Market developments on the afternoon of October 23: In-depth analysis of scenarios

Market experts gave three main scenarios for the afternoon trading session, revolving around the possibility of the market maintaining its growth momentum, testing important resistance levels, or facing correction pressure.

Neutral scenario: Maintain the price base of 1,690–1,695 points

This is the scenario that is considered to have the highest probability of happening. After the strong increase in the morning session, short-term profit-taking pressure may appear, especially in some banking and real estate stocks. However, the market is expected to remain balanced.

Vingroup continued to play a role in keeping the pace with VIC increasing by 2.7% and VHM increasing by 2.4%, contributing more than 7 points to the index. The slight increase in momentum of these two codes will help the VN-Index maintain a positive range around 1,692-1,695 points.

The banking sector is likely to continue to differentiate. Codes such as HDB, LPB, MBB are showing signs of stable cash flow, with the expectation of extending the growth momentum thanks to foreign buying power. On the contrary, TCB and SSB falling nearly 2% may slow down the overall growth. Cash flow in the industry is retained thanks to high liquidity inSHB (35 million shares) and HDB (22 million shares).

If the VN-Index maintains above 1,690 points and the VN30 group increases by more than 10 points, the market will accumulate a new price base around 1,695 points, creating favorable conditions for a technical recovery wave.

Positive scenario: Breakout to test the 1,700–1,705 point zone

This scenario will come true if demand continues to spread strongly from the pillar group to other supporting industries such as real estate, seaports and energy.

The seaport group is “hot” again with VSC increasing by 6.9% and HAH increasing by 6%, accompanied by a clear improvement in liquidity. This is a group of highly speculative stocks, often attracting cash flow in the short-term increase phase. The rotation of cash flow to this group can quickly push the VN-Index towards 1,700 points.

Real estate stocks such as CTD, NVL, KDH, DIG still maintain good purchasing power. In particular, CTD hit the ceiling with over 1 million units of buying volume, becoming the focus of attracting cash flow.

The energy group (PVS, GAS, PVC) showed positive signs as it benefited from oil prices remaining at high levels. If demand is strong enough, the index could test the 1,705-point zone within the session.

Negative scenario: Narrowing the uptrend, falling back to 1,685 points

Selling pressure will increase if demand weakens and the pillar group VIC – VHM turns around after a strong increase in the morning session. At that time, VN-Index may quickly lose the 1,690 point mark.

Selling pressure spreading to banking and securities groups will cause the index to fall back to around 1,685 points.

The stock group is currently a relative weak point, with VIX, SSI, and VND all down 0.5–1%. Failure to improve liquidity in this group will cause the market's upward momentum to lack support.

In addition,FPT's 1.1% decrease could also somewhat dampen investor sentiment as the technology group shows signs of cooling down.

In the negative scenario, total session liquidity is expected to be only around VND21,000-22,000 billion, showing that cash flow is waiting for a more sustainable confirmation signal before returning strongly.

Trading Strategy: Hold and Watch Priority

The market is showing signs of entering a technical recovery phase. Therefore, the appropriate strategy for investors is to hold and observe developments, avoiding buying in the market.

Short-term investors can consider gradually taking profits in stocks that have increased 5-7% in the last two sessions, especially real estate and seaport groups.

For the medium term, investors should continue to hold strong fundamental stocks that are net bought by foreign investors such as VHM, HDB, GAS, PVS, VCB. Prioritize leading enterprises with low valuation advantages and positive Q3 business results.

Source: https://baodanang.vn/thi-truong-chung-khoan-chieu-nay-23-10-nhan-dinh-dien-bien-thi-truong-3308119.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

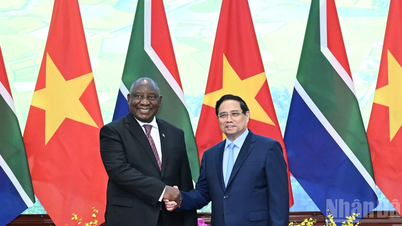

![[Photo] President Luong Cuong holds talks with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761221878741_ndo_br_1-8416-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh meets with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761226081024_dsc-9845-jpg.webp)

Comment (0)