| Commodity market today October 4: Iron ore price reaches highest level, cocoa price plummets Commodity market today October 8, 2024: Oil price continues to 'heat up' |

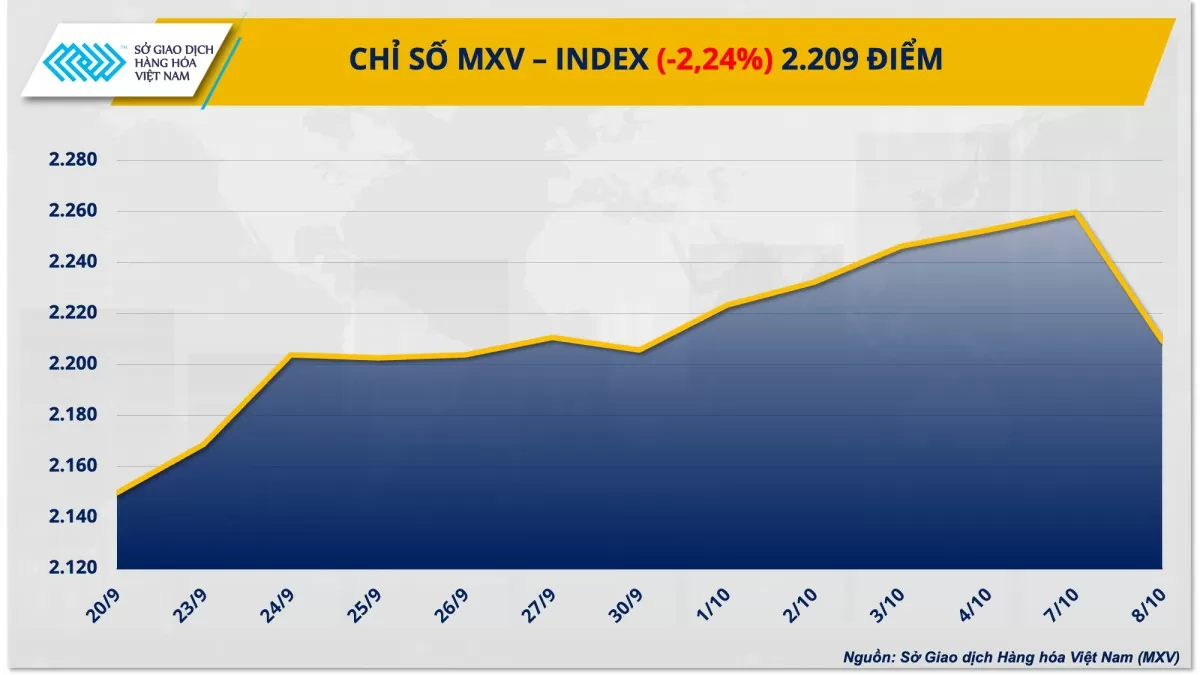

Notably, after many consecutive sessions of price increases, strong selling pressure returned to the crude oil market, causing the prices of both commodities to plummet. In the same direction, in the agricultural market, corn and soybean prices also weakened in the context of accelerating harvesting activities in the US and favorable weather prospects for the new crop in Brazil. Closing, the MXV-Index lost 2.24% to 2,209 points.

|

| MXV-Index |

World oil prices plummet after EIA lowers forecast of supply deficit

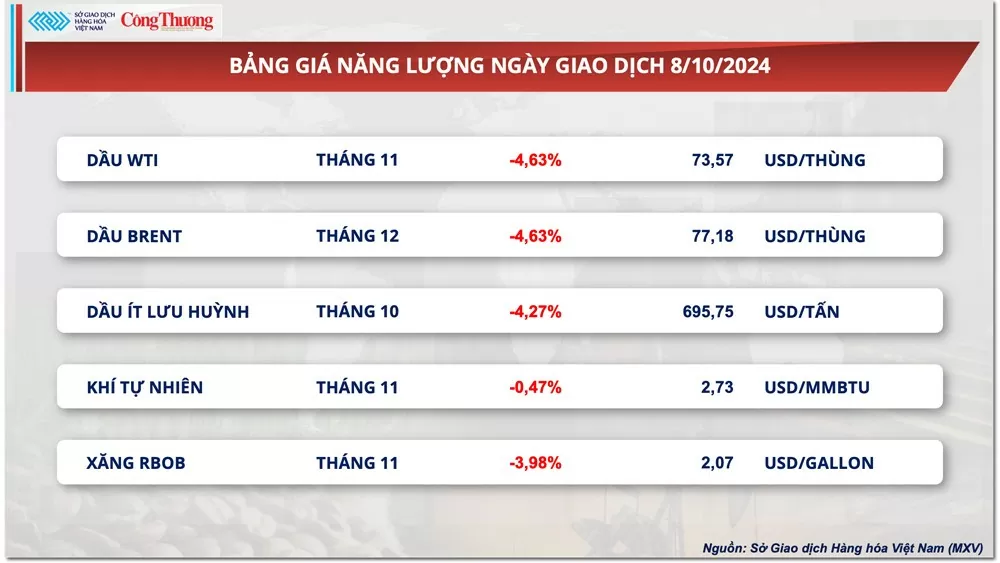

At the close of trading yesterday (October 8), the energy market was in the red. In particular, world oil prices turned sharply down, erasing the increase established at the beginning of last week after the US Energy Information Administration (EIA) lowered its forecast on supply deficit. At the end of the session, WTI and Brent oil prices both fell 4.63%, down to 73.57 USD/barrel and 77.18 USD/barrel, respectively.

