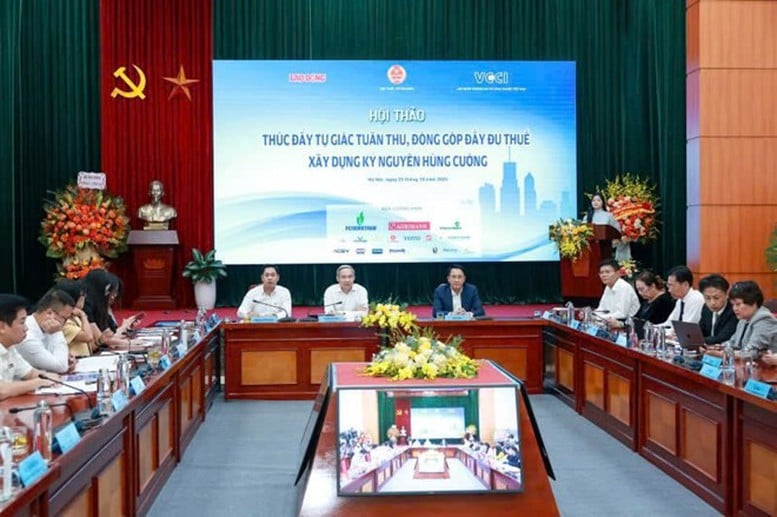

Workshop "Promoting voluntary compliance and full tax payment - Building a powerful era" - Photo: VGP

From administrative compliance to voluntary compliance

On the afternoon of October 23, at the headquarters of the Tax Department ( Ministry of Finance ), the Vietnam Confederation of Commerce and Industry (VCCI) and Lao Dong Newspaper organized a workshop "Promoting voluntary compliance and full tax contribution - Building a powerful era".

Mr. Phan Duc Hieu, Standing Member of the National Assembly's Economic Committee, said: Compliance with the law is not only an obligation, but also a culture. Citing the spirit of Resolution 66-NQ/TW, he emphasized that when making laws and policies, the State must ensure "ease of compliance, not creating additional burdens for people and businesses".

According to Mr. Hieu, to improve tax compliance, the following factors need to be noted: Policies must be clear, procedures must be simple; management must shift from process to goal. In particular, digital transformation requires a change in management thinking; public authorities need to proactively support people; there needs to be a mechanism to encourage good compliance, clearly distinguishing between violators and those who violate to arouse self-awareness.

"Voluntary compliance is a measure of trust, it cannot be forced but must be nurtured with fairness and transparency," Mr. Phan Duc Hieu affirmed.

Mr. Mai Son, Deputy Director of the Tax Department (Ministry of Finance) - Photo: VGP/HT

Self-conscious tax compliance – an indicator of trust and social consensus

Mr. Mai Son, Deputy Director of the Tax Department (Ministry of Finance) emphasized that in modern tax management, voluntary compliance is a measure of development. In developed countries, people pay taxes not only because of legal obligations, but also because they believe that tax money is used fairly, transparently and for the common good.

Mr. Mai Son cited that in Vietnam, many social security programs such as health insurance, education , infrastructure... are maintained by tax revenue. When people see the effectiveness, paying taxes becomes an act of accompanying the State.

Since then, the tax industry has been shifting strongly towards "people knowing - understanding - agreeing" with tax policy.

Mr. Mai Son said that VCCI's independent assessments and business satisfaction surveys have helped tax authorities improve processes and increase transparency.

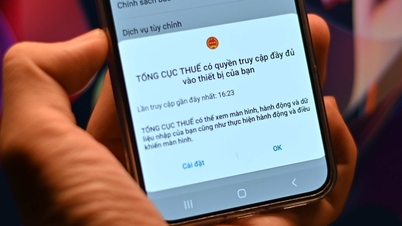

The tax sector has now undergone four major reform phases, moving towards digital data-based management. Accordingly, the tax data system is being linked with banks, insurance, customs, industry and trade, and environmental resources to compare and suggest declarations, reduce errors and compliance costs; apply blockchain and artificial intelligence (AI) in the new generation management system, aiming to be deployed from 2026.

