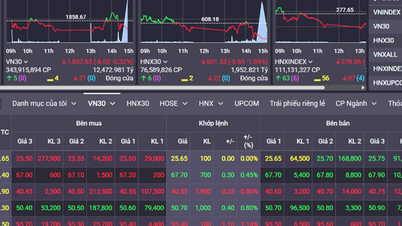

Securities companies quickly pay taxes and fines to maintain their reputation and strengthen investors' confidence - Photo: BONG MAI

Arrange to pay all tax arrears and penalties

Specifically, Mr. Nguyen Kim Long - Director of Law and Compliance Audit of SSI Securities - just said on behalf of the enterprise that this weekend he received the decision from the Large Enterprise Tax Department.

The enterprise is subject to additional tax collection, administrative fines and late tax payment fees for 2022 and 2023 with a total amount of more than 7.3 billion VND.

Grasping the information, this leading securities company in the market quickly arranged to pay the above amount to the state budget, fulfilling its obligation.

According to data from the Ho Chi Minh City Stock Exchange (HoSE), SSI is the second largest securities company in terms of market share in brokerage transactions of stocks, fund certificates and covered warrants in the last quarter, just behind VPS. The remaining companies also in the top group include TCBS, VNDirect, Vietcap, HSC MBS, Mirae Asset, FPTS and KIS.

Accelerate charter capital increase, consolidate position

In a new development this week, SSI Securities has just announced a resolution of the board of directors, related to the offering of about 151 million shares to existing shareholders at a price of 15,000 VND/share, a ratio of 10% (shareholders holding 100 shares can buy 10 new shares at the above price).

As of November 4, there were 5.4 million remaining shares. With these "unsold" shares, the company continued to distribute them to professional securities investors and key staff of the company. Accordingly, there are eight qualified investors, all of whom are senior staff of SSI Securities, who have registered to buy all the remaining shares. The latest payment deadline is Thursday of this week.

According to the latest report, the company said it has sold all of its nearly 151 shares to existing shareholders, raising its charter capital to nearly VND19,640 billion.

The parent company's financial report shows that in the first three quarters of this year, SSI Securities achieved revenue of nearly VND6,500 billion and pre-tax profit of nearly VND3,000 billion, completing 80% and 88% of the yearly plan, respectively.

At the end of the last quarter, the company's assets reached over 65,300 billion VND, a significant decrease compared to the beginning of the year. Liabilities were slightly reduced to nearly 42,000 billion VND.

On the stock market, closing the last trading session of this week, SSI code is in the red with the price of 24,350 VND/share, but still fluctuates slightly up in the past week. In the past month, this stock has decreased about 9%.

SSI Securities was established in 1999, one of the oldest operating companies, leading financial institutions in the Vietnamese stock market. Currently, the company has a wide operating network in Hanoi , Ho Chi Minh City, Hai Phong, Nha Trang.

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)