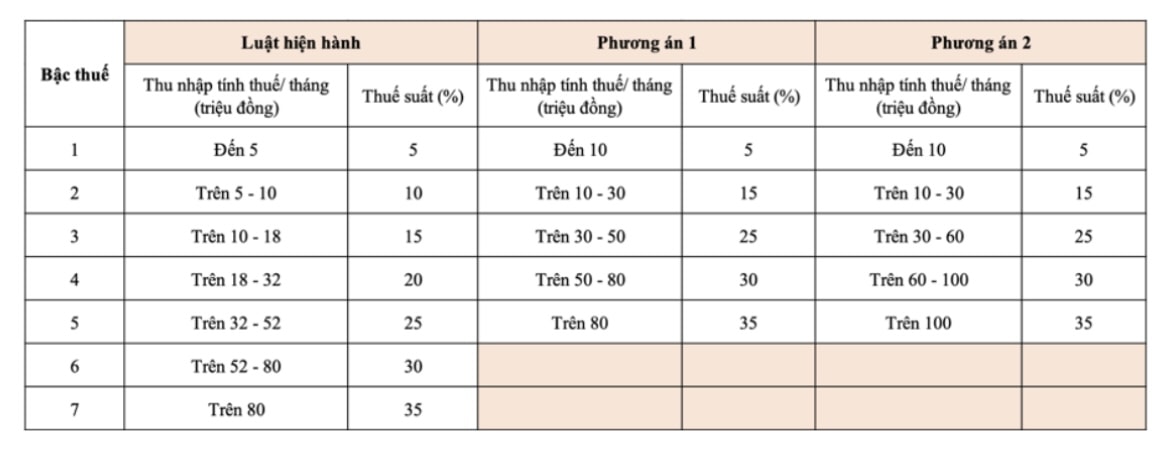

Two proposed options and their impacts

Option 1 shows that taxpayers in level 1 will receive a tax reduction if the family deduction is increased. Taxpayers in tax levels from level 2 and above will receive a reduction in their tax payable compared to the current level.

Option 2 goes further, with greater tax incentives for high-income groups. Specifically, individuals with taxable income of 50 million VND/month or less will still receive tax reductions equivalent to Option 1, while groups with taxable income of over 50 million VND/month will receive greater tax reductions.

In general, the continued application of the progressive tax schedule is consistent with international practice. Reducing the number of tax brackets from 7 to 5 also contributes to simplifying the tax schedule, making it easier to calculate and manage.

However, the maximum tax rate in Vietnam (35%) is still moderate compared to the world. For example, Finland has the highest tax rate of up to 57.3%; Japan, South Korea and China are all at 45%; the Philippines and Indonesia also reach 35%. The number of tax rates in Asian countries ranges from 5 to 13, while in Europe, North America and Australia, the number of tax rates is usually from 5 to 6. This shows that the current proposal of the Ministry of Finance is reasonable in terms of the general trend.

Family deduction and real life

Along with adjusting the tax schedule, the Ministry of Finance is also proposing two options to adjust the family deduction level in the draft Resolution of the National Assembly Standing Committee.

- Option 1: Adjust according to the consumer price index (CPI). The deduction for taxpayers is 13.3 million VND/month, for dependents is 5.3 million VND/month.

- Option 2: Adjust according to average income per capita and GDP/person growth rate. The deduction is 15.5 million VND for the taxpayer and 6.2 million VND for dependents.

However, both options are causing public concern as they do not accurately reflect the reality of the rapidly increasing cost of living. The basic salary in 2020 was 1.49 million VND/month, now it has increased to 2.34 million VND - an increase of more than 57%. Meanwhile, the family deduction has not changed accordingly, making workers feel disadvantaged.

The shortcomings need to be considered

In addition to the unrealistic family deductions, the current tax schedule also has a very close gap between tax brackets, making it easy for taxpayers to fall into a high tax bracket just because their income increases insignificantly. This creates a sense of concern, even a loss of motivation, because the more you work, the more heavily you are taxed.

The complexity of tax calculation not only causes difficulties for taxpayers but also puts more pressure on tax authorities. This can even lead some people to tend to circumvent the law or evade taxes, affecting the transparency and fairness of the tax system.

Currently, the threshold for personal income tax after deduction is 11 million VND/month. However, many localities such as Ha Tinh and Ninh Thuan have proposed raising this level from 16 to 25 million VND/month to reflect the actual cost of living. In reality, in big cities, the current income of 11 million VND/month is barely enough to cover rent and school fees for children.

Both current adjustment options rely on only one factor: CPI or income/GDP/capita. This leads to a policy gap, as it does not take into account the overall context of living costs, inflation, real incomes and changes in people's consumption structure.

Therefore, a third comprehensive option is needed: combining both inflation rate (CPI) and income/GDP growth per capita. This option will more closely reflect current living conditions, ensure fairness among taxpayers, and at the same time maintain stable revenue for the State budget.

The development of a third option also demonstrates the willingness, listening and positive response from the management agency to the legitimate aspirations of the people and experts. More importantly, it is also a substantial step to perfect tax policy, linked to real life and development trends.

The reform of personal income tax is not simply a technical problem, but also a social issue, related to trust and the requirement of fairness in policy. When tax policy is built on a reasonable, fair and practical basis, people will readily agree and the implementation will become more effective and sustainable.

In the current context of development and integration, it is necessary to determine that the highest goal of all reform policies is to take people's happiness as a measure, take people as the center and driving force of development.

Therefore, in addition to the two options being put forward for comments, it is necessary to consider adding a third option - a balanced, scientific and humane choice, ensuring the harmony of interests between the State, the people and the whole society in the process of innovation and long-term development.

Source: https://baonghean.vn/sua-doi-thue-thu-nhap-ca-nhan-can-bo-sung-phuong-an-3-hop-ly-de-sat-thuc-tien-10304596.html

![[Photo] Prime Minister Pham Minh Chinh chairs the 16th meeting of the National Steering Committee on combating illegal fishing.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759848378556_dsc-9253-jpg.webp)

![[Photo] Super harvest moon shines brightly on Mid-Autumn Festival night around the world](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759816565798_1759814567021-jpg.webp)

Comment (0)