The goal is to use big data to analyze risks, detect fraud and support taxpayers more proactively.

"The tax sector strives to reduce administrative costs by 44%, higher than the general requirement of 30%. This is both a commitment and a desire to build a friendly, transparent and effective tax environment, contributing positively to the country's development and ensuring social security," Mr. Mai Son emphasized.

Turning to the group of business households, Ms. Le Thi Chinh, Deputy Head of the Tax Department's Professional Department, said: Resolution 68-NQ/TW of the Politburo and Decision 3389/QD-BTC of the Ministry of Finance have determined the milestone of eliminating lump-sum tax from January 1, 2026, replacing it with a modern declaration method - an important turning point in tax management of business households.

Ms. Le Thi Chinh, Deputy Head of the Tax Department's Professional Department - Photo: VGP/HT

The declaration method brings 3 big benefits: Simpler thanks to the easy-to-understand formula: actual revenue multiplied by the tax rate by industry; More transparent thanks to electronic invoices and sales software; Easier to forecast when business households can track revenue, expenses, profits and losses, and calculate tax obligations in advance.

Ms. Le Thi Chinh informed that in just the first 9 months of 2025, more than 18,500 business households have switched to declaration, nearly 2,530 households have upgraded to enterprise models, of which 98% of households declare electronically and 133,000 households use electronic invoices from cash registers.

These figures show that business households' confidence in the new model is increasing.

Tax authorities are accompanying taxpayers through 3 groups of solutions:

Perfecting institutions, amending the Law on Tax Administration and the Law on Personal Income Tax, ensuring simplicity and fairness; Simplifying procedures, developing smart electronic tax services; Innovating propaganda - providing direct, easy-to-understand, easy-to-do instructions, sending officials to each household and each business location.

"The shift to declaration is not just a technical change, but a shift in trust – from an inspection model to a support-service model. Digital technology will be the key to promoting a culture of voluntary compliance, when taxpayers can declare and pay taxes right on their phones, quickly and transparently," said Ms. Le Thi Chinh.

IMF: Vietnam well positioned to lead in compliance risk management

From an international perspective, Mr. Frank Van Brunschot, senior expert of the International Monetary Fund (IMF), highly appreciated Vietnam's tax reforms.

Mr. Frank Van Brunschot said that Vietnam's tax/GDP ratio in 2024 is 13.1%, lower than the recommended level of 15-16% that the IMF considers necessary for sustainable growth.

To achieve this goal, he recommended that Vietnam should strengthen compliance risk management instead of increasing tax rates. Specifically, compliance risk management is a strategic approach that helps allocate resources intelligently, focusing on non-compliant groups, while building trust and fairness in the tax system.

To go further, Mr. Frank Van Brunschot said that Vietnam needs to expand the pilot risk management model to new areas, especially tourism and high-value trade. Along with that, it is necessary to increase data sharing between customs, banks and taxes. It is necessary to build a risk-based management culture and train officials to understand and apply new methods.

"Vietnam is well-positioned to lead in compliance risk management. With strong leadership and international cooperation, Vietnam can absolutely achieve a tax/GDP ratio of 16% to ensure resources for sustainable development," the IMF expert expected.

Huy Thang

Source: https://baochinhphu.vn/thuc-day-viec-tu-giac-nghia-vu-nop-thue-1022510231557324.htm

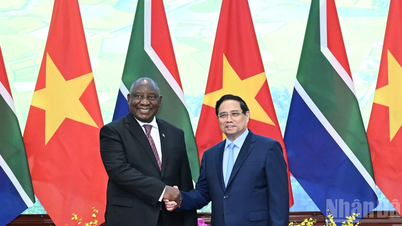

![[Photo] Prime Minister Pham Minh Chinh meets with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761226081024_dsc-9845-jpg.webp)

![[Photo] President Luong Cuong holds talks with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761221878741_ndo_br_1-8416-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

Comment (0)