|

Energy price list |

Despite concerns about geopolitical risks in the Middle East, the EIA asserted that crude oil flows in the region have not been affected and are unlikely to be affected in the near future. In its October Short-Term Energy Outlook, the EIA raised its forecast for global oil production by 300,000 barrels per day (bpd) from the previous report, to 102.5 million bpd. However, demand growth in 2024 was kept unchanged at 1.1 million bpd, with total demand estimated at 103.1 million bpd, before declining to 104.3 million bpd in 2025.

Although the EIA still forecasts a market deficit of about 600,000 barrels per day in 2024, the deficit is significantly lower than the previous forecast. At the same time, the agency believes that the supply-demand balance will return to a relatively balanced state next year. Accordingly, the EIA lowered its Brent oil price forecast for this year and next year to $80.89/barrel and $77.59/barrel, respectively, much lower than the $84.09/barrel forecast in September.

Meanwhile, Russia’s crude oil exports rose to their highest level since July, with the four-week average reaching 3.32 million barrels a day as of October 6, up 60,000 barrels a day. According to Bloomberg, Russia’s abundant export supply comes as refineries enter a seasonal maintenance period.

In addition, the speech of Naim Qassem, the deputy leader of Hezbollah, also had a negative impact on the market. Naim Qassem unexpectedly supported the efforts of the Speaker of the Lebanese Parliament , an ally of Hezbollah, to reach a ceasefire agreement in the country without mentioning the ceasefire conditions in Gaza. This could signal a step forward in efforts to ease tensions in the world's important oil-producing region.

Agricultural prices plummet under harvest pressure in the US and Brazil

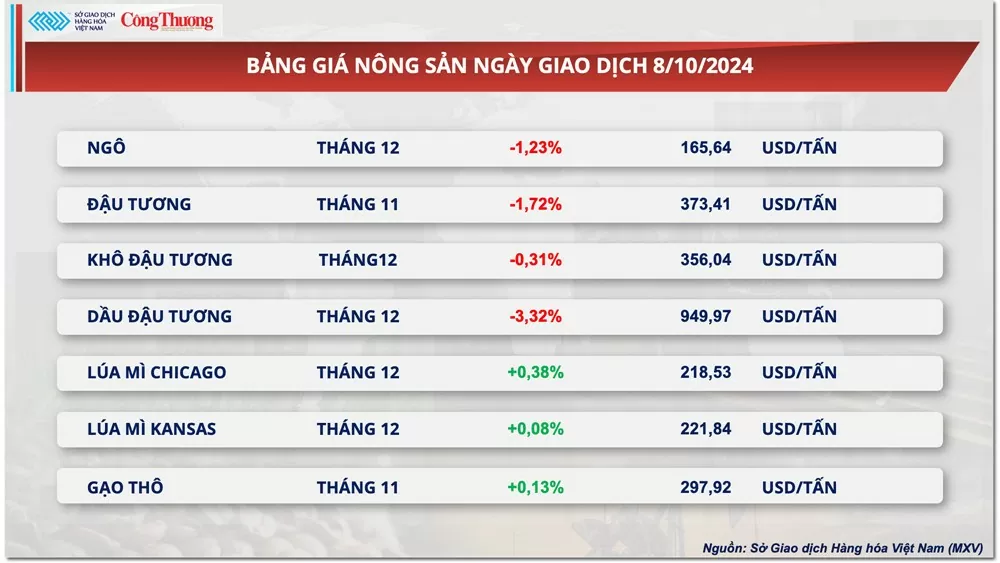

Yesterday’s trading session saw the agricultural market witness a decline in corn and soybean prices. December corn futures fell more than 1% to $165.64/ton, while soybeans extended their five-session losing streak with a drop of more than 1.72% to $373.41/ton.

|

| Agricultural product price list |

The main reason for the decline in corn prices is the acceleration of harvesting activities in the US, along with favorable weather prospects for the new crop in Brazil. Consulting firm AgRural said that the progress of planting corn crop 1 in Brazil has caught up with the same period last year at 37% of the plan. Climatic conditions in the south of the country are ideal for the initial development of corn plants. With rains forecast to return from October 10, Brazil is likely to accelerate the pace of planting this month, bringing the prospect of abundant supply.

