Opening the trading session of the Vietnamese stock market on October 11, VN-Index fell nearly 4 points due to increased supply but closed the session up nearly 8 points.

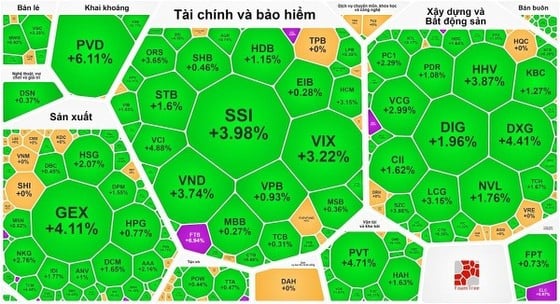

After the previous day's decline, the group of securities stocks increased explosively, many stocks regained their previous peaks. In particular, FTS, OGC increased to the ceiling, SHS increased by 5.2%, AGR increased by 5.74%, CTS increased by 3.38%, HCM increased by 3.15%, ORS increased by 3.65%, SSI increased by 3.98%, VCI increased by 4.88%, VDS increased by 3.99%, VIX increased by 3.22%, VND increased by 3.74%...

Although banking stocks did not increase strongly, they still leaned more towards green with STB increasing by 1.6%, HDB increasing by 1.15%; VCB, VPB, CTG, TCB, SSB, VPB increasing by nearly 1%.

|

Securities stocks exploded in the trading session on October 11 |

Real estate stocks have strong differentiation within the industry, but many stocks also recovered well. Specifically, QCG increased by 4.41%, DXG increased by 4.04%, SGR increased by 4.04%, SZC increased by 3.86%, NTL increased by 2.17%, DSX increased by 1.05%, DIG increased by 1.96%, NVL increased by 1.76%, HDC increased by 1.64%, IDC increased by 1.46%, KBC increased by 1.27%, PDR increased by 1.08%... On the contrary, VHM decreased by 1.25%, SJS decreased by 3.87%; LDG, KDH, ITA decreased by nearly 1%...

The oil and gas group maintained good growth momentum with BSR up 1.91%, PLX up 2.5%, OIL up 2.86%, PVS up 4.23%, PVB up 5.18%, PVC up 5.23%, PVD up 6.11%, PTV up 8.33%...

In addition, the manufacturing group also performed positively with GVR increasing by 3.24%, DGC increasing by 1.78%, DCM increasing by 1.65%, DPM increasing by 1.55%, HSG increasing by 2.07%, BMP increasing by 3.66%, PHR increasing by 2.06%, NKG increasing by 2.76%...

Closing the trading session, VN-Index increased by 7.12 points (0.62%) to 1,150.81 points with 265 codes increasing, 213 codes decreasing and 74 codes remaining unchanged.

At the end of the session at Hanoi Stock Exchange, HNX-Index also increased by 2.83 points (1.21%) to 237 points with 100 codes increasing, 54 codes decreasing and 73 codes remaining unchanged.

Low liquidity with total transaction value in the whole market only nearly 14,700 billion VND, down more than 3,000 billion VND compared to the previous session.

The positive point is that foreign investors have stopped their net selling streak and returned to buying nearly 23 billion VND on the HOSE floor.

Source

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)