Meanwhile in the US, the USDA Crop Progress report shows that corn quality is high, with 64% of the crop rated good or excellent, well above the same period last year. In addition, 30% of the US corn acreage has been harvested, higher than the five-year average thanks to favorable weather. The supply of corn available on the market is forecast to increase, putting pressure on prices.

Similarly, the soybean market has been pressured by the rapid harvest in the US. USDA recorded 47% of the soybean acreage nationwide harvested, up from 26% last week and well above the 5-year average of 34%. The increase in supply will be a key factor in shaping the short-term trend of soybean prices.

With the current pace of harvest and the positive supply outlook in major exporting countries, corn and soybean prices are likely to continue to face difficulties in the coming sessions. However, factors such as consumption demand, export situation and exchange rate fluctuations still need to be closely monitored, as they can create unexpected turning points in the market.

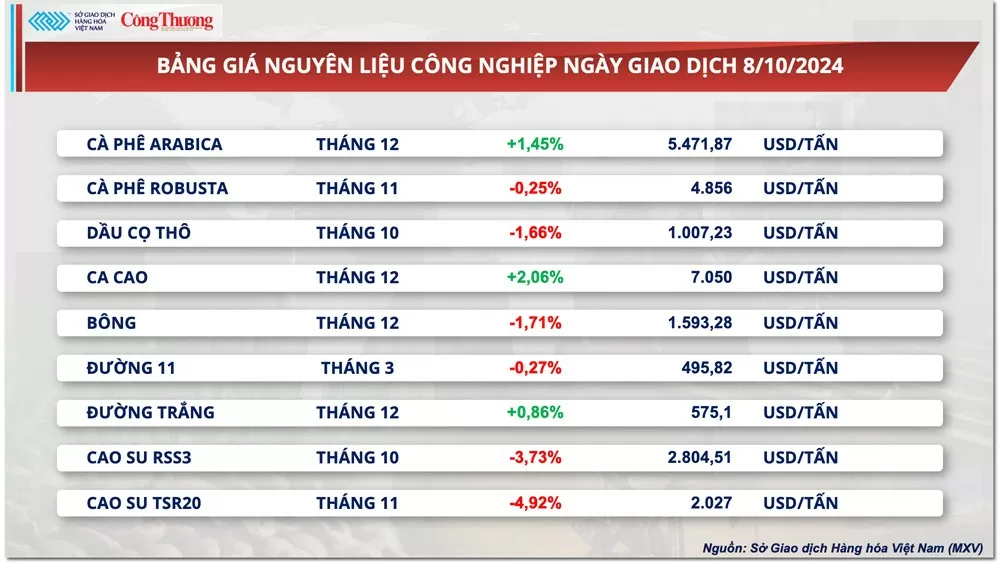

Prices of some other goods

|

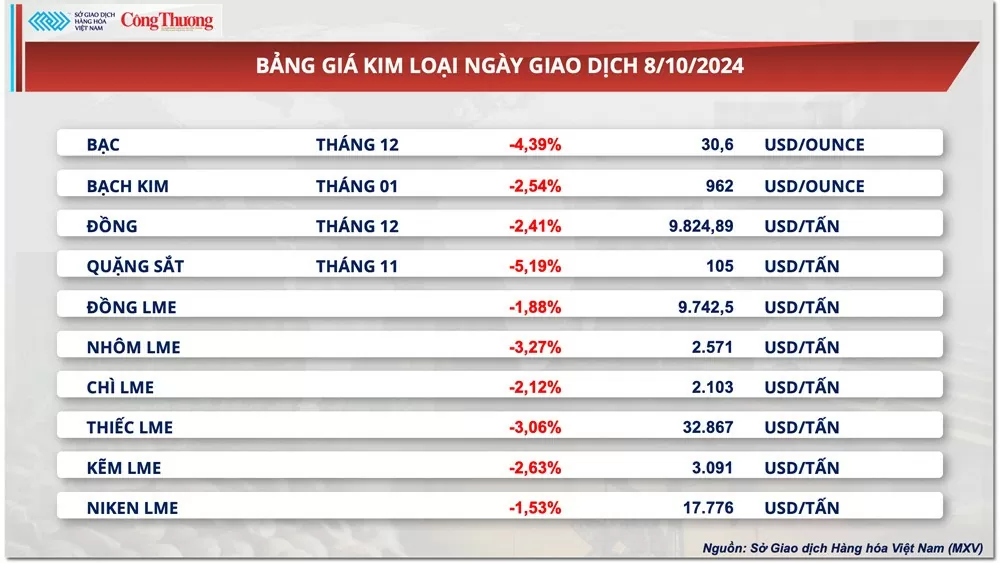

| Metal price list |

|

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-910-thi-truong-nang-luong-ruc-do-keo-chi-so-mxv-index-quay-dau-suy-yeu-351201.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

Comment (0)